Foreign exchange rate and wage pressure on companies

Mustafa Sönmez - mustafasnmz@hotmail.com

DHA Photo

The huge value losses of the Turkish Lira against the dollar and the euro throughout 2015, as well as the increase in the minimum wage and personnel expenses in general, are raising costs in all sectors. It seems as if this dual pressure, in the face of shrinking domestic and international demand, will make it quite a tough year for company managers. Especially for managers that have heavy foreign currency debts, these burdens could create hard times leading to bankruptcies, handovers and liquidations.

Cost items

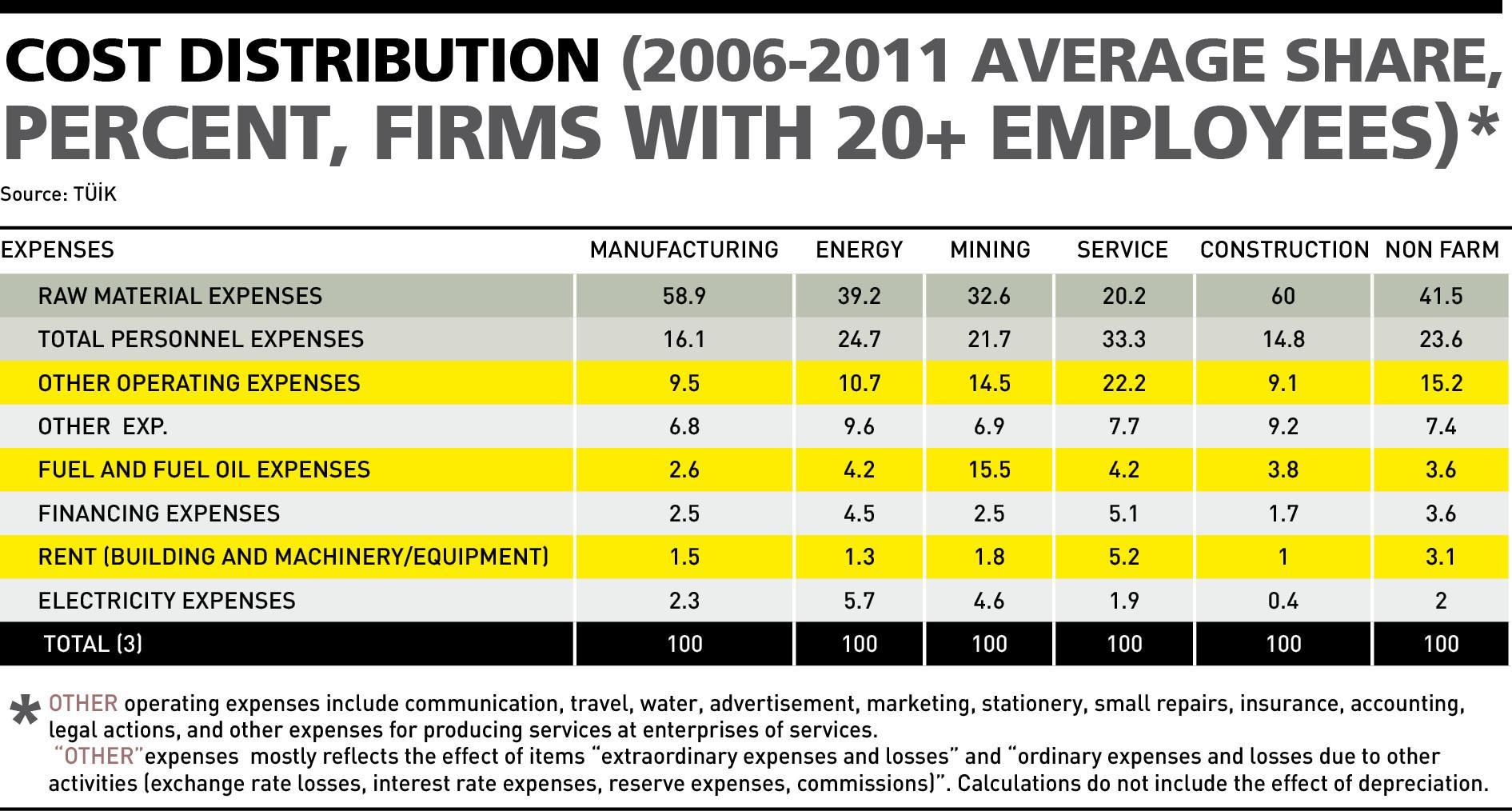

In the Central Bank’s 2015 Second Inflation Report, the cost survey revealed that raw material and salary expenses constituted two-thirds of company costs. Another survey shows that the highest share in company costs belonged to raw material costs at 41.5 percent. Personnel expenses followed at 23.6 percent.

According to a Central Bank survey, two major items were followed by other operating costs at 15.2 percent, which are generally non-production costs. While energy (electricity, fuel and fuel oil) have a share of 5 percent, rent (building and machinery/equipment) and financial expenses make up 1.5 and 2.5 percent of the total.

In sectors related to production (except for service), raw material expenses had the biggest share in total expenses. This category has the lowest share at 20.2 percent in the service sector and the highest at 60 percent in the manufacturing and construction sectors.

In the labor-intensive service sector, the share of employment costs is around 33 percent. From the point of the size of their share, personnel expenses (salaries, social security premiums and severance and notice pay) constitute 24.7 percent in the energy sector and 21.7 percent in the mining sector. In the manufacturing and constitution sectors, the share of personnel expenses is nearly 16 percent.

Hikes in the prices of raw material affect the costs of firms; this, in turn, affects product prices, leading to cost inflation. Especially in sectors where there is a high usage of imported inputs, sharp exchange rate hikes create a pressure cost-wise on consumer inflation.

Increase in workforce

According to Central Bank research, in the period when workforce costs were examined the annual average increased 10 percent in nominal terms, about 2 points above general consumer inflation. When the share of personnel expenses in total costs is taken into consideration – given the profit margins – the salary increases that occur in excess of the targeted inflation actually restrict the fall in inflation, ensuring salaries can become targets.

Personnel expenses within manufacturing industry costs are 16 percent.

In the period ahead of us, the pressure on costs stemming from raw material price increases due to exchange rate hikes has become a major issue, along with salaries.

The demand to increase the minimum wage by 30 to 50 percent – something that was included in the election manifestos of political parties for the 2015 elections – transformed into an expectation before being announced at 1,300 Turkish Liras. However, employers that did not voice any opposition before the elections began expressing their discontent when the rises were about to come into force.

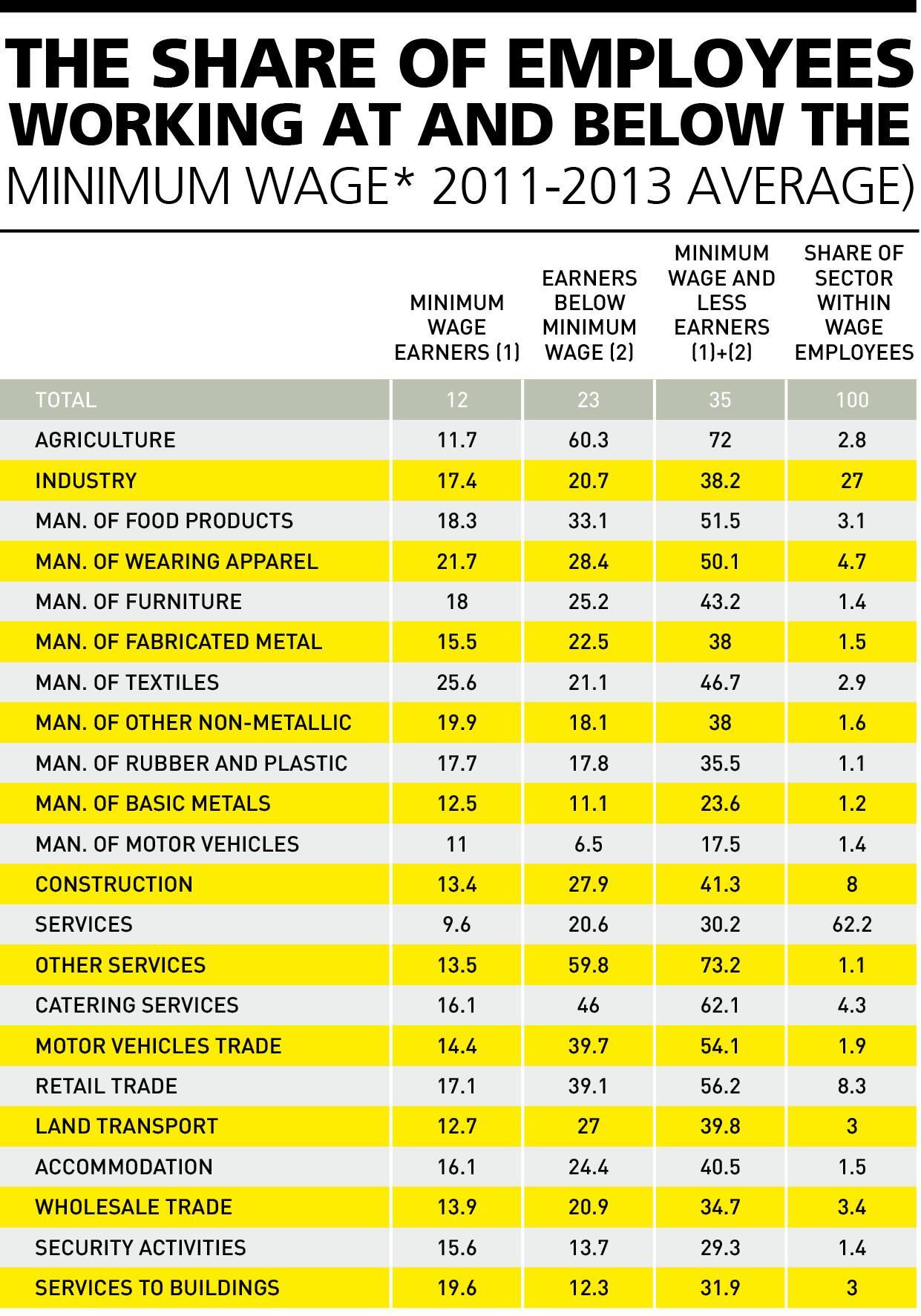

Minimum wage in sectors According to the Central Bank’s 2015 First Quarter Inflation Report, among all wage earners, about 35 percent of Turkey’s workforce earns the minimum wage or below. Among wage earners, a distinct concentration is observed around the minimum wage. For the general economy, the share of those earning a minimum wage or below is 35 percent; in industry it is 38.2 percent. In the construction and service sectors, it is 41.3 and 30.2 percent, respectively. This rate goes up to 72 percent in the agriculture sector.

The sectors that have the greatest number of workers earning the minimum wage and below are in the food, clothing, furniture, fabrication metal and textile industries, where a non-qualified workforce is especially employed. In these sectors, minimum wage increases are expected to have a greater impact on workforce costs and thus pricing performance.

In those subsectors where the number of minimum wage earners is lower, where qualified workers are employed are the automotive and base metal industries. The share of minimum wage earners in these sectors, are 17.5 and 24 percent, respectively.

Real costs of wages

A significant portion of the personnel expenses of companies consist of the high salaries of top-level, white-collar workers who have no relation to production, as well as members of the executive committee. Also, it should not be forgotten that half of the cost consists of tax that goes to state and social security (SGK) premiums.

The cost of a minimum wage earner to the employer was 1,472 liras in the first half of 2015; it rose 1,560 liras in the second half. This means more than 50 percent of the net minimum wage is paid to the state in terms of taxes and premiums.

The monthly minimum wage of a net 1,300 liras promised before the 2015 elections means a 30 percent raise compared to the previous minimum wage. The gross monthly wage of this net figure is 1,818 liras and its cost to the employer is 2,227 liras.

Trade union activity in Turkey, meaning the right to collective contracts, is highly restricted. Of the 18 million wage earners in the country, about 3 million are public employees, while the remaining 15 million are private wage earners. Altogether, less than 1 million of them are able to use their collective contracting rights.

The Turkish Confederation of Employer Associations (TİSK) defines the average worker’s salary in workplaces subject to collective bargaining as 2,255 liras. This is twice the net minimum wage. TİSK says the cost to employ an average wage earner in their member companies reaches 3,867 liras with tax and premiums.

Costs and measures

Industrial firms will inevitably reflect cost increases stemming from imported material because of exchange rate hikes, their competition and market issues.

Now, there are already demands that the government introduce reductions in tax and premium issues in salaries so that the other important cost item, the increase in wages, can be curbed. As well, companies, even if they do not wish to, might resort to layoffs while demanding some facilitation from the government on the issue of severance.

All of this, needless to say, could produce new tensions, especially in employee-employer relations.