Greece begins bond buyback program to reach bailout fund

ATHENS - Agence France-Presse

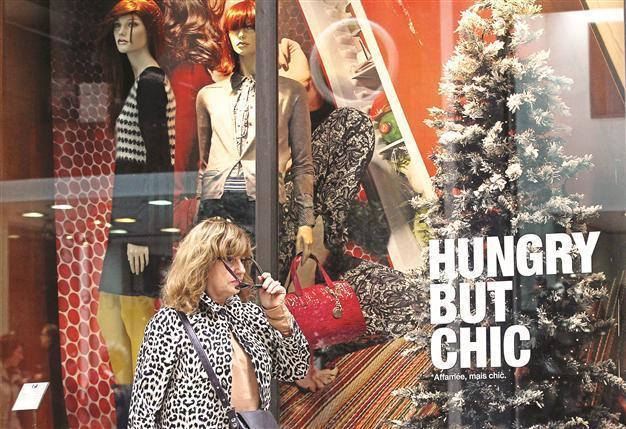

A woman walks in front of a seasonal decorated shopping window of a department store that has just filed for bankruptcy, in central Athens. EPA photo

Greece launched yesterday an operation to buy back debt at a big discount, a vital part of a repackaged rescue plan to avert bankruptcy before the end of the year. Eurozone finance ministers are expected to review the details of the operation when they meet later in Brussels, as well as discuss help to Greek Cyprus and banking supervision.

The national PDMA debt agency said it had begun offering to buy back Greek bonds from private investors on a voluntary basis, a procedure closely watched on financial markets where there was uncertainty over whether enough investors would accept the terms.

The buyback is a condition for Greece to receive its latest installment of EU-IMF bailout funds.

The PDMA said in a statement that eligible holders had been invited to submit by Dec. 7 Greek sovereign bonds to receive payment of between 32.2 and 40.1 percent of the face value.

Those who participate will receive in exchange six-month bills issued by the EU’s EFSF rescue fund with up to 10 billion euros ($13 billion) available for the operation.

Up to 20 series of Greek sovereign bonds with a face value of 62.3 billion euros held by

private creditors are eligible for the buyback.

In March, Greece’s private creditors had already agreed to write off about 107 billion euros’ worth of Greek sovereign bonds and many institutional investors such as banks and insurance companies have completely written off the value of Greek debt in their balance sheets.

Bonds lose valueThe value of Greek bonds has plunged in value as the debt crisis has risen in intensity and since the massive debt writedown by private bondholders at the beginning of the year.

On the eurozone bond market, the interest rate on Greek-10-year bonds fell sharply yesterday to 14.670 percent, the lowest since the debt restructuring in March, from 16.131 percent at the close on Nov. 3.

Last week Greek banks signaled their reluctance to accept further losses on their government bond holdings after the March writeoff.

Last week Greek Finance Minister Yannis Stournaras said “the success of the operation is a patriotic duty.” Greek banks are also in critical need of the release of the rescue loans, a major part of which is dedicated to recapitalizing them.

Moody’s expressed doubt however that even with the buyback and disbursement of the latest rescue loans will resolve Greece’s debt problem.

It said given that around 70 percent of the country’s debt is held by official creditors such Greece’s eurozone partners and the IMF, that “only a reduction in principal on outstanding official debt would lead to a semblance of sustainability in Greece’s debt.” Germany, which holds elections next year, has been most vociferously opposed to eurozone states writing off part of their Greek debt.

But German Chancellor Angela Merkel said over the weekend that she did not rule out taking a so-called “haircut” on Greek debt after 2014, marking an apparent softening in position.