Four Passover Seder questions

I would like to celebrate the Passover and Easter of my heathen readers by carrying an old tradition to my column.

Jews remember their exodus from Egypt at the Seder, which marks the beginning of Passover. During the dinner, which was also Jesus’ Last Supper, the youngest child at the table asks four questions about why this night is different from others. Being a kid at heart, I will answer four questions about why some recent Turkish economic indicators are so different.

How come the February trade deficit turned out to be so low? Turkey economists forecast the trade balance using taxes on imports. As I highlighted

in my March 18 column, strong tax revenues were pointing to a trade deficit of $9 billion to $10 billion. When the actual deficit turned out to be $7 billion, I did a bit of investigative journalism and found out that state-owned natural gas distribution company, BOTAŞ, had made overdue tax payments for gas imports.

Does this change your outlook on growth? A bit, not too much. I still believe that the economic recovery is on track. It is just not as strong and as quick as I had previously thought. Note that annual growth for the last quarter of 2012, which will be released this morning, is likely to be 2 to 2.5 percent. Growth for the whole year would then be around 2.5 percent, which is better than many of Turkey’s peers, but still way below the country’s potential of 5 to 6 percent. Therefore, a pickup this year should not be too surprising.

The Central Bank changed direction again. Your take? I believe central bankers should be risk-averse, so I am all for the bank taking

precautionary measures against a sudden stop in capital flows. I also feel that tightening liquidity will restrain loan growth better than raising reserve requirement ratios. But I don’t like the fact that the bank is

going through extraordinary pains to disguise its moves so that it

won’t be criticized by the likes of

Economy Minister Zafer Çağlayan – after all the bank did cut one of its rates, as

the admiral has been demanding.

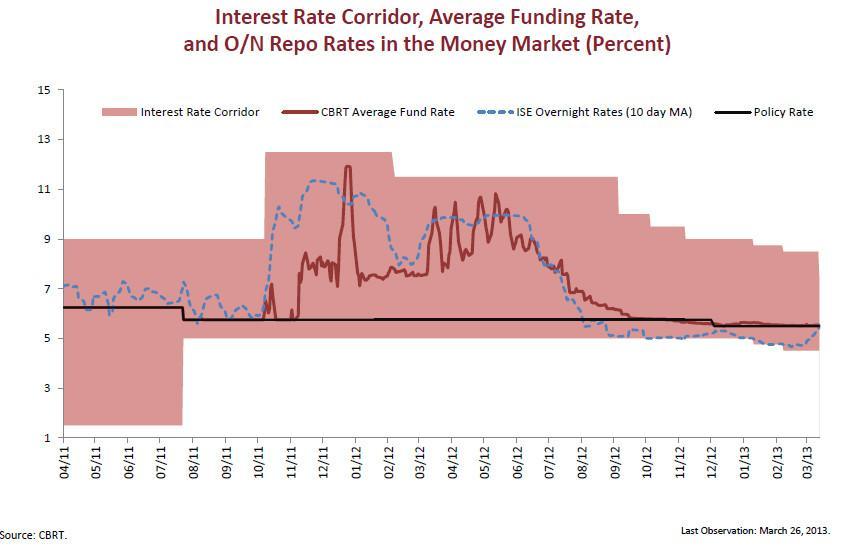

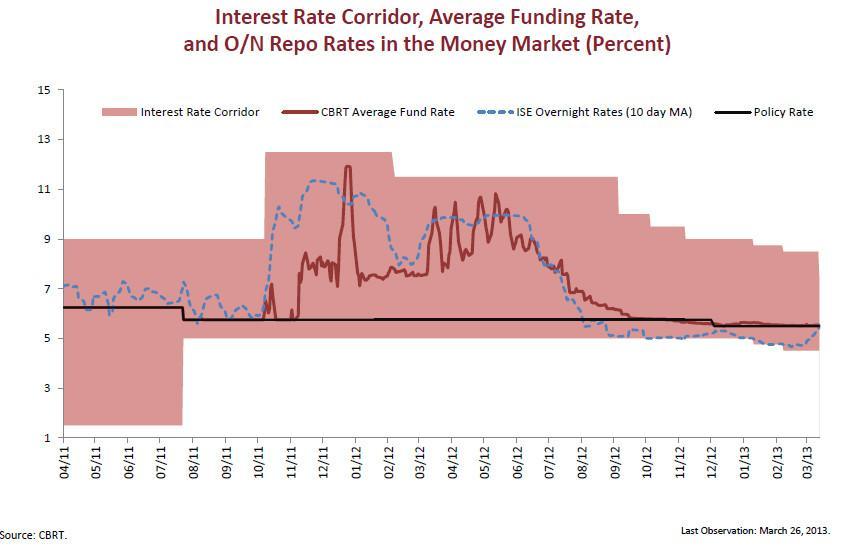

Speaking of liquidity, has the bank already tightened it?

Speaking of liquidity, has the bank already tightened it? Primary dealers borrowed 6.25 billon Turkish Liras at the overnight lending rate on March 29, leading some to think that the tightening has begun. This was actually mainly due to tax payments and banks’ usual end-quarter balance sheet makeup. But if you look at the bank’s new measures for gauging monetary policy, which were explained during

their March 27 meeting with economists, you can see that it has actually been decreasing liquidity for a while.

Bonus: How do you feel about economic policy?

Bonus: How do you feel about economic policy? Great! The Central Bank will surely

win the Nobel Prize. Inflation is under control. Istanbul is

on its way to becoming a global financial center. Thanks to the

state-run Housing Development Administration (TOKİ), a

construction-led boom is underway. By distributing a tablet to each student, we are sure to solve

Turkey’s bottleneck in human capital.

By the way, this last question was my way of celebrating April Fools’ Day!

I would like to celebrate the Passover and Easter of my heathen readers by carrying an old tradition to my column.

I would like to celebrate the Passover and Easter of my heathen readers by carrying an old tradition to my column.