The rate cut that tells a lot

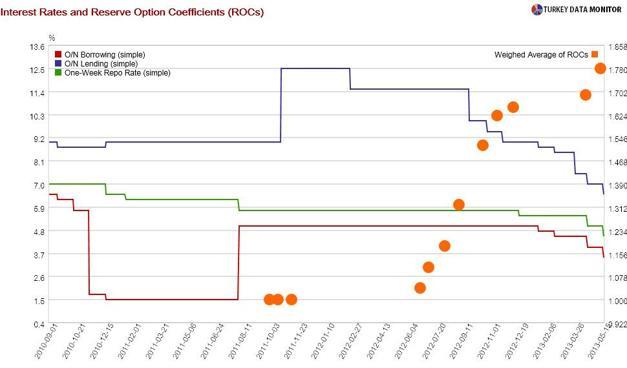

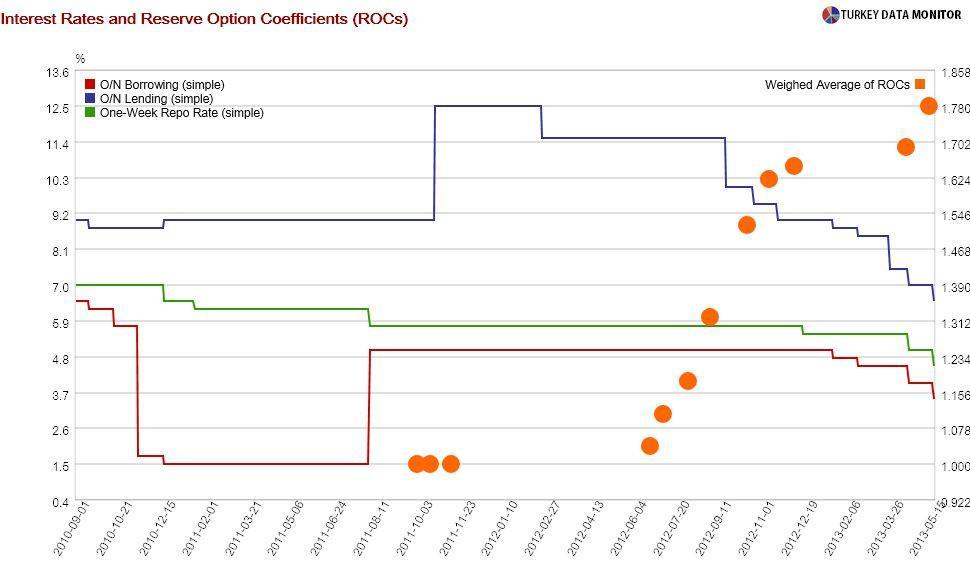

The Central Bank

delivered another 0.5 percentage points cut at yesterday’s rate-setting meeting. In addition, the Bank shifted the interest rate corridor down by the same amount and increased its

reserve option coefficients. Domestic and international economic developments justify the Bank’s move.

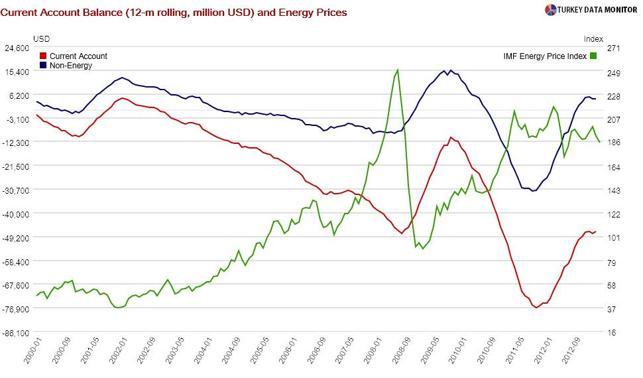

On the domestic side, the latest data hint that economic conditions are not improving. At $5.4 billion, the

March current account deficit turned out to be lower than expected ($5.7 billion), bringing the annual deficit down to $47.1 billion, smaller than the end-year figure of $47.5 billion. It is true that low energy prices are keeping the deficit at bay, but the non-energy current account balance is not deteriorating, as imports are not picking up - a sign of weak domestic demand.

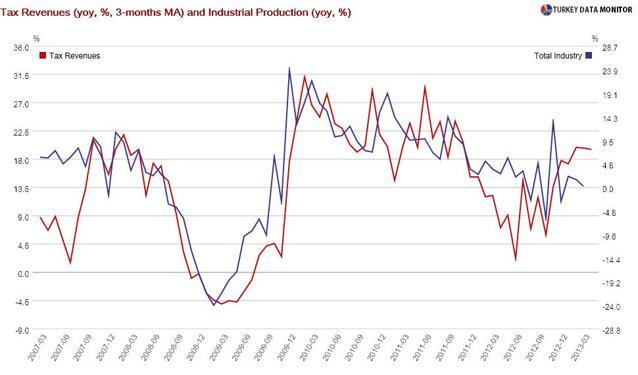

In fact, the current account is the latest in a series of data, such as last week’s

industrial production, that is confirming that the economy is not recovering as quickly as envisaged. There are, however, some recent signs of green shoots. For example, the increase in tax revenues in April budget figures released on May 15 and the rise in CNBC-e’s preliminary confidence index are positive, but it is still too early to declare that recovery is underway.

Interestingly, the current account deficit has not surged, and growth has remained weak despite strong capital flows. Capital inflows were $9.3 billion in March, significantly higher than last year’s $6.3 billion. Turkey used to grow as long as it could secure external financing, but

that relationship recently broke down.

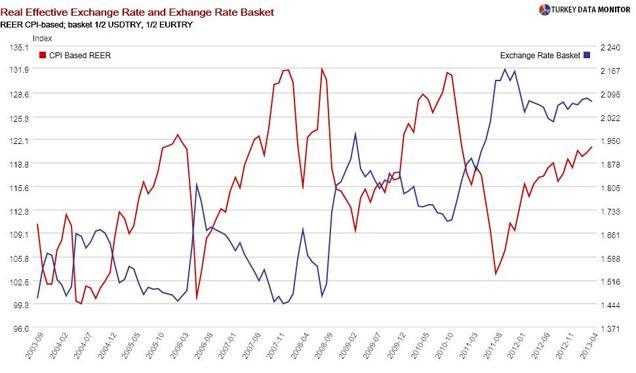

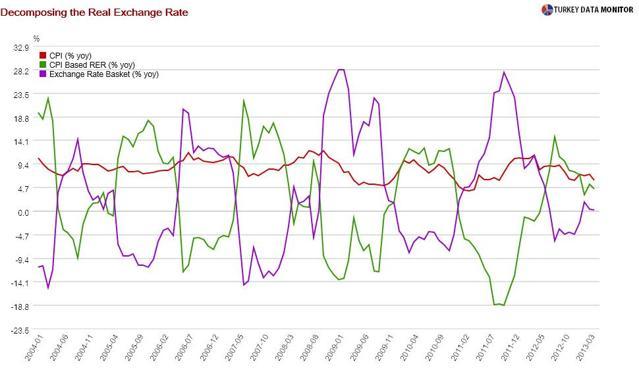

But there is one thing the strong capital flows are achieving. They prevented the exchange rate from depreciating more than it would have done otherwise. According to my back-of-the-envelope calculations, the real exchange rate is slightly above 120. Governor Erdem Başçı has noted that

he does not desire it to pass that level.

Foreigners have increased their Turkish bond holdings by $7.5 billion since the end of March, not only because of confidence in the country’s fundamentals, expectations of an upgrade to its credit rating, or hopes of a rate cut, but also thanks to the unconventional policies of advanced countries’ central banks. In fact, other

emerging market central banks are cutting rates to prevent their currencies from appreciating.

Başçı has been emphasizing of late that the Central Bank will keep its easing bias as long as this global low rates environment continues, and several of Turkey’s peers have lowered rates since the Bank’s latest move on April 16. It makes sense for the Central Bank to follow suit, as not doing so would make Turkey

a magnet for yield-hungry capital.

But the problem is that Turkey has higher inflation than almost all of its peers. This means that the Central Bank has to work extra hard to keep the real exchange rate from appreciating. But more importantly, Turkish real interest rates are

likely to be in negative territory for a while, which could deter savings and cause asset price bubbles.

The Central Bank delivered another 0.5 percentage points cut at yesterday’s rate-setting meeting. In addition, the Bank shifted the interest rate corridor down by the same amount and increased its reserve option coefficients. Domestic and international economic developments justify the Bank’s move.

The Central Bank delivered another 0.5 percentage points cut at yesterday’s rate-setting meeting. In addition, the Bank shifted the interest rate corridor down by the same amount and increased its reserve option coefficients. Domestic and international economic developments justify the Bank’s move.