Bayram/Eid present: Economic crisis

When I heard that Ahmet Akarlı, Turkey economist for investment bank Goldman Sachs, was expecting the lira-dollar exchange rate to be 2.2 in a year, I was shell-shocked.

I even thought about asking him to send me some of the stuff he was smoking while making that prediction. But I then got hold of his research note published on Aug. 6, and it turns out that his analysis is internally consistent. Just like your

friendly neighborhood economist, Akarlı is expecting a crisis. He calls it an “adjustment,” but his scenario is very similar to the one I have spelled out several times in my columns.

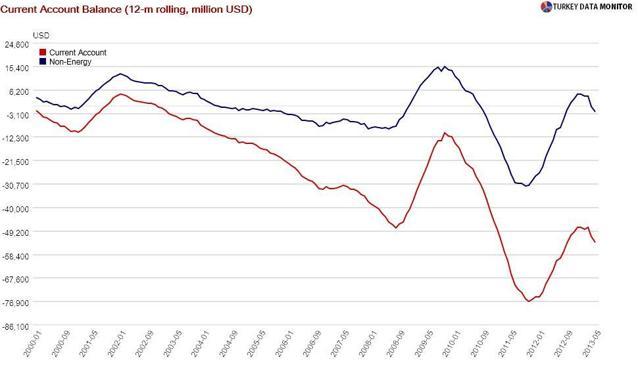

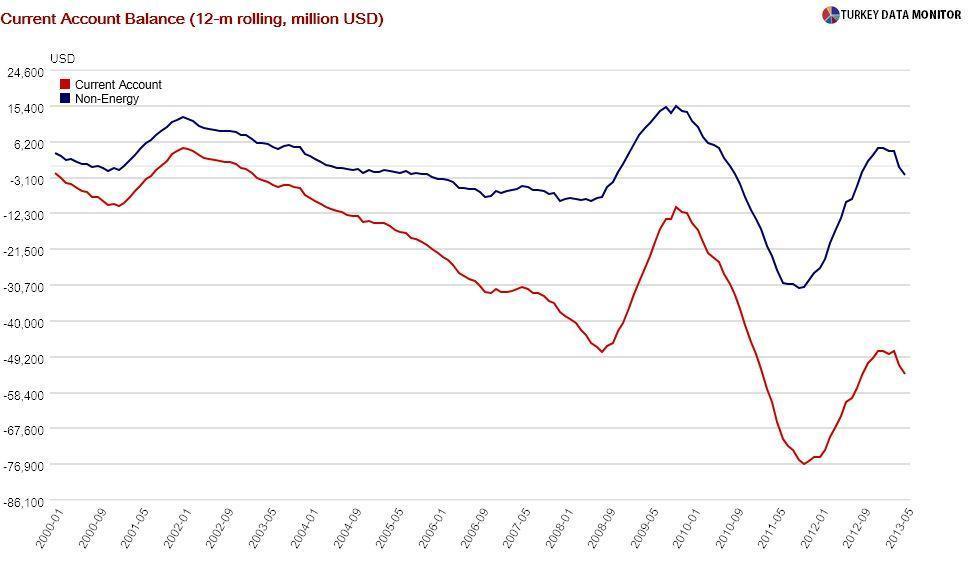

Everyone knows about Turkey’s large current account deficit. The lesser-known flip side of the coin is that the country has been accumulating large net external liabilities to be able to finance this deficit. Turkey’s net international investment position, which is the difference between its external financial assets and liabilities, has deteriorated steadily during the last decade, with the exception of the mini-crisis years of 2008 and 2011. It is now minus $445 billion, or 52 percent of GDP.

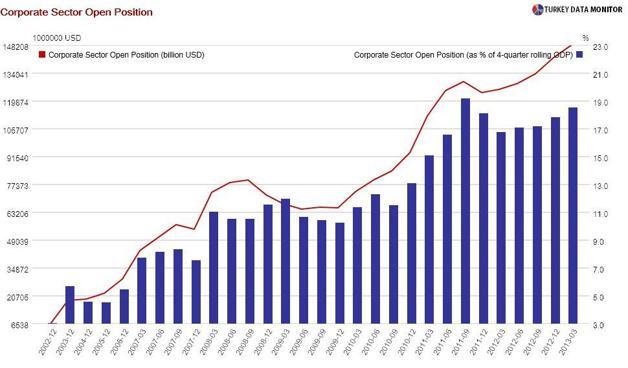

Akarlı notes that Turkey is now the second-most leveraged emerging market after Hungary. Turkey is extremely vulnerable because foreign liabilities have accumulated mainly in corporate balance sheets as well as money that can easily leave the country, such as short-term loans and portfolio investment.

As a result, Turkey is stuck with a huge external financing need. Akarlı estimates the country’s gross external financing requirement, which is in essence the current-account deficit and total (short- and long-term) external debt amortizations falling due, to be $ 221.5 billion, or 26 percent of GDP.

Akarlı argues that as the Federal Reserve starts

tapering its bond purchases and U.S. real interest rates rise, external financing pressures will intensify, eventually resulting in a significant macroeconomic adjustment. And since the Central Bank’s reserves are not enough to deal with such a shock, the burden of adjustment will have to fall on exchange and interest rates.

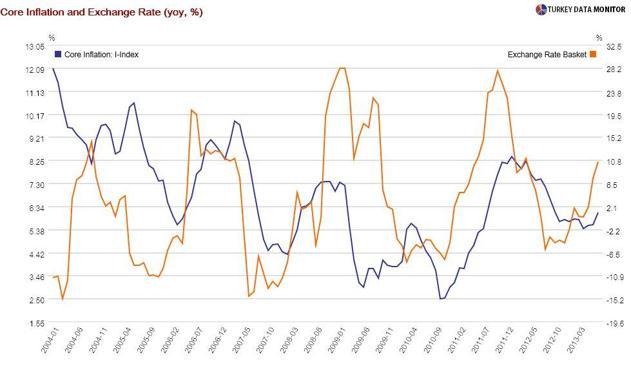

Both are risky. Letting the exchange rate depreciate too much would pressure the balance sheets of Turkish companies, which have an open position of $150 billion, while at the same time increasing inflation. On the other hand, letting higher interest rates carry the burden of adjustment would jeopardize the banking sector, which holds a significant amount of interest rate risk. More importantly, it would slow down an economy that is yet to show signs of recovery.

Therefore, Akarlı argues that the adjustment will have to fall on both: He expects the Central Bank to hike its lending rate 3.75 percentage points in the next 18 months, while at the same time raise its borrowing and policy rates 1 percentage point as well. He foresees the lira-dollar exchange rate at 2.2 during the next year.

I would like to wish my Muslim readers a happy Bayram / Eid Mubarak. I wish I had a more cheerful present for them.

When I heard that Ahmet Akarlı, Turkey economist for investment bank Goldman Sachs, was expecting the lira-dollar exchange rate to be 2.2 in a year, I was shell-shocked.

When I heard that Ahmet Akarlı, Turkey economist for investment bank Goldman Sachs, was expecting the lira-dollar exchange rate to be 2.2 in a year, I was shell-shocked.