FED head Bernanke shakes up global markets

WASHINGTON

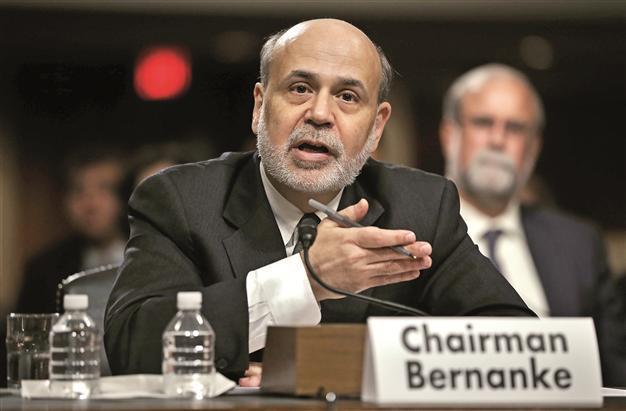

FED Board Chairman Ben Bernanke testifies during a hearing before the Joint Economic Committee May 22 on Capitol Hill in Washington, DC. AFP photo

Global markets had long eyed on the US Congress tesimony by the chairman of the Federal Reserve (FED) Ben S. Bernanke on May 22. His testimony to the Congressional Joint Economic Committee, a panel that includes members of the House and Senate, and his meeting with press members then shook the global markets.

Bernanke told Congress Wednesday that the U.S. job market remains weak and that it is too soon for the FED to slow its extraordinary stimulus programs. Reducing the FED’s efforts to keep borrowing rates low would “carry a substantial risk of slowing or ending the economic recovery,” Bernanke said in testimony.

The FED has been buying $85 billion a month in Treasury and mortgage bonds since September. That has helped lower long-term interest rates and encouraged more borrowing and spending.

But Bernanke said that the FED could just as quickly reverse course and pick up the pace if the economy falters.

Most of Bernanke’s testimony focused on the many risks facing the economy, along with the benefits gained so far from the Fed’s stimulus. His comments suggest the Fed is not ready to taper the bond purchases.

Bernanke speech affects stocksStocks surged immediately after Bernanke began speaking at 10 a.m. EDT. But they gradually fell during Bernanke’s testimony and then turned negative in the afternoon. Bernanke appeared to contradict his prepared statement to Congress in a live question and answer session late on Wednesday by saying the central bank could scale back the pace of bond purchases at one of the next few meetings.

Investors fear that if economic support in the U.S is withdrawn before Europe has managed to establish stable growth, fragile confidence will be shattered, potentially sending the economy into recession. “Investors should not over-react to every shifting nuance when FED officials speak. U.S. monetary policy was data dependent before the testimony and remains so,” equity strategist at Peel Hunt said.