How I learned to stop worrying and love the slowdown

I am not sure what to make of this week’s Turkish economic data.

The

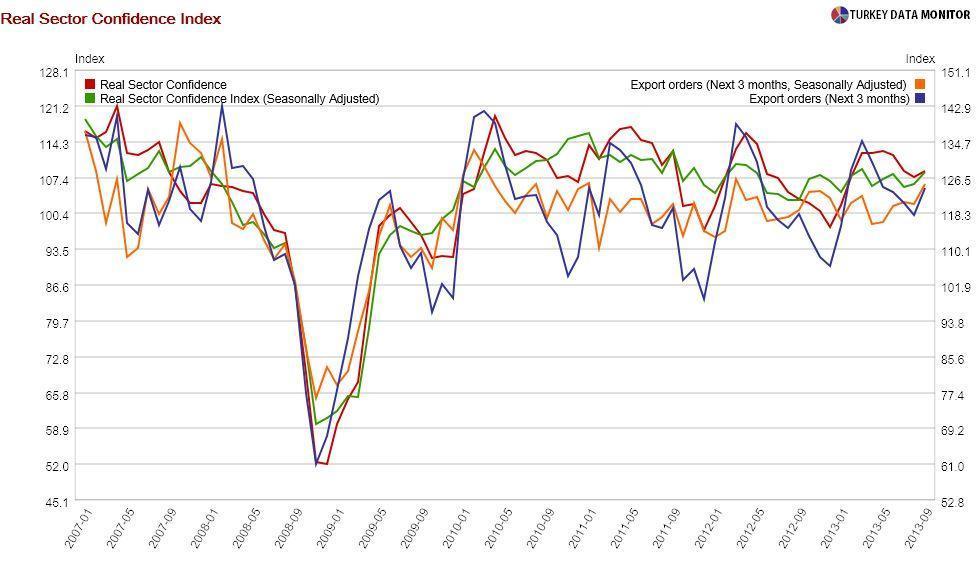

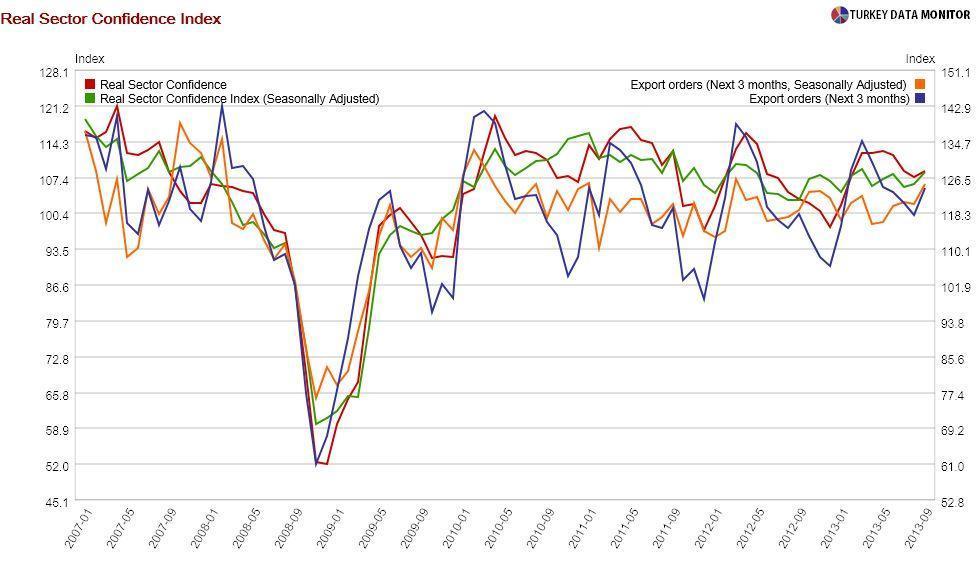

Purchasing Managers’ Index (PMI), which was released on Oct. 1, rose to 54 in September from 50.9 in August, reaching its highest level since January. The increase seems to be in line with the recent

real sector confidence index (RSCI), which was released on Sept. 24, but a detailed look at the components of both indices paints a different picture.

In

their analysis of the data, Capital Economics, a macroeconomic consultancy, notes that the new export orders component of the PMI barely moved, which leads them to conclude that the improvement in economic activity is mainly coming from domestic demand. But the rise in RSCI was mainly driven by the outlook for the next three months, including exports, and so it may be useful to resort to other statistics.

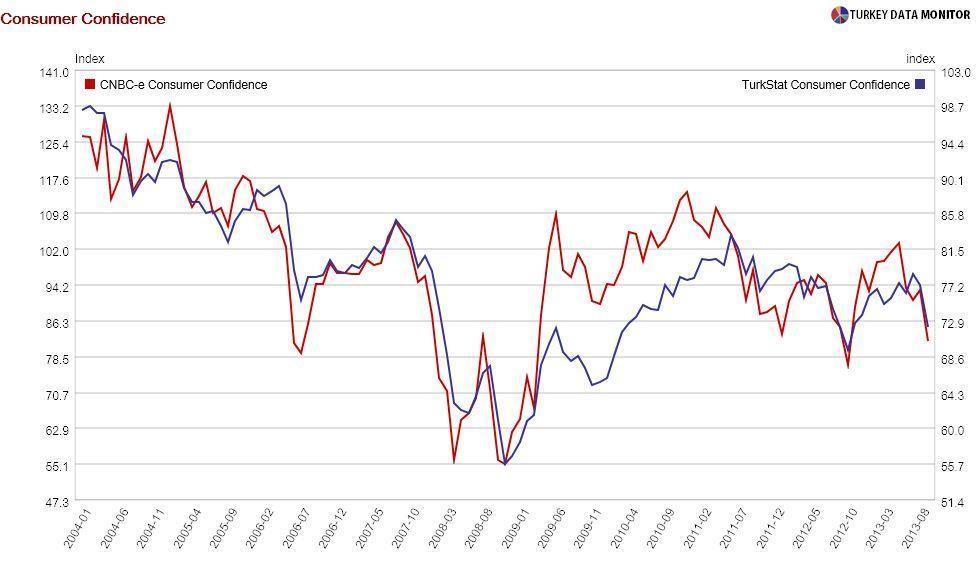

According to weekly data from the banking regulator, loan growth is slowing down. Some of the recent decrease in the pace of foreign currency (FX) credit is due to lira appreciation, but the Central Bank’s favorite measure, which adjusts for FX moves, is showing a clear downward trend. More importantly, the CNBC-e consumer confidence index, published on Oct. 1, dropped sharply, confirming the

plunge in the official index, which was released on Sept. 27.

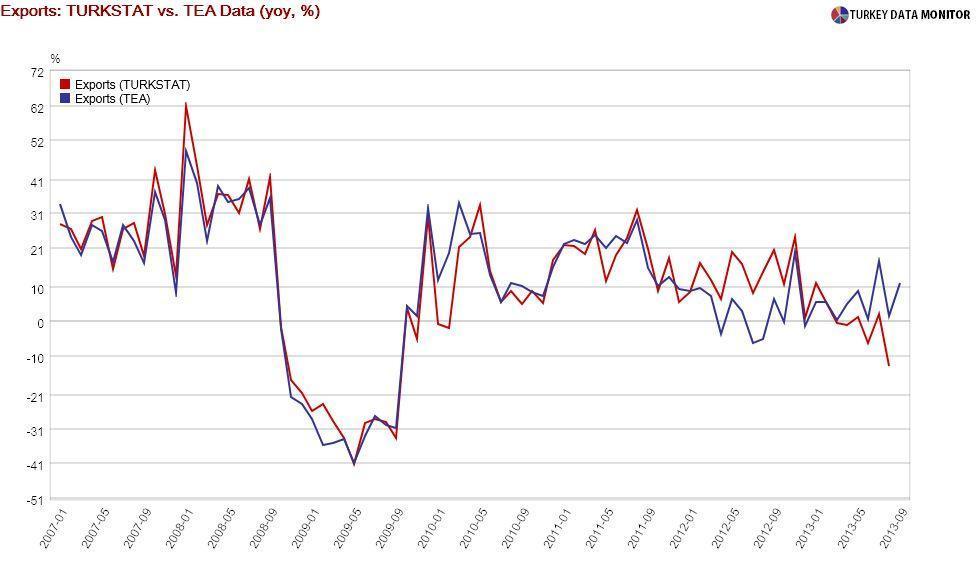

OK, so if it is not domestic demand that is driving the economy, it should be external demand, right? Another statistic released on the first day of each month may provide some answers. According to preliminary data published by the Turkish Exporters Association,

exports rose 11.1 percent annually in September, leading Finance Minister Mehmet Şimşek, who is often as

confused as is

confusing, to

tweet jubilantly.

However, there was one more business day (21) in September of this year compared to last year. Özgür Altuğ of BCG Partners calculates the actual increase in exports to be 4-5 percent after making a working day adjustment.

All in all, I cannot say with confidence that I am seeing green shoots in Turkish data when I look at all statistics of the last two weeks, especially those related to domestic demand. This should not come as a surprise; higher interest rates and the weaker lira were bound to hit demand. This impact can be best seen in automobiles. According to Automotive Distributors’ Association data released on Oct. 2,

light vehicle sales fell 2.4 percent annually in September.

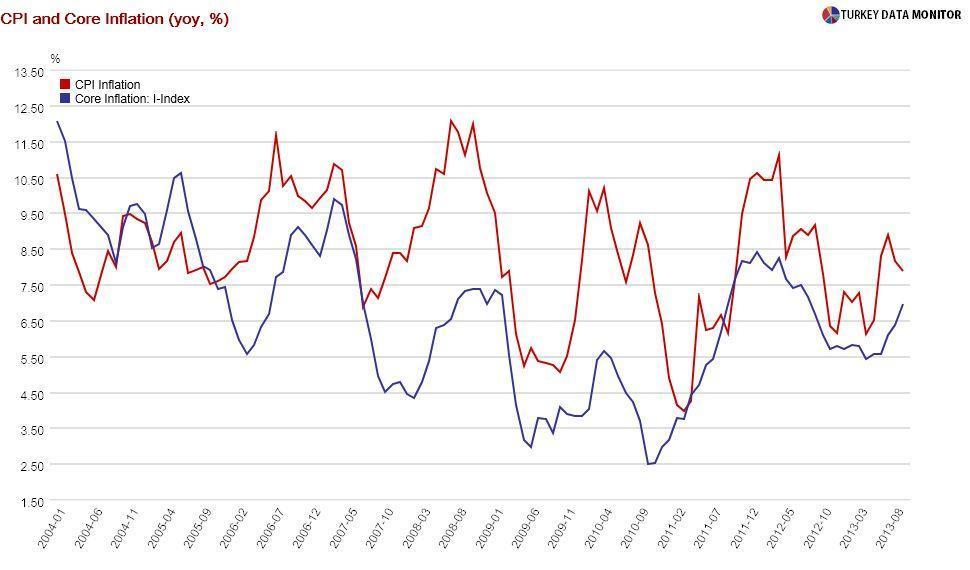

This is not necessarily a bad thing. A slowdown in domestic demand will relieve not only the current account deficit, the Achilles’ heel of the economy, but also inflation. Indeed, data released on Oct. 3 revealed that

consumer prices rose 0.8 percent (monthly) in September, higher than expectations of 0.6 percent. Annual inflation actually decreased from 8.2 to 7.9 percent because of base effects, but the jump in core inflation is ringing alarm bells.

The key question is whether Prime Minister Recep Tayyip Erdoğan will allow an orderly slowdown in the economy before triple elections.

I am not sure what to make of this week’s Turkish economic data.

I am not sure what to make of this week’s Turkish economic data.