Easy money officially comes to an end

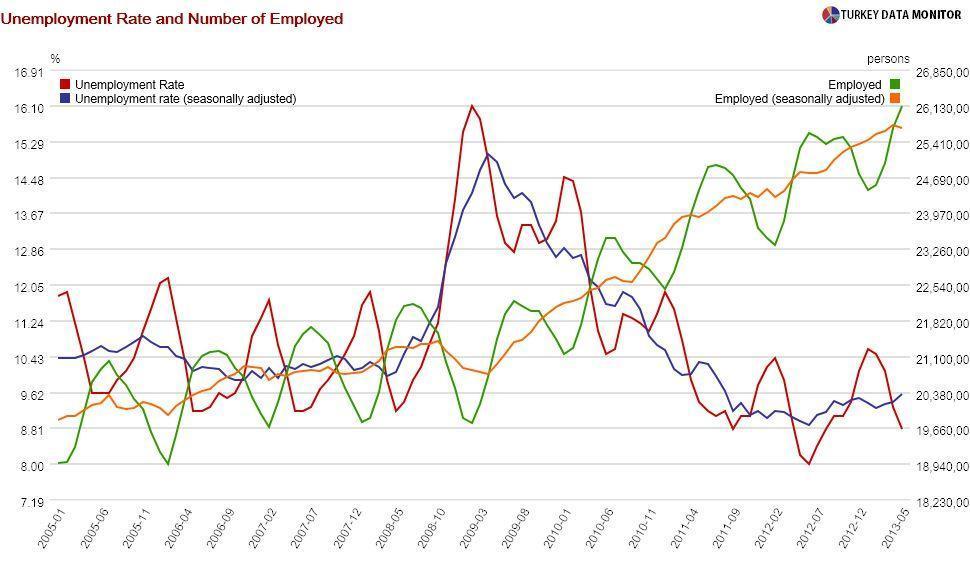

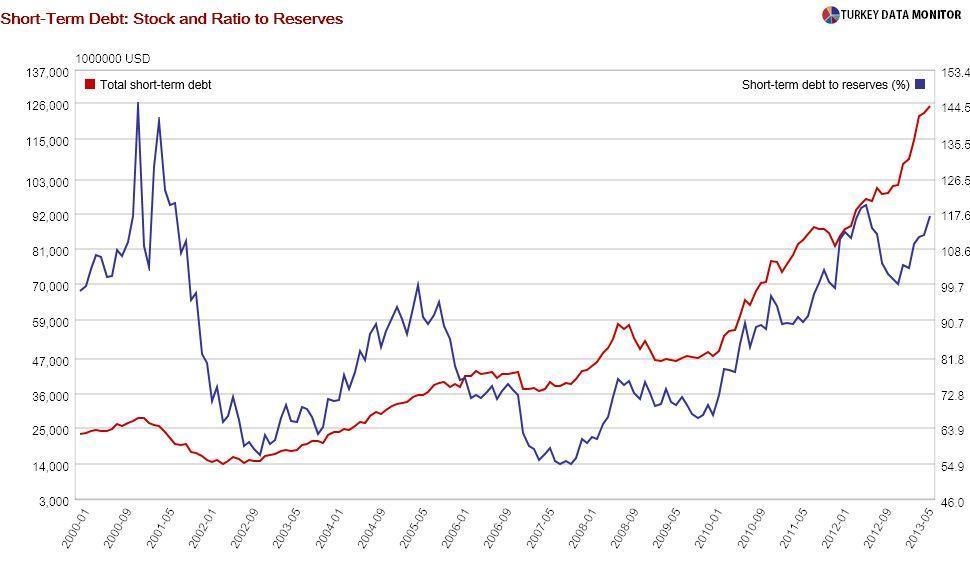

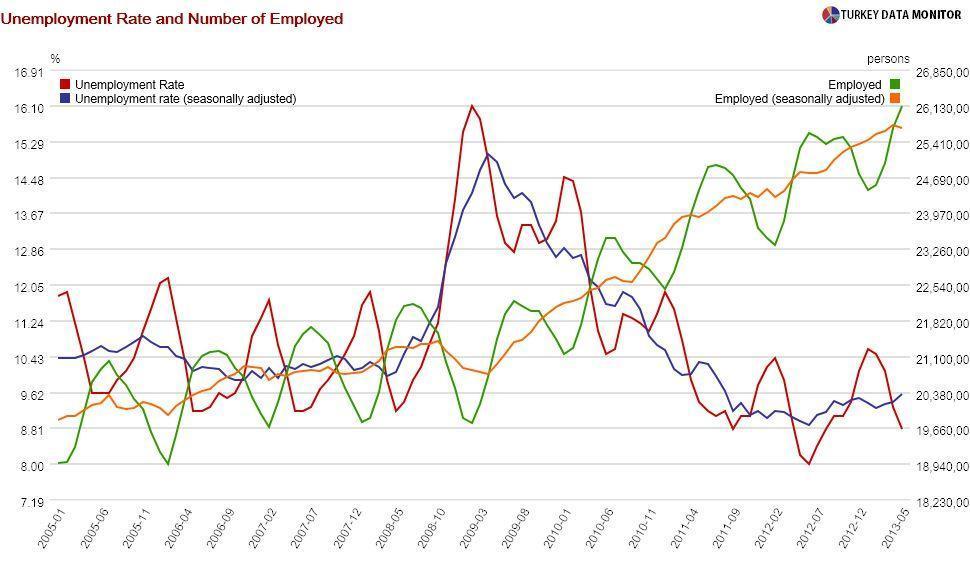

We have another data-intensive week ahead in Turkey. June labor force statistics and the August budget will be released today, whereas the July short-term external debt takes the stage on Sept. 18.

I will be watching whether the rise in the unemployment rate and fall in non-farm employment carried on

from May to June. I expect the headline budget to be strong, as

Finance Minister Mehmet Şimşek hinted, but I will be looking for early signs of pork barrel spending in non-interest expenditures. As for short-term external debt, I will be seeing if its ratio to reserves will increase from June’s 119.1 percent.

I have to follow these data, but that doesn’t mean you should. In fact, you could just completely ignore Tuesday’s Central Bank of Turkey rate-setting meeting as well. Since Governor Erdem Başçı

committed to no rate hikes, none of the economists surveyed by business channel CNBC-e expects a change in any of the interest rates. The Bank could lower its foreign currency

reserve requirement ratios or

reserve option coefficients, but these would have

a marginal impact on the exchange rate.

The fate of the lira and Turkish assets will instead depend on

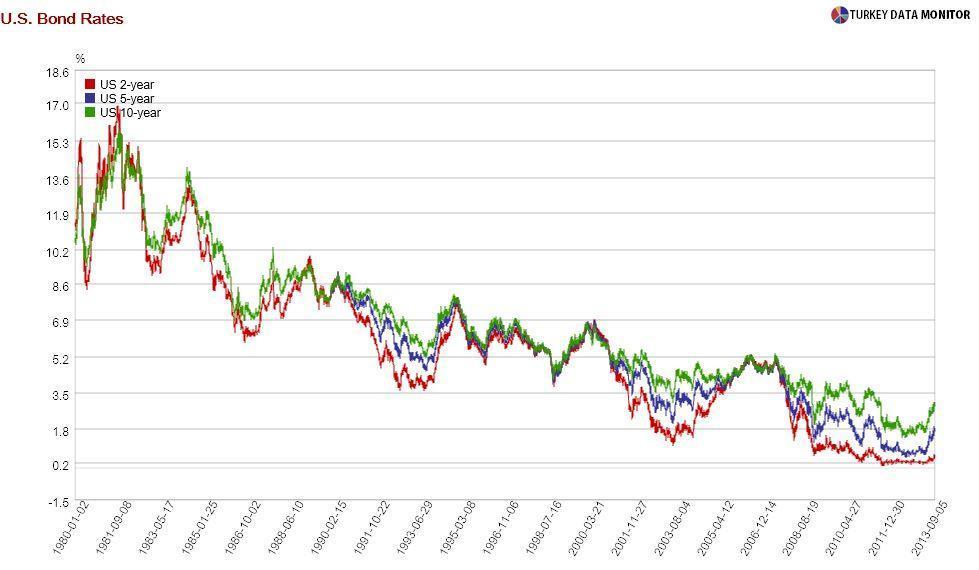

the Fed’s monetary policy decision, which will be released at 9 p.m. on Sept. 18. Markets are expecting the Fed to decrease its $85 billion a month of bond purchases by $10-15 billion. Since this amount is priced in, it should not elicit a market response. Similarly, a delay to tapering, or at least a less aggressive one, would lower U.S. 10-year government bond yields. Emerging markets would rally.

The problem with this view is that it is not the consensus. One third of the economists

surveyed by the Wall Street Journal expect no tapering at this meeting. Therefore, the negative reaction to a tapering announcement could be greater than expected. Likewise, I would not be surprised if the rally in emerging markets were muted in response to a delay in tapering.

But whatever the Fed does, it certainly won’t end uncertainty. For one thing, they could adjust the tapering based on the strength of U.S. data or developments in

Congress budget battles. The appointment of Larry Summers as Fed chairman would further

complicate the picture. Even if he calms down worries that he would terminate quantitative easing and raise interest rates, the Fed’s forward interest rate guidance would no longer be valid. Therefore, I expect a bit of volatility in the short-run.

Even if all goes well and emerging markets end up rallying, led by

high-beta countries like Turkey that perform better in good times, the era of easy money and abundant capital flows will officially be over on Sept. 18. As economy tsar Ali Babacan once again emphasized on Friday the 13th, the government and the Central Bank, on the other hand, believe that Turkey will continue to attract money.

That’s why they have taken no precautions for this new age of normalization. As economist Atilla Yeşilada notes, if uncertainty doesn’t get us first, imprudence and complacency will.

We have another data-intensive week ahead in Turkey. June labor force statistics and the August budget will be released today, whereas the July short-term external debt takes the stage on Sept. 18.

We have another data-intensive week ahead in Turkey. June labor force statistics and the August budget will be released today, whereas the July short-term external debt takes the stage on Sept. 18.