Four Passover Seder questions

Since

I am undoubtedly a member of the Zionist

interest rate lobby according to pro-government daily Sabah, I might start

acting like one by celebrating the Easter and Passover of my heathen readers.

The

Passover Seder, which marks the beginning of Passover and was possibly Jesus’

Last Supper, unites these two religious events. During the dinner, the youngest

child at the table asks four questions, and being a kid at heart, I would like

to carry over the tradition to my column to summarize recent key Turkish

economic events.

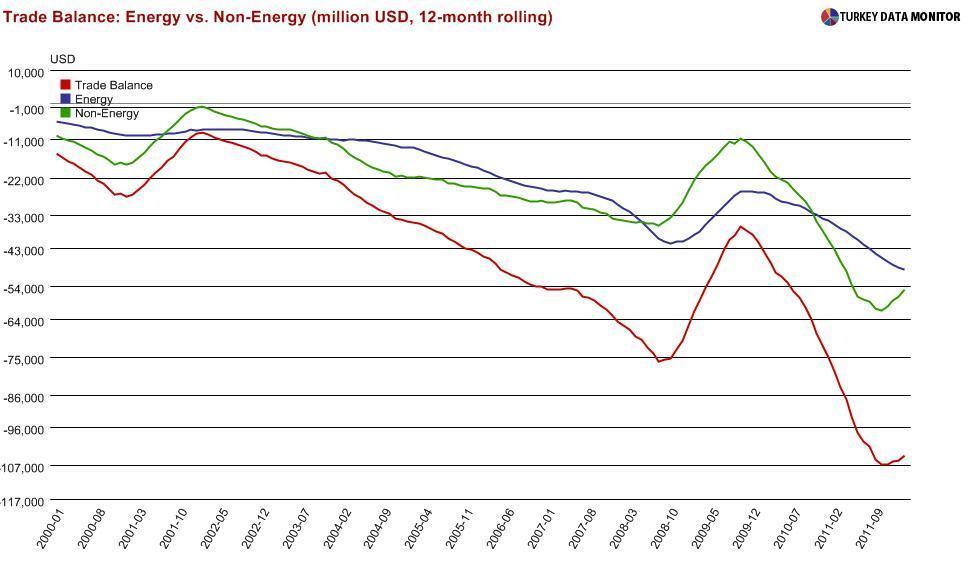

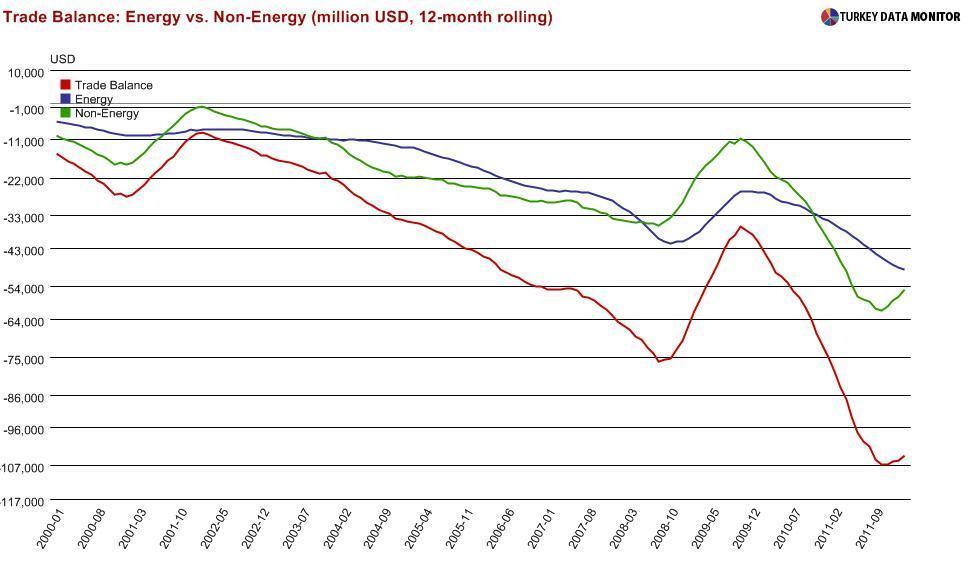

Is the current

account adjusting? It is tough to jump to conclusions from one

month of data, but the February

trade deficit, at $5.9 billion, came in much better than expectations of

$6.5 billion. The sharp decline in the non-energy deficit is especially

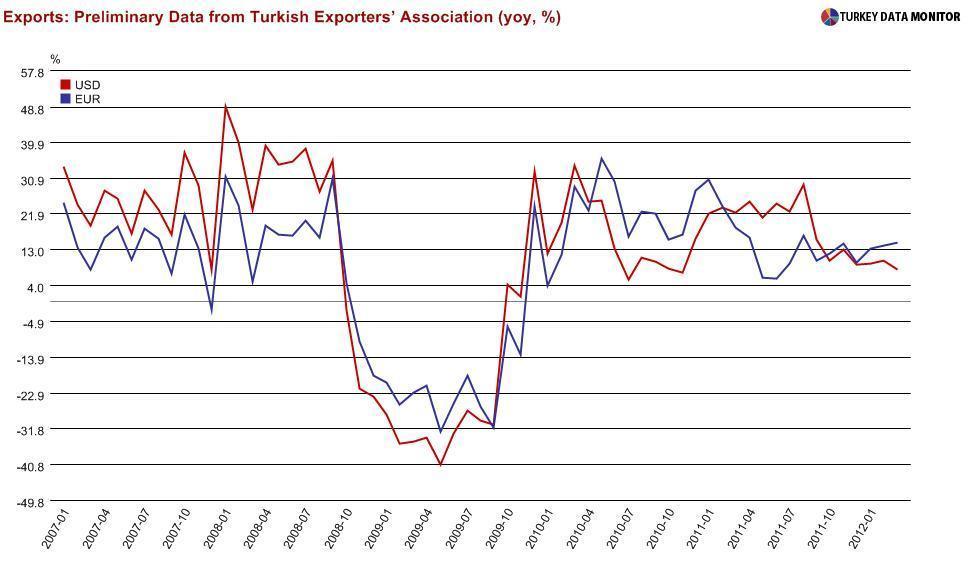

positive. Besides, preliminary export figures from the Turkish Exporters

Association are hinting

that exports are proving to be relatively resilient.

Then, is the economy

rebalancing? Yes and no. If you look at the growth

data from the last quarter of 2011, which were released last Monday, this

is a no-brainer: Foreign demand contributed a hefty 3.2 percent to growth,

which is not very common except in recessions. In contrast, the contribution of

domestic demand plunged to 2.4 percent from 9.4 percent in the previous

quarter.

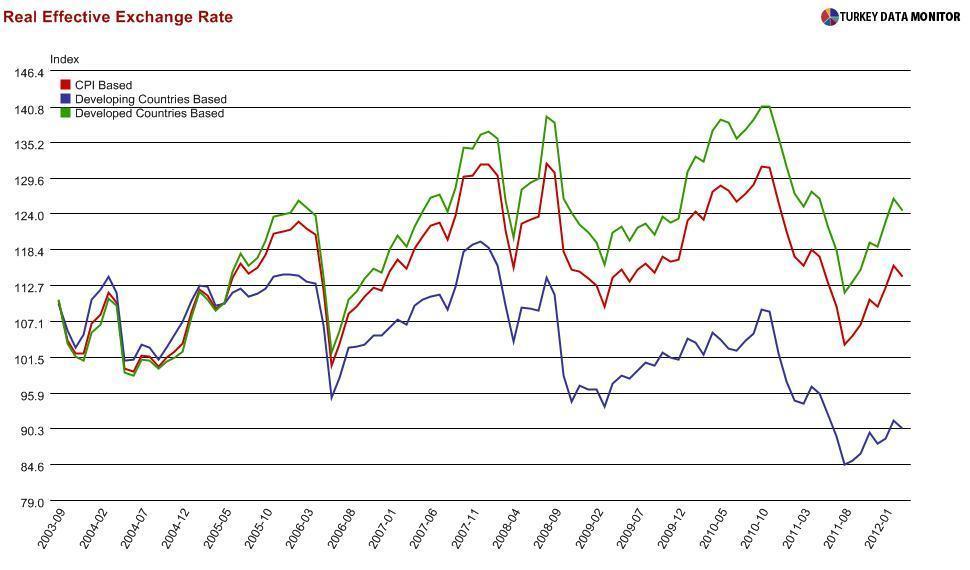

But

early indicators are hinting that this adjustment may not extend into the

second half of this year unless the current policy stance changes. For example,

if the lira really “beats the dollar” this year, as Central Bank Governor Erdem

Başçı boldly

claimed in January, the relative lira strength may start to bite into

exports and revive imports.

All

in all, it is very tough for Turkey to grow 4 percent or so this year, as the

government is envisaging, and bring both the current account deficit and

inflation to the 7 percent range. In a “good scenario”, capital flows may pull

growth above 4 percent, but that would mean certain death to this rebalancing

process.

What about the

favorable March inflation? Consumer

prices rose

by a lower-than-expected 0.4 percent in March, mainly because of softer

food inflation, leaving the yearly

figure unchanged at 10.4 percent. Besides, the decline in core inflation is

hinting that the worst is already behind us.

The

recent energy price hikes will contribute 0.5-0.6 percent to April inflation,

causing the yearly figure to rise. Inflation will then start its descent in

May, but it is very unlikely to go as low as 6.5 percent, as the Central Bank

is projecting.

How do you feel about

the new investment

incentive scheme? It is definitely well thought-out and an

improvement over the previous one. Tackling

the current account deficit by encouraging domestic production of

intermediate inputs, most of which are currently imported, is a step in the

right direction.

But

these measures should not be substitutes for investment

climate reform. If Batman (the city, as I am sure Bruce Wayne has his own

generator) has frequent electricity outages, an industrialist would think twice

before setting up shop there, regardless of the incentives.

Nirtzah, or next

year in Jerusalem, and thus I conclude my economic seder.

religion,