E.ON to exit Finland and sell stake in Fennovoima

HELSINKI - Reuters

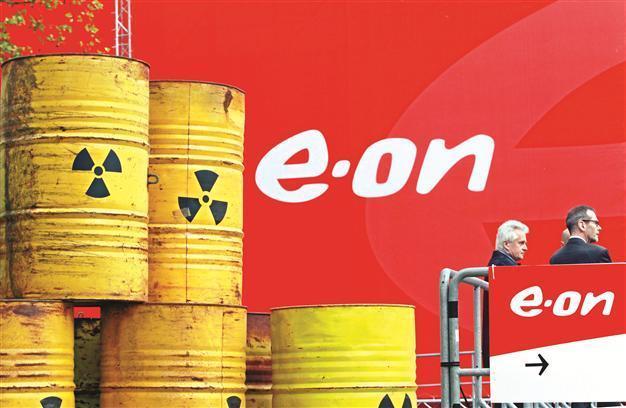

Mock-ups of atomic waste barrels are arranged by protestors at the gate of an E.ON meeting in Essen, Germany. REUTERS photo

Germany utility E.ON is selling all its operations in Finland, including a stake in an unbuilt nuclear project, as it tries to raise funds and reduce its debt.

The move raises questions over the future of the Fennovoima reactor which is aimed at providing cheap energy to shareholders such as stainless steel maker Outokumpu, retailer Kesko and subsidiaries of Swedish metals firm Boliden .

E.ON, whose debt stood at 41.1 billion euros at the end of June, needs cash for its expansion in growth markets such as Turkey and Brazil amid stagnant growth in debt-burdened Europe.

Earlier this year, E.ON announced plans to buy a 10 percent stake in Brazil’s MPX Energia for $471 million.

Like its peers RWE and EnBW, E.ON was dealt a massive blow when Germany decided last year to phase out nuclear power following Japan’s Fukushima disaster.

E.ON’s 34 percent makes it the biggest single shareholder in the Fennovoima project, which is set to choose a supplier for a planned reactor in Pyhajoki, northern Finland, next year.

The other investors hold stakes through an entity called Voimaosakeyhtio SF.

Analysts say it would make sense for Fennovoima to find a utility with nuclear experience to invest in the project but that might be difficult.

Juha Kinnunen from equity research firm Inderes said a potential buyer of E.ON’s stake could be Vattenfall, the Swedish state-owned energy group which earlier this year filed an application to replace existing Swedish reactors with new ones.

Finland’s own state-controlled utility Fortum in 2010 was left without a permit to build a new reactor. However, Kinnunen said he would not expect the company to take part in this project where it would only hold a minor stake.

“Fortum has just said that they are looking to cut their capital expenditure, so this kind of project would turn that upside down.”

UPM-Kymmene, a forest group with major nuclear energy holdings, is also an unlikely buyer, Kinnunen said.

Vattenfall, Fortum and UPM declined to comment whether they would be interested in the stake.

Fennovoima chairman Pekka Ottavainen told Reuters he was confident about the project’s future and said E.ON would help it find a new investor.

The project, originally estimated to cost 4-6 billion euros, required a new tranche of financing from owners by the summer of 2013, he said.