Turkey’s risks under review amid tense regional politics

MUSTAFA SÖNMEZ - mustafasnmz@hotmail.com

The looming tension between supporters and opponents of president-elect Recep Tayyip Erdoğan, the domestic struggle within the ruling Justice and Development Party (AKP) and regional tensions are also being monitored by ratings agencies.

It was just a day after the announcement of the results of the presidential elections that the first assessment came from the credit rating agency Fitch. The agency said that although Recep Tayyip Erdoğan had won the presidential elections, the political risk in Turkey was still high.

Fitch was highlighting that political risks would weigh on Turkey’s ratings through its potential effects to discourage capital inflows and reduce policy predictability. Fitch also recalled how the anti-government protests last summer and the corruption scandal, domestic political and social shocks could damage perceptions of sovereign creditworthiness.

Fitch also said policy coherence and credibility were already weaker than ratings peers, chiefly because of shortcomings in the monetary policy framework, stressing that Erdoğan’s maintenance of pressure on the Central Bank to cut interest rates could further undermine the CB’s credibility following sharp rate hikes in January. In the event of a rapid unwinding of these hikes, Turkey would become more vulnerable to a sudden change in investor sentiment, Fitch said.

The government was quick to respond to Fitch’s statement, drawing attention to the political risks.

Economy Minister Nihat Zeybekci, known to be close to the prime minister, said the following on Twitter: “One would have to be blind and ignorant not to be able to see the intention behind Fitch’s assessment. In the morning of the most important, democratic and precise election in our history, an institution which makes political risk warnings cannot be regarded as objective assessment.”

Erdoğan and Gül

Erdoğan and Gül The geopolitical and political risks facing Turkey have been highlighted in the increasing number of statements issued by credit rating agencies about the country. The domestic struggle within the ruling Justice and Development Party (AKP) is also being monitored closely. Erdoğan’s efforts to retain control over his party after he ascends to the Çankaya Presidential Palace, coupled with his desire to exert executive power while in Çankaya and impose a de facto presidential system, have brought forth new chaos and debates about unlawfulness inside and outside the AKP.

The fact that one of the founders of the AKP, Abdullah Gül, wants to return to the party and the demands from within the AKP to see him as the new party chair were deemed unsuitable by Erdoğan, opening the way to a quickly developing fight. According to some, this struggle has a potential to split the AKP and even lead to the creation of a new party. As such, agencies that monitor these developments have noted the rise of political risk in their reports while also taking into consideration these domestic struggles.

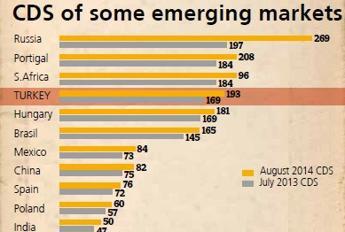

What do CDSs say? At the top of the indicators used for foreign investors who want to understand the risks in Turkey are Credit Default Swaps (CDS). CDS are a financial swap agreement indicating how much the investor pays the insurer. Turkey is near the top in the list of CDS of emerging markets; one of the factors that has caused this outcome is the geopolitical risk that has been highlighted in recent times.

The regional wars of recent months have brought the concept of “geopolitical risk” to the forefront for many countries. European Central Bank President Mario Draghi first highlighted this, claiming such situations sap the appetite for risk and accelerate deflation in the European economy. As a matter of fact, the increases in countries’ risk premiums for July-August alone demonstrate the significance of the geopolitical risk, especially for Turkey.

Among emerging markets in the CDS listing, excluding Argentina, Russia is top amid the tension with Ukraine and the United States and European Union’s attempt to tame with sanctions. In one month, Russia’s risk premium has increased 30 percent. However, Russia is a resilient sovereign economy that has a current accounts surplus; it has adequate reserves to balance out its risks.

Second spot is occupied by one of the sick countries of the eurozone, Portugal, whose banking system is leaking. However, in the final analysis, an EU country does not sink, it is always floated. Third place belongs to South Africa, which is experiencing similar foreign money dependencies to Turkey and which is exposed to capital outflows. It, however, is also under the umbrella of the BRICS, meaning it can count on making use of the emergency funds provided within the organization.

And then we come to the fourth country, Turkey; it is obvious that it is Turkey which is the most fragile and most open to damage from risk. In addition to the economic and political risks that present threats currently, there is the risk of being dragged into combat in the Middle East and Russia. The increase in the risk premium for the last two months is 7 percent, a high figure.

There is a series of negative course of events that will increase Turkey’s risk tension.

The pain of rating

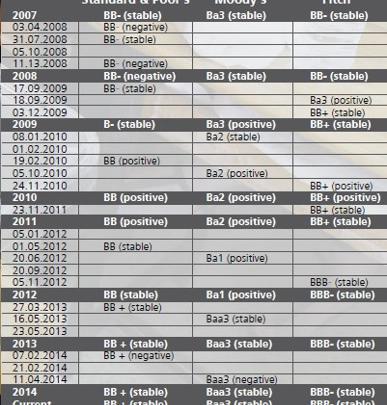

The pain of rating The ratings of international credit rating agencies, primarily Standard & Poor’s, Fitch and Moody’s, are another method to understand Turkey’s risk level. If the credit ratings of these agencies are especially heading toward “negative,” then the message is clear: Be very careful when you are investing in this country. Countries and institutions that want to issue bonds in global markets have to obtain credit ratings; if such countries do not get themselves assessed by these agencies, then no investor will take them into consideration. As such, countries can acquıre loans only when they are rated by these agencies. The highest rating is AAA (or Aaa) and the lowest rating is D. These ratings are accompanied by such signs as + and – or stable, negative or positive to show the expectations for the future. S&P and Fitch use the signs (+) and (-); Moody’s uses figures 1, 2 or 3.

Turkey which has a current account deficit of up to 8 percent and desperately needs external loans at reasonable interest rates, meaning it must take the ratings of international credit rating agencies seriously whether it likes it or not. If the rating is good, then investors will look into the direction of that country; if it is the opposite, they will turn their backs, precipitating an outflow of capital and a concomitant rise in foreign exchange rates.

May 2013 was a watershed moment in that it featured the announcement of the end of a monetary climate and the declaration of the beginning of another. The U.S. FED announced that it would slowly end its bond support program, after which capital outflow began from several countries, including Turkey, where external money had been invested. At the same time, local currencies also went through a devaluation.

Together with the scandals of Dec. 17-25, 2013, the risk in Turkey grew substantially for foreigners and despite all the interventions aimed at curbing it, the Turkish Lira lost 20 percent of its value against the dollar and 25 percent against the euro. Companies which borrowed in foreign currencies recorded huge losses.

The credit rating agencies of course evaluated this new climate, made new measurements and gave new ratings. While S&P closed 2013 by giving Turkey a BB+stable, the rating went down to BB+negative in February 2014. The rating has stayed there for the time being.

Fitch gave a BBB-(stable) in November 2012; it has not changed it since. Moody’s gave its best rating of Ba1 positive in mid-2012. In May 2013, in other words at breaking point, the rating was first brought down to Baa3(stable), then in April 2014 to Baa3 (-). On Aug. 8, the news that the agency would issue a new rating stirred the markets before the elections but the expected did not happen, there was no change in the rating.

An era has started in which all of Turkey’s risks are being assessed and new ratings are being given, meaning international investors will determine their positions accordingly. It only remains to be seen what course will be taken.

Erdoğan and Gül

Erdoğan and Gül  The pain of rating

The pain of rating