The dove that pretended to be a hawk

Once upon a time, there was an unhappy dove employed in a distant kingdom’s postal services as a messenger.

This dove was jealous of the hawks because the king took them hunting. So he decided to act like one. He started eating raw meat and attacking the other messenger doves. He even hunted a baby mouse. The king finally took notice of the dove and decided to take him on a fox hunt. The dove eagerly dove on the first fox he could get his eyes on. The fox froze for a second, but then jumped, grabbed the dove and ate it.

Similar to the dove in this Aesop-inspired story by

your friendly neighborhood economist, Governor Erdem Başçı is also pretending to be a hawk. During the presentation of the Central Bank of Turkey’s

latest Inflation Report on Oct. 31, he reiterated the Bank’s commitment to lowering inflation by noting that monetary policy

would remain tight until inflation got close to the Bank’s 5 percent target.

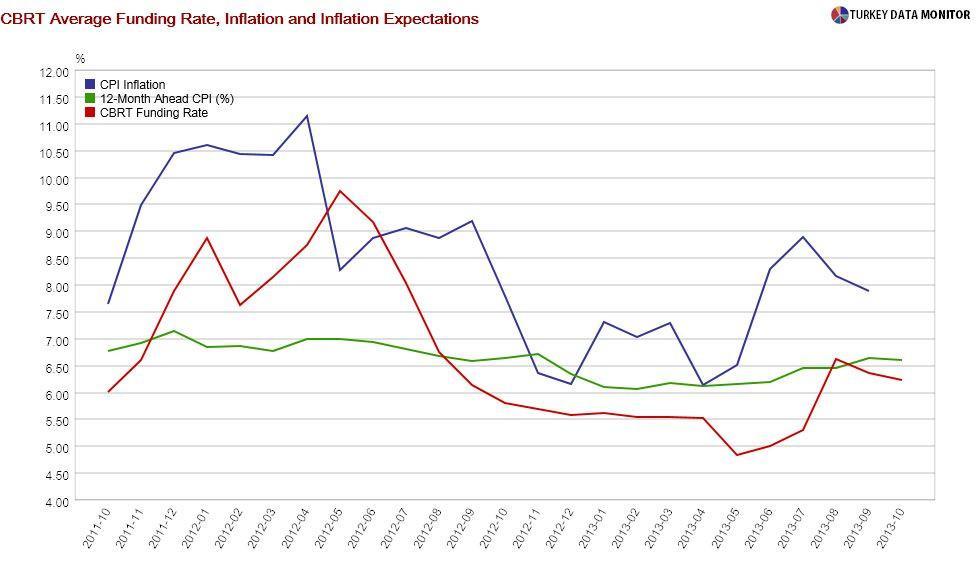

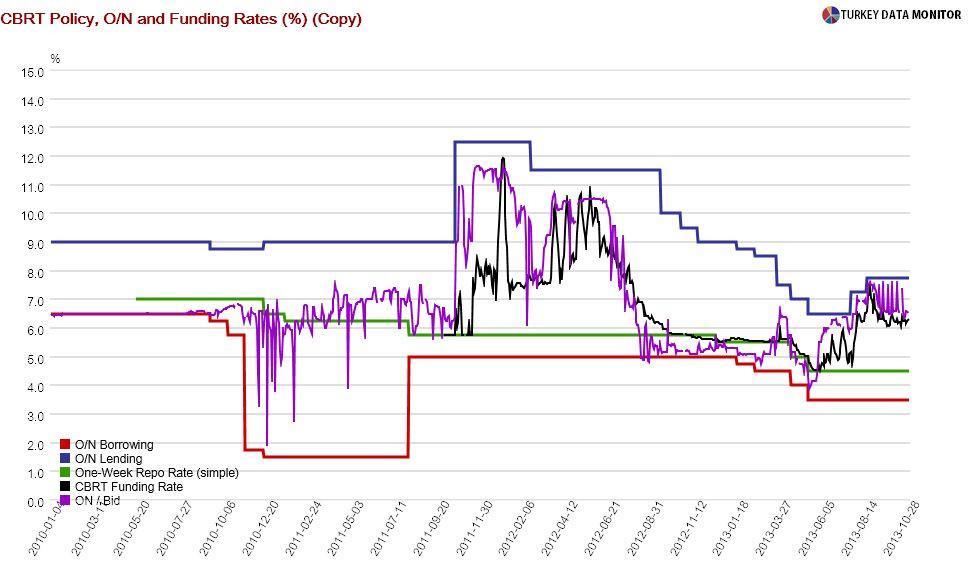

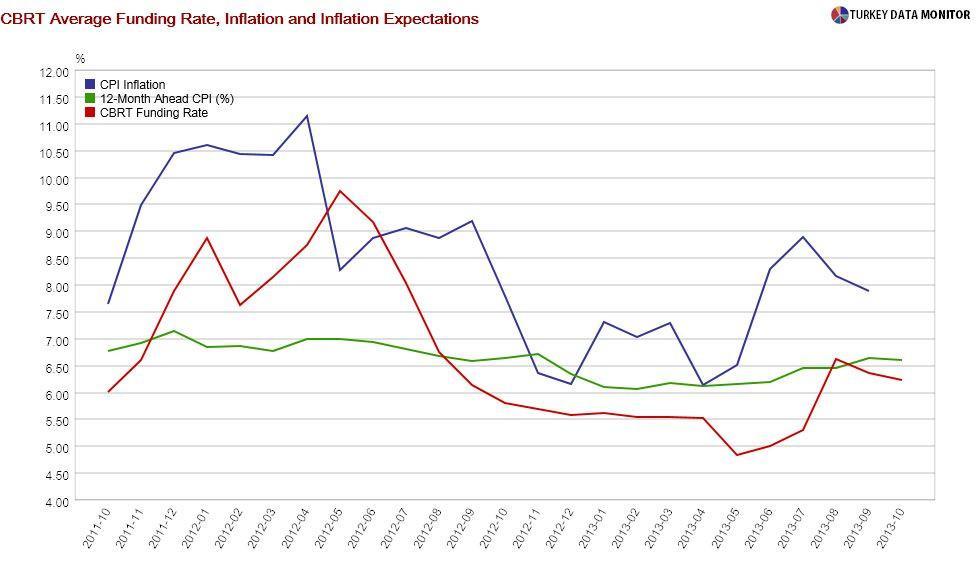

That sounds great, but while the Bank’s average funding rate is currently 6.3 percent, inflation and inflation forecasts for the period 12 months ahead are 7.9 and 6.6 percent respectively. This means that both ex-ante and ex-post real interest rates are negative. Başçı revealed they were decreasing the maximum liquidity provided by one-week repos at 4.5 percent to 10 billion liras, which should increase the average funding rate by 0.2 percentage points.

Başçı also confirmed that they don’t see the need to raise the overnight lending rate, which is the ceiling of the Bank’s interest rate corridor and the upper limit of the average funding rate. You tell me if a 0.2 percentage point rate hike, or the 7.75 percent ceiling for that matter, are enough to tame inflation- or counter capital outflows if global liquidity gets scarce, especially as peers like

India and

Brazil are tightening more aggressively.

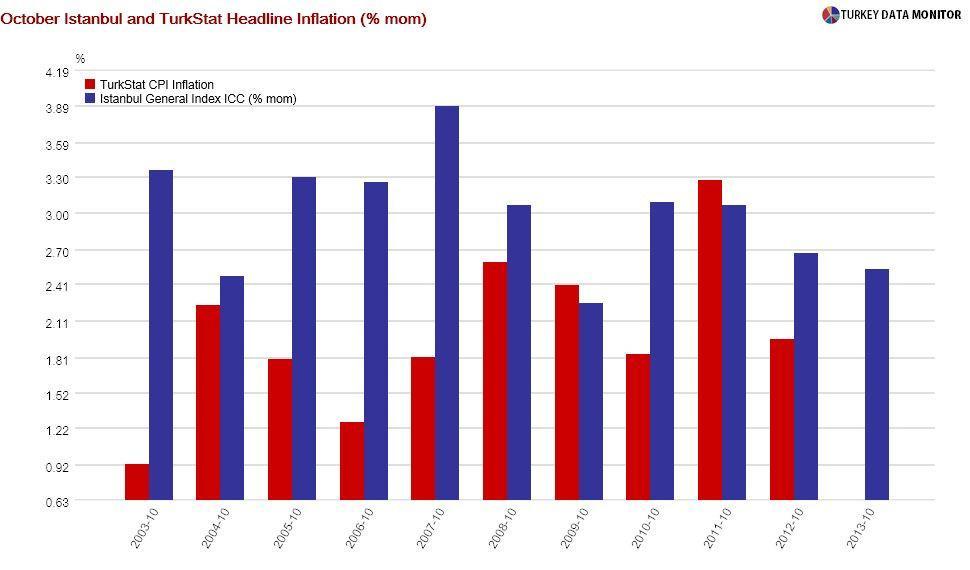

To add insult to injury, even the Bank’s short-term inflation forecast is unrealistic. As expected, the Bank increased its end-of-year inflation projection to 6.8 from 6.2 percent. Today’s October inflation could come in higher than expectations of 1.3 percent (monthly) if the Istanbul Chamber of Commerce’s inflation rates statement, which was released on November 1, is any guide.

My forecast of 1.5 percent would bring annual inflation down to 7.4 from 7.9 percent because of base-year effects. But inflation is likely to pick up in the final two months of 2013, ending the year just below 8 percent. I am sure the Bank knows this math, but they are keeping their projection at 6.8 percent to appear hawkish.

The worst part of being a dove pretending to be a hawk is that foxes will still see you as a dove. For example, markets did not take Başçı’s 1.92 end-year dollar-lira exchange rate forecast

at the end of August seriously. So he backpedaled in the Q&A session after the presentation of the report, stating that his end-of-year assumption was the average for October (1.99).

Let’s hope that Başçı doesn’t get seriously tested by the foxes on either inflation or the exchange rate.

Once upon a time, there was an unhappy dove employed in a distant kingdom’s postal services as a messenger.

Once upon a time, there was an unhappy dove employed in a distant kingdom’s postal services as a messenger.