Sizzling or cold Turkey?

A well-known Turkish expression would roughly translate as “there is good in every malice.” If nothing else, last week’s rout in global markets seems to have improved investors’ perception of Turkey.

Several domestic and international banks released reports on the country last week, arguing that global market movements were positive for Turkish assets and the economy. They were specifically referring to the fall in oil prices, U.S. 10-year government bond yields, and the dollar.

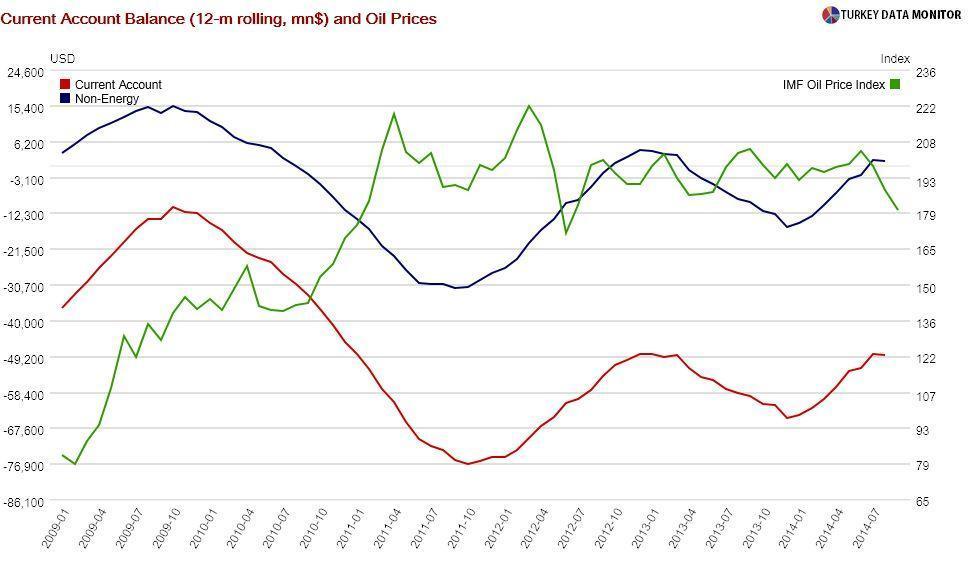

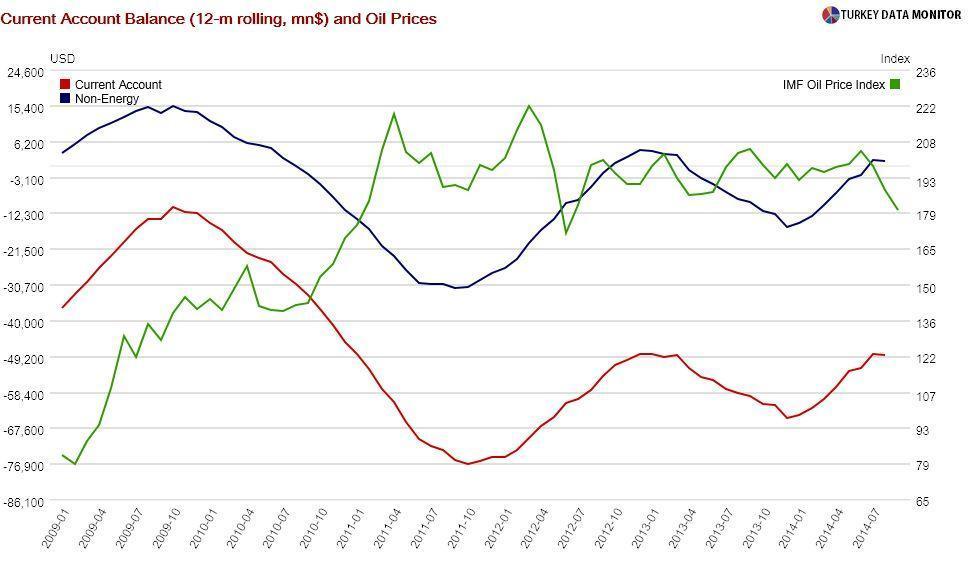

At first look, the argument makes sense. The fall in oil prices would lower Turkey’s current account deficit and inflation, falling Treasuries would mean that yield-seeking investors would continue to flock to Turkey, and a weak dollar would decrease Turkey’s imports bill. But the devil is in the details.

As every Turkey economist knows, a one-dollar fall in oil prices reduces Turkey’s current account deficit by roughly $400 million. But lower oil prices could also raise growth, and the dollar and oil prices usually move together. Taking these factors into consideration, I found the impact on the deficit to be almost half of the well-known rule of thumb - not enough to make a sizable difference.

Using a similar methodology, Citi economists

show that “the immediate impact of a 10 percent increase in oil prices on inflation is 0.2-0.3 percentage points,” which would not change the country’s challenging inflation outlook. They also cannot find “support to the widespread perception that falling oil prices should prop up the lira.”

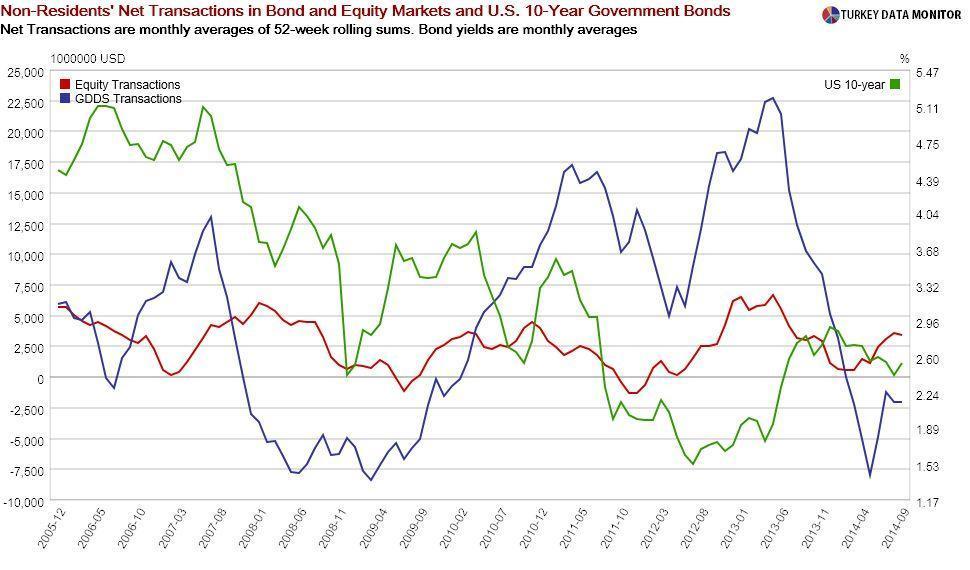

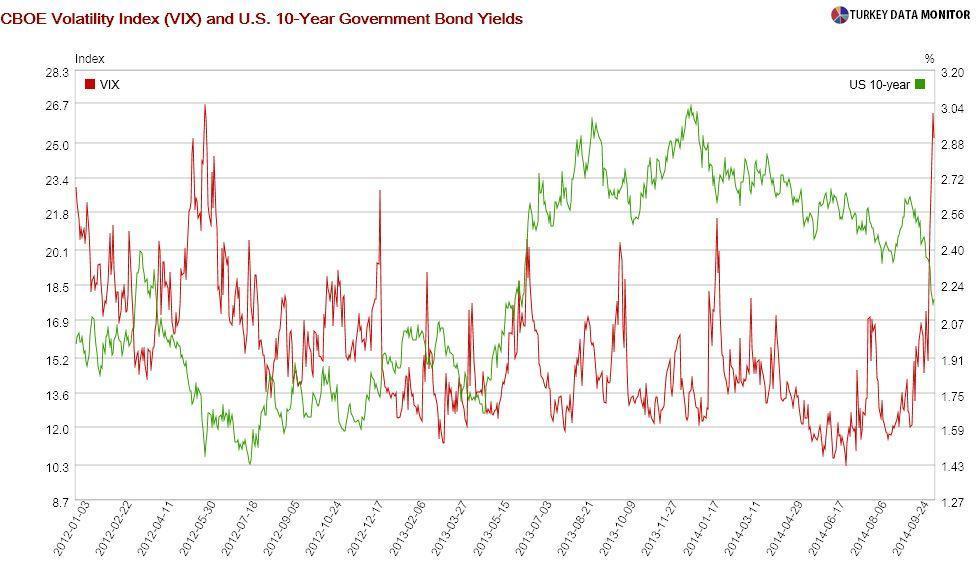

It is true that low U.S. bond yields have been associated with capital flows to Turkey, but global risk aversion was low during those times. The VIX index, a measure of the implied volatility of U.S. stock options often touted as the markets’ fear gauge, was at three-year highs last week. During such times, investors flock to safe havens like U.S. Treasuries.

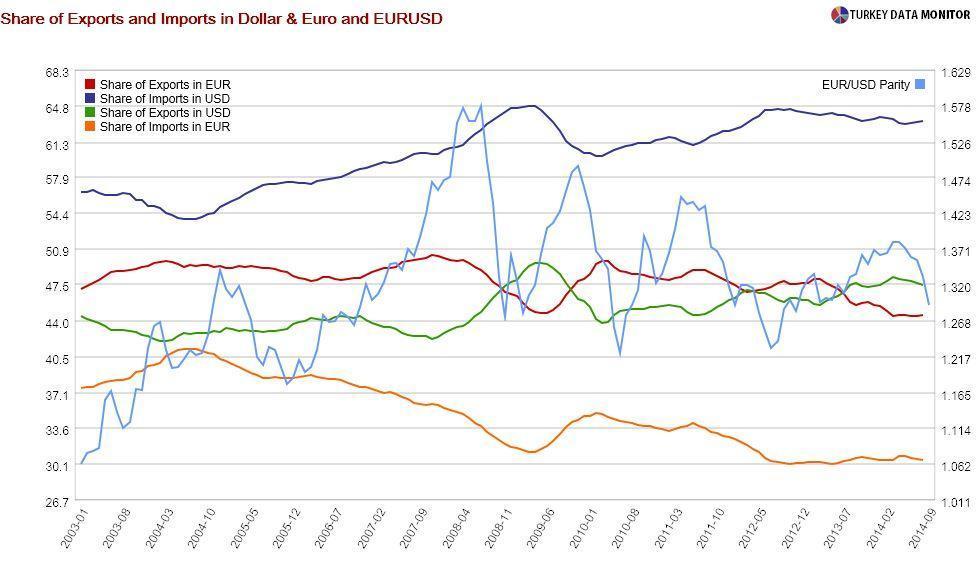

As for the dollar, well, it’s complicated: For one thing, we have yet to see if the recent dollar weakness will prove to be permanent. Economic fundamentals may tell you about the direction of exchange rates, but they are extremely difficult to

forecast in practice.Besides, if you asked me on the relationship between the exchange rate and imports, I would tell you that “it depends”: While a weaker dollar would initially lower Turkey’s imports bill, cheaper imports could lead to more demand for imports, which could eventually dominate the price effect. This is called the

J-curve effect.In any case, the euro dollar exchange rate is more relevant than the dollar lira rate, as Turkey earns half of its export revenues in euros, but pays two thirds import bills in dollars. Given the

pessimistic outlook on Europe at the IMF-World Bank Annual Meetings, I don’t see the dollar weakening against the euro.

On a more general note, I would say that the recent reports on Turkey are extremely shortsighted. I don’t claim to be an economics guru, but the gurus at the meetings all underlined that the next 12 months would be characterized by not only lower oil prices, but also a transition to a stronger dollar and higher U.S. interest rates.

In that sense, I see last week’s sharp market moves as “

normalization pains,” and so the recent Turkey-hugging reports might be working with the wrong assumptions to begin with. The positive mood about Turkey is bound to change before Turkey day, if not sooner.

A well-known Turkish expression would roughly translate as “there is good in every malice.” If nothing else, last week’s rout in global markets seems to have improved investors’ perception of Turkey.

A well-known Turkish expression would roughly translate as “there is good in every malice.” If nothing else, last week’s rout in global markets seems to have improved investors’ perception of Turkey.