Asia shares slip on N Korean leaders’ death, eurozone fears

HONG KONG - Agence France-Presse

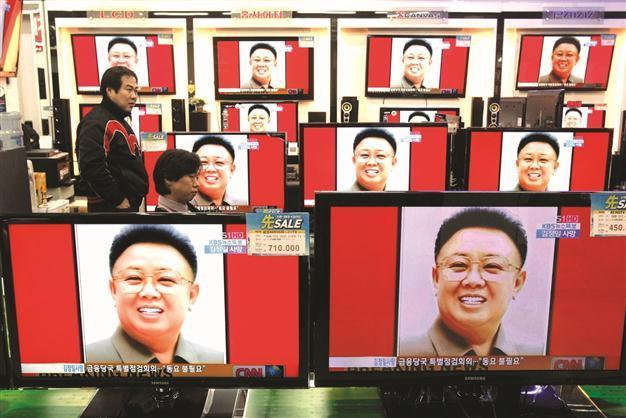

South Koreans watch a news reporting about the death of North Korean leader Kim Jong Il on TV screens at the Yongsan Electronic shop in Seoul, South Korea, yesterday. AP photo

Asian shares fell yesterday following news that North Korean leader Kim Jong-Il had died, raising geopolitical concerns in the region amid uncertainty over the future of the nuclear-armed nation.

Markets began the day on a low because of worries over the ongoing European debt crisis after Belgium’s credit rating was cut, France’s outlook was lowered and six other eurozone members were put on downgrade watch.

Seoul’s Kospi equity index closed down 3.43 percent, while Tokyo’s Nikkei-225 shed 1.26 percent to close at 8,296 points. Sydney equities tumbled 2.38 percent to 4,060.

Stock exchange indexes in Hong Kong lost 1.18 percent, while Shanghai shed 0.3 percent. Equities in Taipei fell 2.24 percent to 6,633 points..

Stock markets extended their already deep losses amid nervousness about the future direction of North Korea, with little known about Kim Jong-Un, who is in his late 20s and considered inexperienced.

“Kim Jong-Il’s death is the latest spanner in the works. Although a succession plan was already in place, change means uncertainty and uncertainty is not good for markets,” said Stan Shamu, strategist at IG Markets in Melbourne.

South Korea’s government went on an emergency footing, the South’s Yonhap news agency reported. Deputy Finance Minister Choi Jong-Ku said authorities in Seoul would monitor financial markets.

The U.S. dollar jumped to 1,199 Korean won after the news of Kim’s death, from 1,164.30 before. It later eased to 1,173.60.

“Uncertainty is mounting as there are worries over the direction of North Korea and its leadership,” Ichiyoshi Investment Management fund manager Mitsushige Akino said. “Investors are simply in a rush to liquidate their positions.”

Warning from S&P

In a statement, Standard & Poor’s said South Korea’s sovereign credit ratings may be affected if political instability hits North Korea.

Kim’s death “has raised security risks on the Korean peninsula” but South Korea’s “A” foreign currency and “A+” local currency ratings are not affected in the short-term, the agency said.

“However, security risks and political stability in North Korea could deteriorate rapidly if political succession is not smooth,” S&P said. “South Korea could experience adverse security and financial implications as a result. If sufficiently serious, the creditworthiness of South Korea could be negatively affected.”

Concerns over the eurozone crisis also took their toll. On Friday, Moody’s Investors Service cut Belgium’s credit rating by two notches to Aa3, with a negative outlook, from Aa1. Fitch Ratings lowered its outlook on France’s triple-A rating to negative from stable. The agency also placed six eurozone nations, including Spain and Italy, on watch for downgrade.

In commodity markets, New York’s main contract, light sweet crude for delivery in January, rose two cents to $93.54 a barrel while Brent North Sea crude for February gained 15 cents to $103.50.

Status quo likely to remain

ISTANBUL - Hürriyet Daily News

After Kim Jong-il’s death, the most likely outcome, at least in the short term, is the “maintenance of the status quo,” according to analysts.

“The big issue is whether new leadership will lead to an acceleration of economic reform, increase the risk of a meltdown that ultimately leads to re-unification with the South, or simply maintain the status quo,” said Julian Jessop, the chief economist at London-based Capital Economics. “Kim Jong-un is very much an unknown quantity, but probably too young and weak to make much change quickly,” Jessop said, adding that for now, the most likely outcome is probably the maintenance of the status quo, as “the survival of the regime is not dependent on any one individual.”

Erik Lueth of the Royal Bank of Scotland said the possibility of a military aggression from North Korea is limited. “(Kim Jong Il’s) death was more or less anticipated by the Northern leadership,” Lueth said in a note to investors yesterday. “Despite this, North Korea remained very engaged in efforts to restart the six-party talks ... North Korea has no record of aggression while engaged in negotiations with opponents.” However, Lueth noted that the chances of a “regime collapse” have increased.