Bankrupt Detroit puts US municipal bonds at risk

WASHINGTON - Agence France-Presse

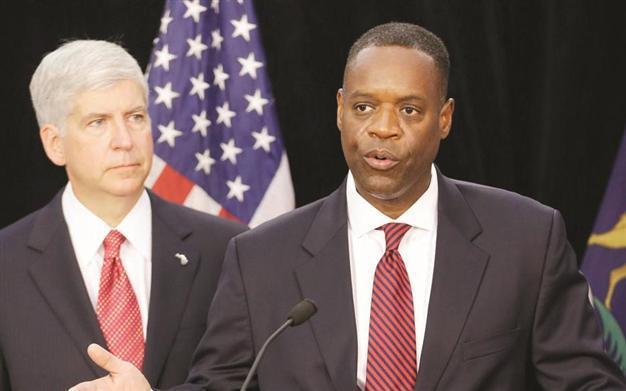

State-appointed emergency manager Kevyn Orr (R) speaks as Michigan Governor Rick Snyder watches during a news conference. AP photo

The city of Detroit’s record bankruptcy filing has cast a cloud over the U.S. municipal bond market as creditors face potential steep losses on the typically safe investment.

Bond holders are nervously awaiting a federal judge’s decision on Detroit’s request on July 18 for bankruptcy protection as it seeks relief from a staggering $18.5 billion debt.

The biggest U.S. city bankruptcy in the nation’s history was not unexpected, given decades of decaying finances in the once-mighty automotive capital known as Motor City.

“Are we about to enter a new era of municipal finance? The debts of many municipal entities are large enough to make the current state of affairs more compelling for bankruptcy. It all depends on how much debt you can erase,” said Robert Brusca of FAO Economics. “Detroit bears watching very closely. It is both a special case and a paradigm,” he said.

The Detroit bankruptcy reorganization filing, if approved, is expected to make it harder for municipalities in Michigan and other U.S. states to borrow money by undermining confidence in what used to be among the most trusted bonds available.

White House monitoring

The White House says it was monitoring the situation but the Obama administration has not signaled it would throw the city a lifeline.

On July 19, ratings firm Standard & Poor’s cut its rating on Detroit’s general obligation (GO) debt from “CC” to “C”, just one notch above default, and said the outlook was “negative.”

Ridley said: “We view Detroit’s default and subsequent bankruptcy filing as idiosyncratic, and not as a symptom of a wider issue in the municipal market.” About half of Detroit’s debt is owed to the pension funds and retiree health care benefits of the city’s 10,000 workers and 20,000 retirees.

Detroit Emergency Manager Kevyn Orr said the city has about $2 billion to repay $12 billion in “unsecured” debt, which includes the pension obligations.

In mid-June, Orr proposed negotiations for writedowns to creditors as the insolvent city was forced to defer payments on some obligations.