Who is manipulating Borsa Istanbul?

Markets were shocked on June 25 when Turkish equities watchdog Capital Markets Board (CMB)

launched an investigation into the country’s top brokerages on transactions from May 20 to June 19.

The CMB has asked for specific information from certain brokerages in the past. But never before had they undertaken such a broad investigation. They have requested information on personnel, including their Turkish ID numbers, all institutional or personal research and information notes sent to clients and communications with, or orders from, foreign customers.

As Turkish daily Radikal columnist Uğur Gürses

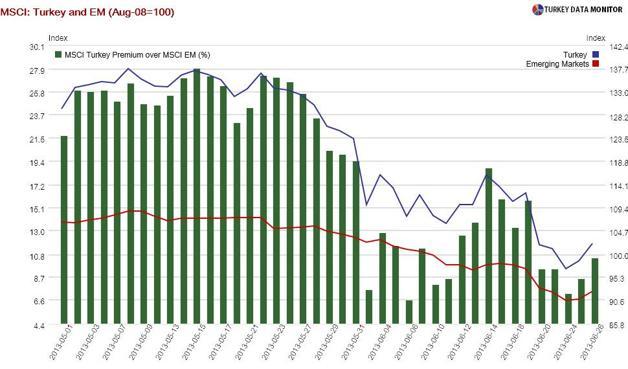

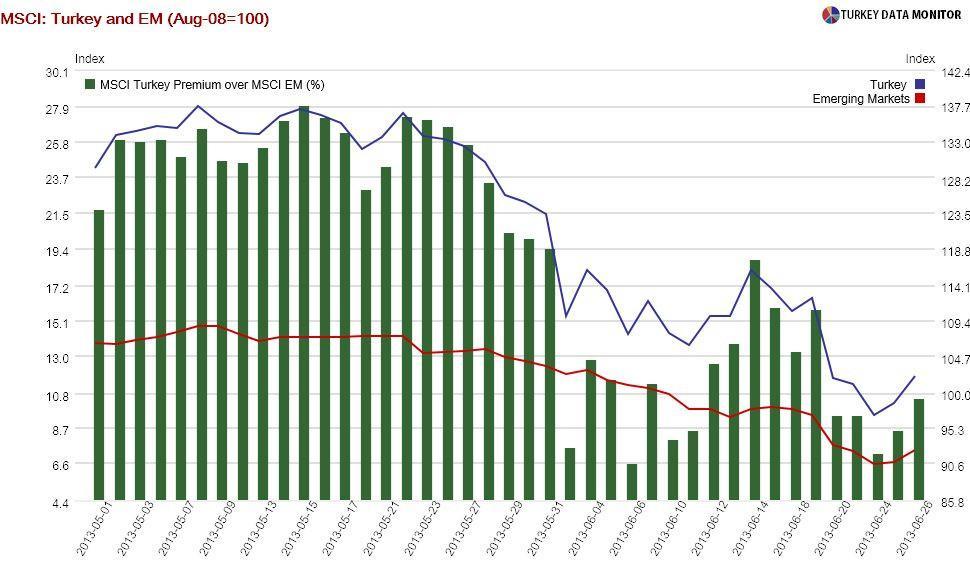

noted, out of 45 major stock markets, 43 fell excessively in June. This is not surprising: Worries that the FED would exit its quantitative easing and Japan’s own monetary policy experiment would fail defined the month. To my knowledge, Turkey is the only country that launched an investigation.

Turkish equities were indeed one of the worst performers in June, but this was as much because of

the country’s vulnerabilities as the Gezi protests. As followers of Turkish markets know very well, Turkey performs better than other emerging markets (EMs) in good times but underperforms in bad times. This time was no exception.

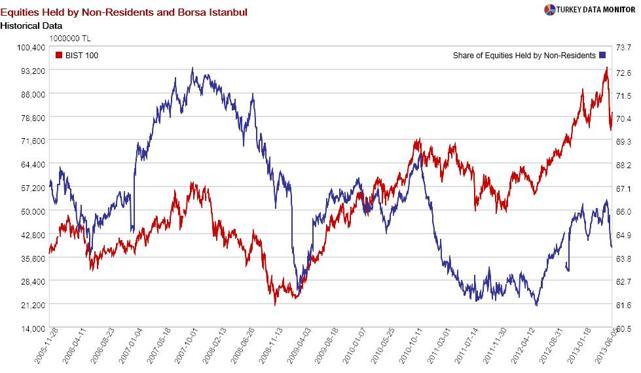

But surprisingly enough, we did not see major outflows from Turkish equities. Using data from

EPFR Global, a company that tracks fund flows, I found out that outflows from Turkey, in comparison to overall EM outflows, were not more than in other “escape from EM” episodes, and certainly smaller than what the drop in Borsa Istanbul would have justified.

This is in line with what ministers Ali Babacan and Mehmet “

nominal $” Şimşek have stated, which I had dismissed as propaganda. Economist Atilla Yeşilada also recently noted, based on reports from Standard Bank and Merrill Lynch as well as his own contacts, that investors had not lost their faith in Turkey. But how come Borsa Istanbul fell so much then? A look at foreigner ownership data may provide some clues.

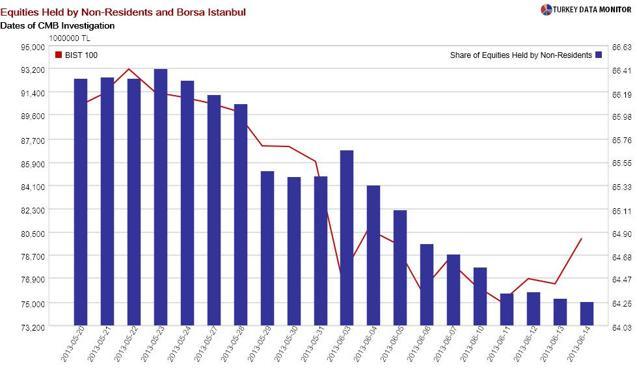

Interestingly, the usually robust relationship between foreign ownership and equity prices is very weak during the period of the CMB investigation. Foreign ownership did indeed fall sharply on June 29, shortly before the police crackdown at Gezi Park. While that may please conspiracy theorists, there was a major sell-off in EMs across the board that day. Foreigners then increased their share when stocks fell 10 percent on June 3.

While foreigners seem to have bottom-fished from May 29 to June 3, their behavior afterwards is quite different. They have been constantly lowering their ownership since then without taking Turkish equity performance into consideration. They continued to reduce their Turkey exposure on June 13 and 14, the last two days

ownership data is available, despite the sharp bounceback in Borsa Istanbul.

In sum, if there was any manipulation, domestic residents were as responsible as foreigners. Maybe that’s why Prime Minister Recep Tayyip Erdoğan is

going after the local banks.

Markets were shocked on June 25 when Turkish equities watchdog Capital Markets Board (CMB) launched an investigation into the country’s top brokerages on transactions from May 20 to June 19.

Markets were shocked on June 25 when Turkish equities watchdog Capital Markets Board (CMB) launched an investigation into the country’s top brokerages on transactions from May 20 to June 19.