Rate hike at tomorrow’s monetary policy meeting?

Let me cut right to the chase: The Central Bank should hike rates, although even that may not work in controlling lira depreciation at this point. In any case, they probably won’t. I gave away any incentive to read on, but let me nevertheless explain.

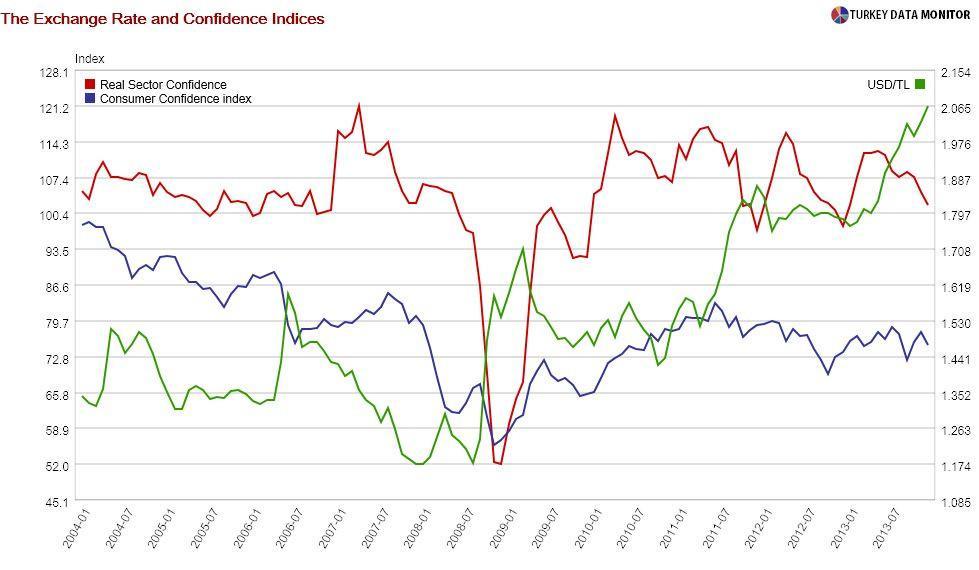

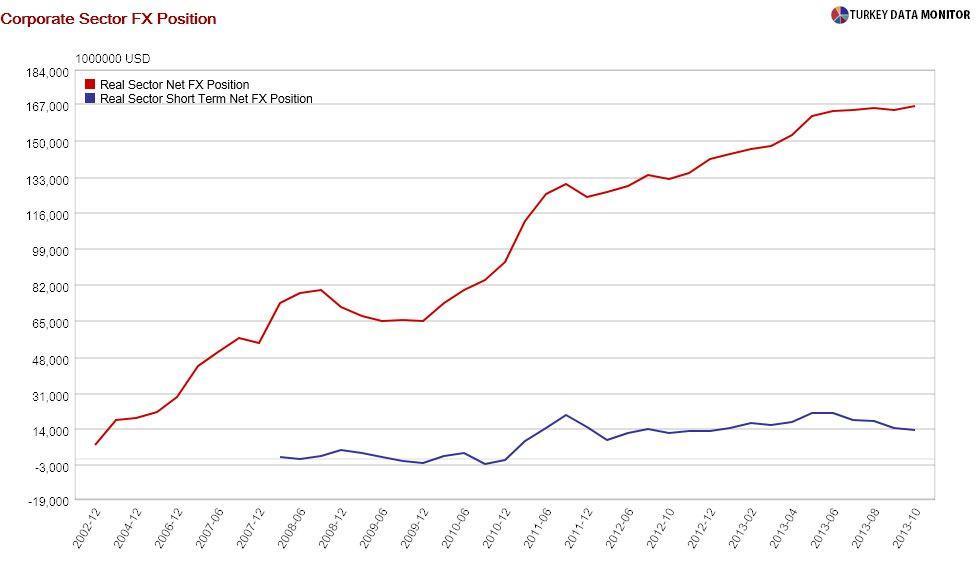

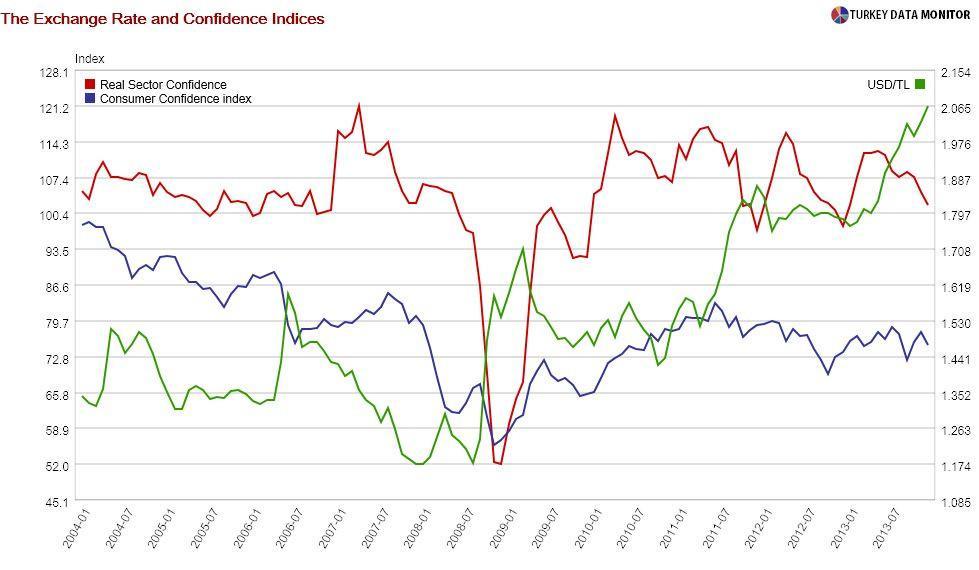

Given the exchange rate pass-through to inflation, firms’ large foreign currency (FX) open positions and the relationship between the exchange rate and consumer/business confidence, the recent lira weakness is worrying. However, the Central Bank does not have enough reserves to defend the currency, leaving an interest rate hike as the only viable option. However, because of Prime Minister Recep Tayyip Erdoğan’s

taste for low rates, the Bank has been claiming they have plenty of alternatives.

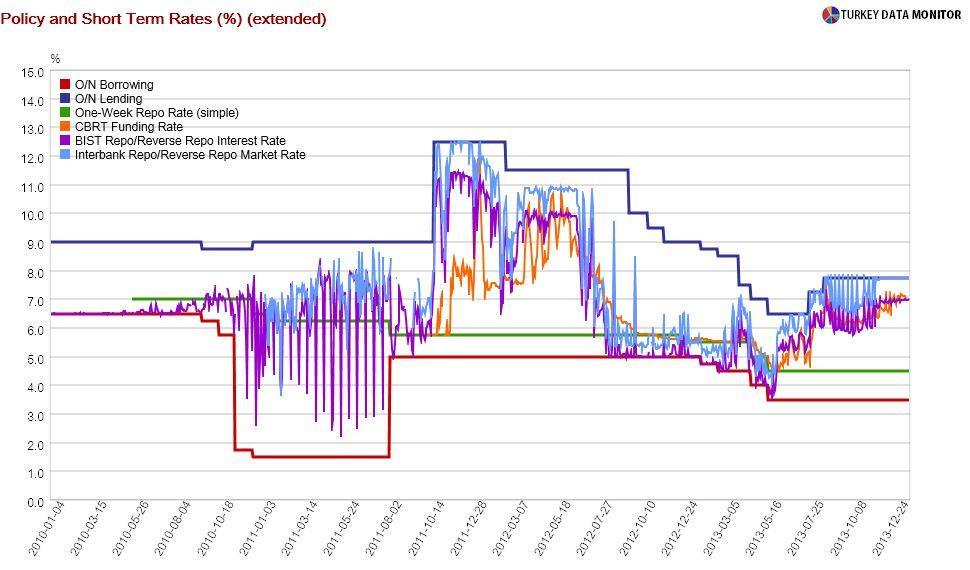

For example, the Bank has already committed to selling at least $3 billion of FX this month. They could decide to wait and see if banks will release some FX as the new

reserve option coefficients (ROCs) come into effect this week, and raise ROCs further if need be. They could also bring the average funding and Borsa Istanbul overnight rates, which are both around 7 percent, to the 7.75 percent ceiling determined by the overnight lending rate before raising the lending rate itself.

Of course, Erdoğan does not want the extra borrowing cost on businesses on top of the cost of depreciation two months before the local elections. His Finance (and

Public Enlightenment and Propaganda) Minister Mehmet “

Nominal” Şimşek noted early in the month that

the recent measures to curb credit by the banking regulator and

tax hikes had alleviated the need for higher interest rates.

While

revealing the 2013 budget figures, Şimşek emphasized that they would not hike rates just because some would ask them to do so. He also tried to discount the impact of the lira weakness by noting corporates’ short-term open position was only $14 billion and the currency depreciation would have

an immediate and large effect on the trade deficit. Finally, he downplayed inflationary risks by noting the output gap would put downward pressure on prices.

Most of these arguments

do not have much validity, but that is not the point. Such comments have shown

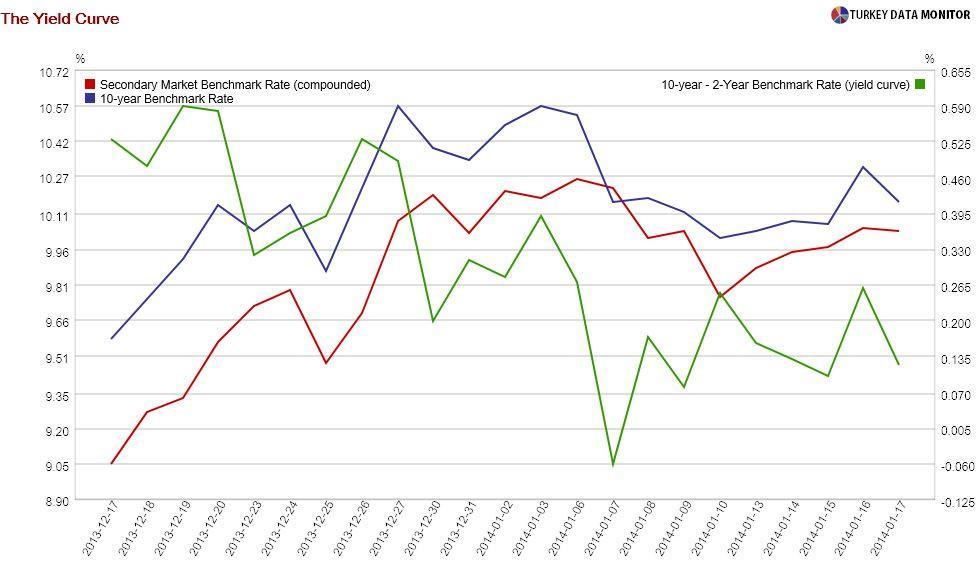

Erdoğan’s aversion to higher rates. But markets are skeptical. Of the 18 economists surveyed by business channel CNBC-e, 7 are expecting a hike to the overnight lending rate. According to Deniz Invest’s Özlem Derici, the fall in the two and ten-year government bonds towards the end of the week reflected expectations that a rate increase would relieve the lira and attract capital flows.

If they indeed do not hike tomorrow, the Central Bank will probably start praying for political stability, which could end the lira’s free fall, but given

Jan. 17’s developments, is a mirage. I hope I am proven wrong- either on the rate meeting or its aftermath. After all, I would hate to see Erdoğan’s interest rate obsession doom Turkey

along with himself. His

downfall would not worry me the least.

Let me cut right to the chase: The Central Bank should hike rates, although even that may not work in controlling lira depreciation at this point. In any case, they probably won’t. I gave away any incentive to read on, but let me nevertheless explain.

Let me cut right to the chase: The Central Bank should hike rates, although even that may not work in controlling lira depreciation at this point. In any case, they probably won’t. I gave away any incentive to read on, but let me nevertheless explain.