Friday I’m in love (with the Central Bank)

I could not think of a better inaugural Friday column than Turkish monetary policy, given my extensive coverage of the topic. That is partly the Central Bank’s fault, as they have introduced quite a bit of innovation to a field

usually deemed boring.

It was one year ago when the Bank

tightened its stance aggressively by increasing the overnight lending rate, the ceiling of its interest rate corridor, to 12.5 from 9 percent and reducing the liquidity provided through its one-week repo auctions. It then announced that the cost of Central Bank funding would replace the one-week repo as the policy rate. The Bank can control that rate by deciding on how it will fund markets.

After lowering it to 11.50 percent at the

February Monetary Policy (MPC) meeting, the Central Bank kept the lending rate constant until last month’s MPC, when it implemented a 1.5 percentage points cut in response to signs of slowdown in the economy. Latest indicators have not improved the economic outlook.

Consumer confidence plummeted to its lowest level in over two years on Tuesday. Likewise, the

September budget, released on the same day, hinted that the weakness in tax collections is continuing.

More importantly,

Monday’s July labor force statistics showed that the low growth is finally starting to take its toll on employment. After controlling for seasonality, the number of employed fell 0.4 percent monthly, while the unemployment rate increased from 8.9 to 9.1 percent. Therefore, I wasn’t surprised when the Bank

cut its lending rate by 0.5 percentage points at yesterday’s MPC.

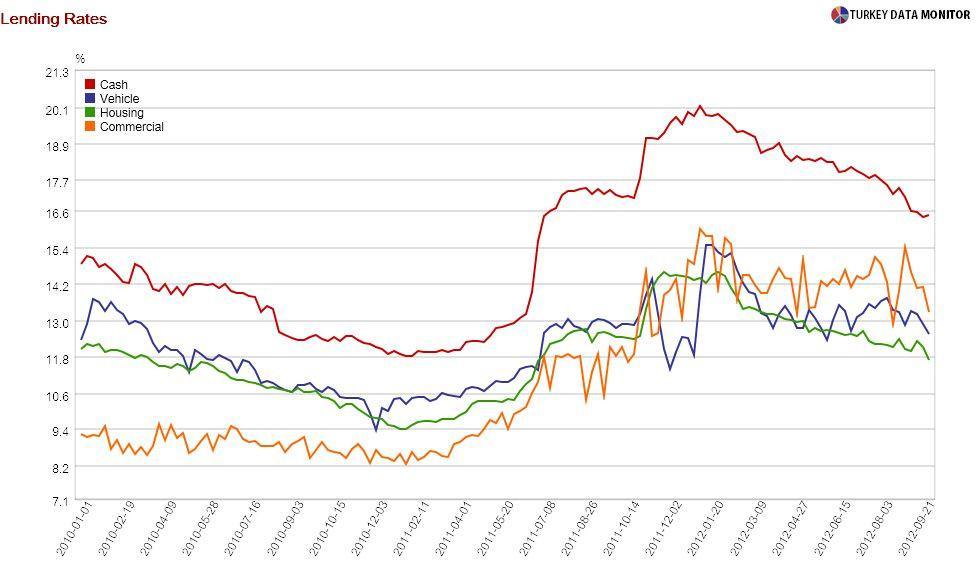

You may argue this move will not have much impact. After all, while the Central Bank has aggressively lowered banks’ funding costs since the summer, loan rates have not fallen by much. This is because banks determine their credit rates based on the ceiling of the corridor, so lowering this upper band could support lending.

The Central Bank also increased the reserve option coefficients (ROCs) by a further 0.1 in each tranche. For example, if a bank would like to keep 0 to 40 percent of its required reserves in foreign currency (FX), it now needs to set aside 140 liras worth of euros or dollars for 100 liras of reserves.

When

I discussed ROCs in detail after l

ast month’s MPC, I argued that they could induce external borrowing by banks. You could also assert that banks would now exchange FX for liras through the Central Bank rather than in London via swaps, so their total FX borrowing would not change.

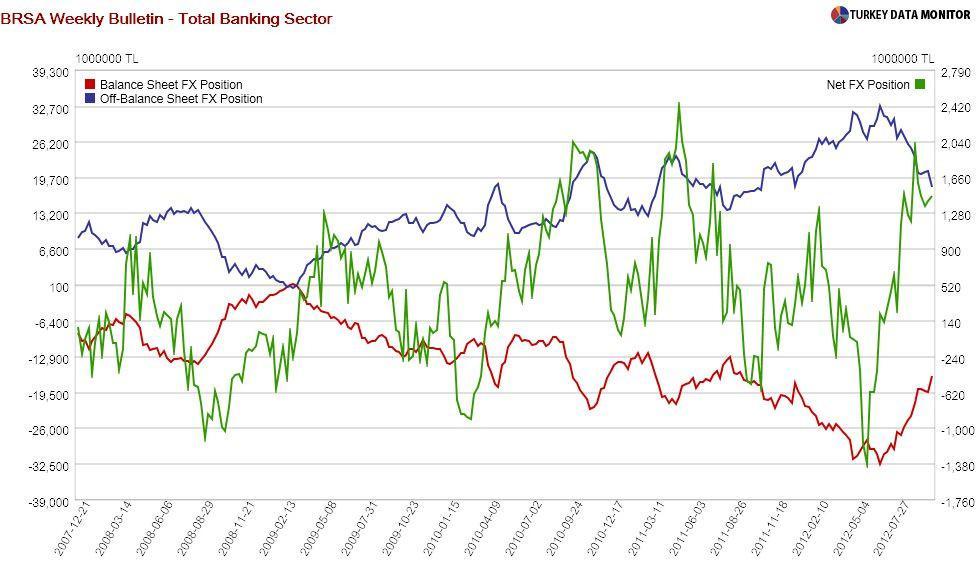

Monday’s weekly banking statistics

Monday’s weekly banking statistics and

yesterday’s external debt figures actually support both claims. There is a marked deterioration in banks’ off-balance sheet FX position, which is a proxy for swap activity. On the other hand, their balance sheet FX position has improved, and their external short-term debt stock rose by nearly $ 4 billion in August.

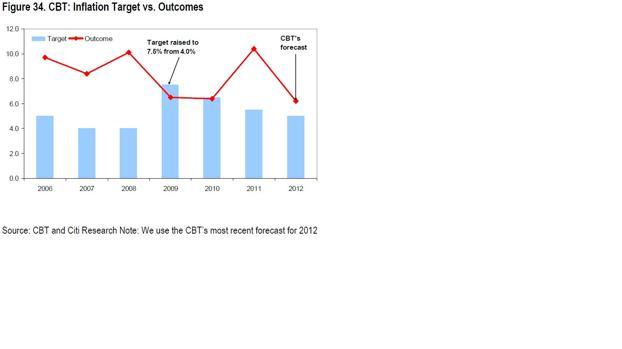

I am aware of the

complex problems the Central Bank is facing and actually even appreciate

their innovative solutions. However, monetary policy should be about credibility, clarity and consistency. Maybe, that’s why the Bank has been consistently missing its inflation targets, as Citi economists argue in

a recent research note.

I could not think of a better inaugural Friday column than Turkish monetary policy, given my extensive coverage of the topic. That is partly the Central Bank’s fault, as they have introduced quite a bit of innovation to a field usually deemed boring.

I could not think of a better inaugural Friday column than Turkish monetary policy, given my extensive coverage of the topic. That is partly the Central Bank’s fault, as they have introduced quite a bit of innovation to a field usually deemed boring.