Turkish markets baffle finance theory

Something as rare as a black swan was spotted in Turkish markets in the second half of last week:

The yield curve inverted.

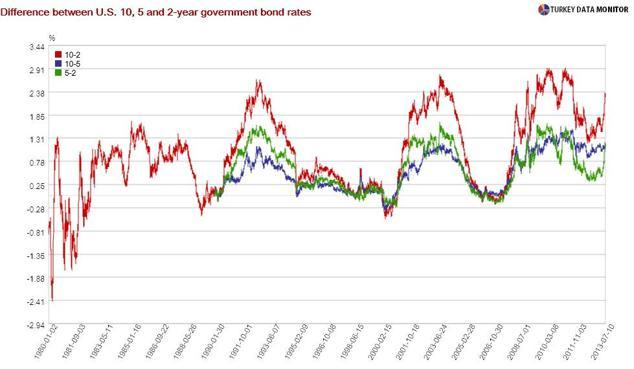

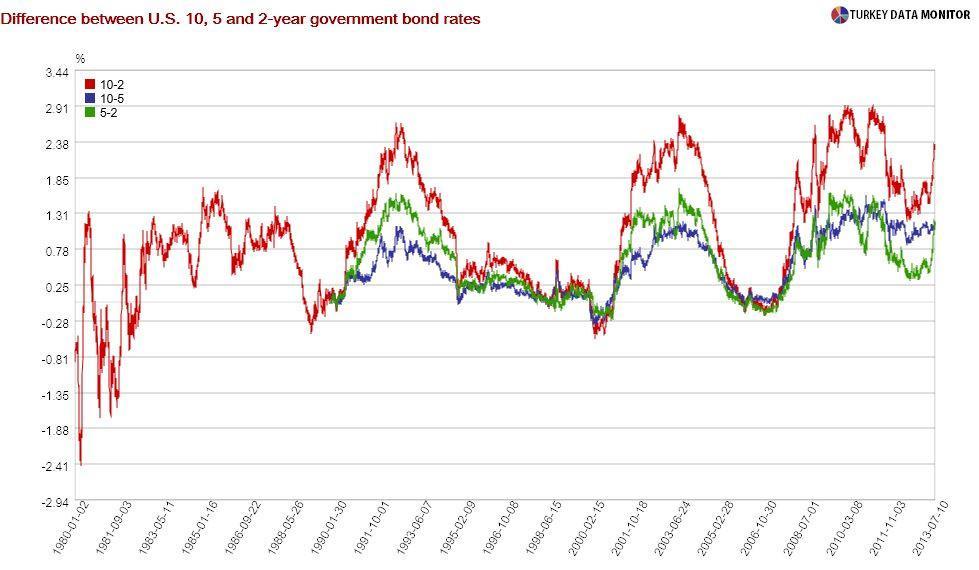

Although it sounds fancy, the yield curve is simply the difference between short- and long-term government bond rates. Bonds with longer maturities would normally pay higher rates to compensate for the risk you are taking for locking in your money for the long haul.

That has usually been the case in Turkey, but the two-year benchmark bond yield rose above the 10-year one on Wednesday. The difference between the two was as high as 0.14 percentage points late last week. To understand what is going on in Turkey, it is better to start with the regular interpretation of

yield curve inversion, which applies more to the U.S. than any other country.

The yield curve inverts when bond investors expect short-term interest rates to fall. They are willing to hold long-term bonds, despite the lower yield, because they are locking in their return. Another way to see this is to realize that long-term rates reflect both current and expected future short-term rates. When investors foresee a significant decline in short-term rates, the yield curve will invert.

Short-term bond rates are correlated very closely with the policy rate set by the Federal Reserve Board (Fed), the U.S. Central Bank. Long-term bond rates, on the other hand, depend on many more factors, such as China’s bond purchases as well as long-run inflation and growth prospects. So if the yield curve is inverted, investors are expecting the Fed to loosen monetary policy, perhaps because they think the economy is slowing.

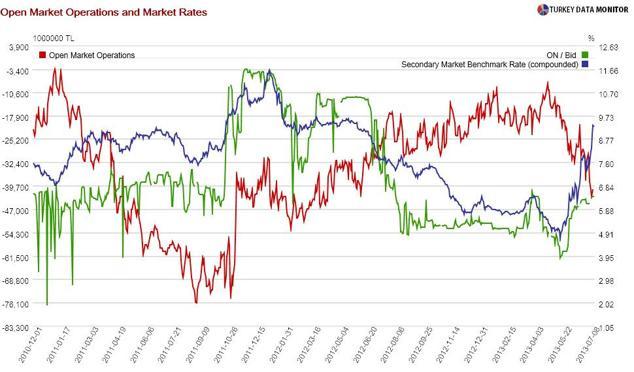

While there are signs that the recovery has lost pace, the American story does not fit Turkey at all. However, as in the U.S., short-term bonds are much more responsive to monetary policy than bonds with longer maturities. As the Central Bank of Turkey tightened liquidity to control lira depreciation, the benchmark yield surged, whereas the rise in the 10-year bond rate was less pronounced.

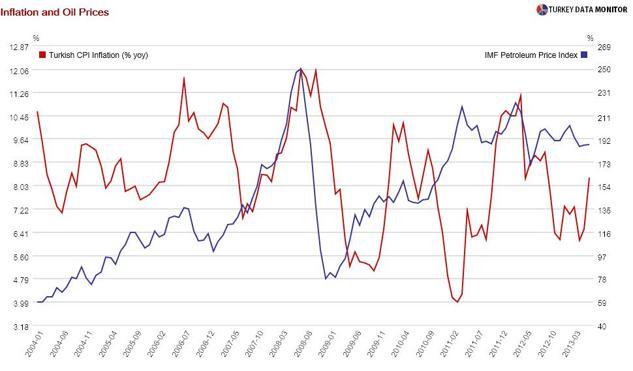

We can also learn from history. The difference between the 10- and two-year government bond yields was as high as 1.90 percentage points at the end of 2011. Of course, the conditions were much more dire then. For one thing, inflation pressures were higher because of an overheating economy and oil prices.

More importantly, European banks were forced to deleverage their balance sheets, and the regional wholesale funding market froze. It was not only Turkish banks that lost access to foreign currency, but panic also spread, resulting in outflows from all emerging markets and a sharp inversion in the curve. The Central Bank spent more than $15 billion of reserves defending the lira.

The Central Bank has so far sold “only” $6.3 billion in the current episode, but yield curve inversion is ringing alarm bells for the lira. If Fed Chairman Ben Bernanke’s

congressional testimonies on July 17-18 are not perceived well by markets, we may see a policy rate hike at the next Turkish monetary policy meeting on July 23.

Something as rare as a black swan was spotted in Turkish markets in the second half of last week: The yield curve inverted.

Something as rare as a black swan was spotted in Turkish markets in the second half of last week: The yield curve inverted.