Turkey ranks sixth in Brookings’ financial inclusion study

WASHINGTON

Courtesy: Brookings Institute

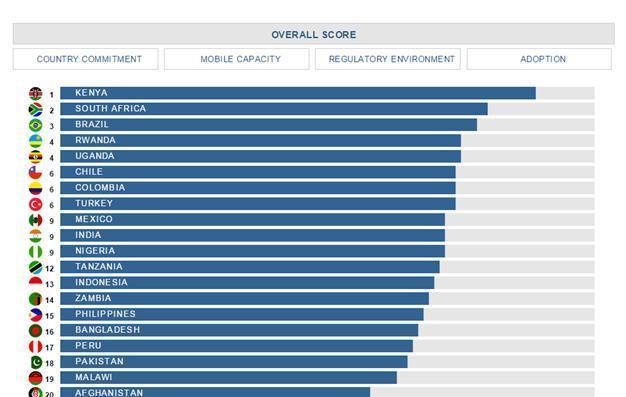

The Center for Technology Innovation at Brookings has launched the 2015 Brookings Financial and Digital Inclusion Project (FDIP) Report and Scorecard, which evaluates access to and usage of affordable financial services across 21 countries. According to Brookings’ FDIP analysis, Turkey ranked sixth among the countries for its financial inclusion efforts.

Brookings experts analyzed the financial inclusion landscape in 21 geographically, economically and politically diverse countries, including Afghanistan, Bangladesh, Brazil, Chile, Colombia, Ethiopia, India, Indonesia, Kenya, Malawi, Mexico, Nigeria, Pakistan, Peru, the Philippines, Rwanda, South Africa, Tanzania, Turkey, Uganda, and Zambia, said the institute in a press release on Aug. 25. In the study financial inclusion was defined as “access to and use of formal financial services providing opportunities for facilitating individual prosperity and economic development.”

Countries received scores and rankings based on 33 indicators spanning four dimensions: Country commitment, mobile capacity, regulatory environment and adoption.

Turkey earned 74 percent of the total possible points to garner the top overall score in the study. The country ranked in 12th place for country commitment, 16th place for mobile capacity, 17th place for regulatory environment and tied for fourth place for adoption.

The country was also “among the highest-scoring countries regarding mobile 3G coverage and penetration of unique mobile subscriptions.”

“Turkey has made important strides in galvanizing its commitment to financial inclusion through regulatory reform and involvement with the broader financial inclusion community. However, there is still room for improvement in Turkey’s financial inclusion ecosystem, particularly with respect to regional and gender disparities associated with access to and use of financial services and products,” said the study.

Developing agent banking regulations, encouraging the development of interoperable electronic money platforms, and creating specific numeric targets within its financial inclusion action plan are concrete steps Turkey could pursue to advance financial inclusion, according to the study.

The top-scoring countries in the analysis were Kenya (achieving 89 percent of the total possible points), South Africa (80 percent), Brazil (78 percent), Rwanda and Uganda (tied with 75 percent each) and Chile, Colombia and Turkey (tied with 74 percent each).

“These countries demonstrated considerable commitment to financial inclusion by defining specific inclusion objectives and taking policy, regulatory and technological steps to speed progress toward inclusion,” said the study.