BlackBerry bid will succeed, says Fairfax

TORONTO - Reuters

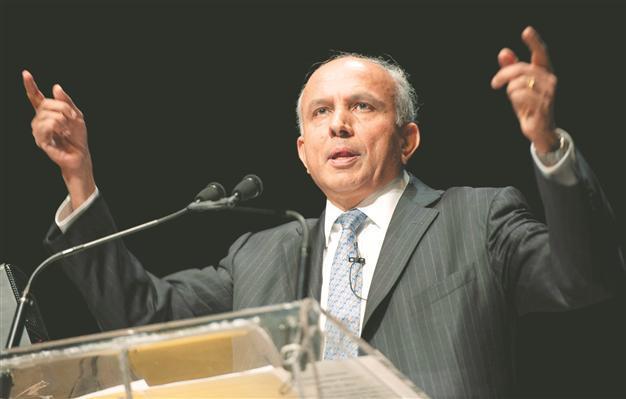

Fairfax Financial Chairman and CEO Prem Watsa speaks at a meeting. AP photo

Fairfax Financial Holdings Ltd Chief Executive Prem Watsa has said he is confident the consortium he leads can find the money to fund its $4.7 billion bid for smartphone maker BlackBerry.

“We wouldn’t put our name to such a high-profile deal if we didn’t feel confident that at the end of the day that our due diligence would be fine and we’d be able to finance it,” Watsa said in an interview on Sept. 25.

The Canadian-led consortium put in its $9 a share bid for BlackBerry on Sept. 23, arguing that the troubled company would have better chances as a private entity, away from Wall Street’s constant gaze. The company pioneered mobile email communications but has lost ground to Apple Inc’s iPhone and other snazzier rivals.

BlackBerry shares closed a full dollar below the bid price on the Nasdaq on Sept. 25, indicating that investors were skeptical the deal would succeed.

Fairfax is BlackBerry’s biggest shareholder, and Watsa said he did not expect Fairfax would need to contribute more than its existing stake of about 10 percent to the buyout bid. He said the bid was led by Fairfax and Canadian funds, but not restricted to them.

“BlackBerry is one of Canada’s great success stories,” he said. “There is no question it’s fallen on hard times recently, but we have every confidence it will be successful again. We’re putting a consortium together to make sure that that takes place.”

The group has until November 4 to conduct due diligence, in which time BlackBerry can also seek out other buyers.

Asked if the bid price could be reduced, Watsa said he didn’t expect that to happen unless the review of BlackBerry produced negative surprises. He said Fairfax had never changed the terms of a deal in 28 years.

He said the group did not include any strategic players, but that one or two technology companies could possibly join.