Foreign investors changing European football landscape

PARIS - Agence France-Presse

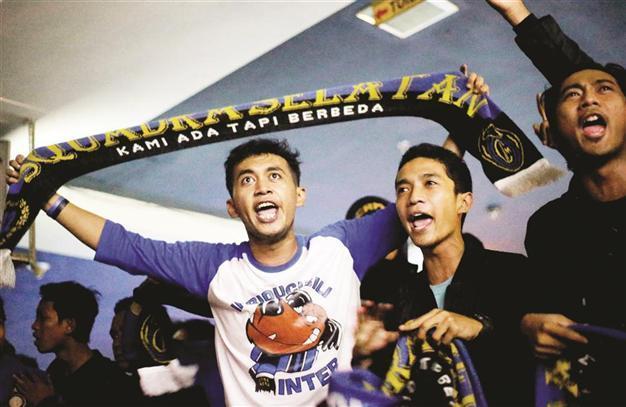

Indonesian supporters of Inter Milan cheer for their team. Indonesian entrepreneur Erick Thohir and two associates signed a deal to take over a majority stake of 18-time Italian champion. AP photo

Asian tycoons, Russian oligarchs, Arab sheikhs, American businessmen - 10 years after Roman Abramovich’s takeover of Chelsea, European clubs remain targets for wealthy foreign investors, and rarely for their love of the shirt.

From Chelsea to the recent buyout of Italian giants Inter Milan by Indonesian media mogul Erick Thohir, a long list of clubs on the continent have changed hands over the last decade.

The trend is most striking in England’s Premier League, where the environment is more welcoming to potential investors, with many clubs listed on the stock exchange.

In total, 11 of the 20 clubs in England’s cash-rich top flight are in foreign hands.

But investors have also turned their attentions to other European leagues, notably France, where clubs are not weighed down by massive debts as is often the case in Spain and Italy and are not protected in the same way as in Germany, where the law prevents any private investor from owning more than 49 percent of a club’s shares.

As a result, Paris Saint-Germain were bought out by Qatar Sports Investments in 2011 and Russian billionaire Dimitry Rybolovlev took control of Monaco in December of the same year before going on to dramatically revive the fortunes of the principality club. “The influx of money has an immediate impact on the market. The first thing these new owners do is pay huge sums for the best players. That causes inflation and sometimes a sporting imbalance with clubs who can no longer keep up,” says Didier Primault, co-director of the Centre for the Law and Economics of Sport (CDES) in Limoges, France.

The CDES have produced a report for the European Union as part of their efforts to regulate the football transfer system. In their report, the CDES have noted that the greatest inflation occurred following Abramovich’s arrival at Chelsea in 2003, after Manchester City were bought by the Abu Dhabi United Group in 2008 and last summer, when PSG and their Ligue 1 rivals Monaco fought with each other to break the French transfer record while Spanish giants Real Madrid and Barcelona also splashed out.

Fortunes have been used up to clear clubs’ debts, with 200 million euros ($267m, 167m) of Thohir’s initial investment in Inter going on reducing the Nerazzurri’s arrears.

But lavishing such sums on debt management and buying players is sometimes done without any regard for the economic logic of the state of the markets at that moment in time.

Monaco: The perfect exampleThe recent case of Monaco was a perfect example, with the principality club marking their promotion back to France’s top tier by spending 167 million euros in the summer transfer window.

Then there was the remarkable policy of another Russian billionaire, Suleiman Kerimov, who turned unfashionable Anzhi Makhachkala from the volatile region of Dagestan into a major player on the European stage by spending big to bring in a whole host of players in 2011, notably Cameroonian striker Samuel Eto’o, who was rumoured to be the world’s highest-paid player when he signed from Inter.

More recently, Malaysian Vincent Tan has steered Cardiff City into the English Premier League for the first time, but his methods - including changing the club’s colours from blue to red and putting a family friend in charge of player recruitment - have not gone down well with supporters.

“There are different types of investors,” says Frederic Bolotny, a consultant on the economics of sport.

“Some are looking for indirect benefits, as part of a political strategy, such as Qatar’s ownership of PSG. Others are more irrational. “Abramovich at Chelsea or Rybolovlev at Monaco are looking for respectability regardless of whether they can make money out of it. “Not of all of these investors can be compared.” Indeed, cases in which foreign investors actively look to make money - such as the Glazers at Manchester United - are very rare.

The gradual introduction of Financial Fair Play (FFP) rules by European football’s governing body UEFA in a bid to stop clubs spending more money than they actually generate should - in theory - prevent more instances of such irrational spending as have become commonplace. “I don’t see how all this can go on once financial fair play is in full force,” says Bolotny, who points a finger towards the “golden contract, completely out of keeping with the market” that PSG recently agreed with the official Qatar Tourism Authority and which will eventually net the French capital club 200 million euros. PSG will have to provide details of the agreement to UEFA before they consider the deal in relation to FFP.

How UEFA go about curbing what seems to be a clear way of avoiding the FFP regulations remains to be seen, but if they do succeed in bringing the European game back to a healthier financial footing, will mega-rich investors continue to show such an interest in the sport on the continent?