Google’s parent firm Alphabet has announced quarterly profits that beat expectations and nearly doubled in 2021, after a booming holiday season for the online ads giant facing anti-trust regulation scrutiny.

The tech giant had net income of $20.6 billion on revenue that grew 32 percent to $75 billion in the final quarter of 2021, ending the year with a total of $76 billion in profit.

That was nearly double the $40 billion annual profit reported for 2020, as the pandemic had already accelerated a shift to online shopping, working and learning that also benefited fellow giants like Amazon and Facebook.

Alphabet CEO Sundar Pichai on Feb. 1 cited “strong growth in our advertising business... a quarterly sales record for our Pixel phones despite supply constraints, and our cloud business continuing to grow strongly” for the success.

In all, Google earned more than $61 billion in advertising revenue, mostly from online search and its video platform, while its cloud business grew by 45 percent to $5.5 billion in revenue.

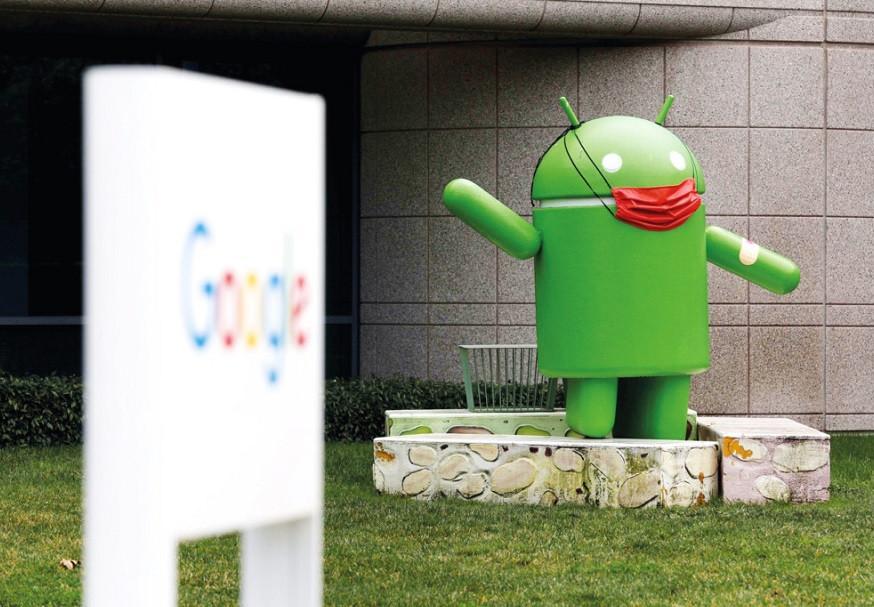

Google’s dominance online has powered it to new heights during the pandemic period, but has also left it in the sights of regulators around the world.

Pichai said during an earnings call that Alphabet is open to “sensible” regulation by U.S. Congress but is “genuinely concerned that they could break a wide range of popular services we offer to our users.”

Regulators’ scrutiny around the world is stacking up as one of the most significant risks for the Silicon Valley giant.

“Google has the biggest uphill battle in terms of antitrust issues among all of the Big Tech companies,” Third Bridge analyst Scott Kessler wrote.

“Despite Apple’s bigger size and Meta/Facebook’s bad publicity, Google is seen most at risk in terms of U.S. antitrust law,” he added.

Just last week, a group of top U.S. justice officials accused Google in lawsuits of tracking and profiting from users’ location data, despite leading consumers to think they could protect their privacy on the tech giant’s services.

These suits are the latest legal threats against Google and other U.S. Big Tech giants, which have long faced probes and court cases but a lack of new national laws that would regulate their businesses.

The courts and legislatures are not moving fast. Two weeks ago, for example, Google appealed a European court ruling that upheld a 2.4 billion-euro fine imposed by Brussels in 2017 for anti-competitive practices in the price comparison market.

The firm predicts that its growth will continue in 2022, with digital advertising expected to bring in more than $171 billion to Google this year, or 30 percent of the global pie, just ahead of Facebook.

Alphabet said its board had approved a 20-to-1 stock split that would make shares more affordable to small investors.

The stock was up nearly 9 percent in after-market trades to $2,990 on Feb. 1. If the stock is still hovering around that price at the time of the proposed stock split, the shares would be reset at about $150 apiece, for a cut of 95 percent. But Alphabet’s market value, now approaching $2 trillion, would remain unchanged because the number of outstanding shares would be 20 times greater than now.