OECD: Euro crisis risk to growth, emerging economies promising

PARIS

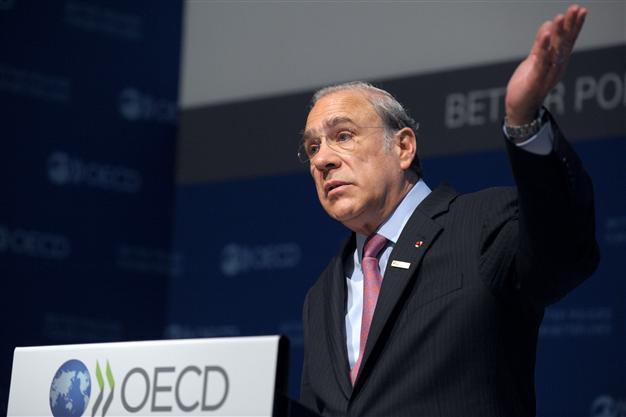

OECD Secretary-General Gurria presents the 2012 Economic Outlook at the group’s

HQ in Paris. The report puts EU’s debt crisis as the huge risk to the global recovery. AFP photo

The intensifying eurozone

crisis poses the most serious risk to the muted recovery in the global economy, with the United States and Japan set for modest

growth, the Organization for Economic Cooperation & Development (

OECD) said yesterday.

Emerging economies such as China and Brazil, on the other hand, are set for a cyclical upswing, the OECD said in its latest twice-yearly Economic Outlook report. The OECD held its forecast for global growth this year steady at 3.4 percent, but lowered its outlook for the eurozone to a 0.1 percent contraction, urging more easing of monetary policy and

euro-wide measures to boost growth.

OECD Chief Economist Pier Carlo Padoan warned “the crisis in the euro area has become more serious recently, and it remains the most important source of risk to the global economy.” The policy forum of 34 advanced economies forecasts growth in 2013 will pick up to 4.2 percent globally and 0.9 percent in the 17-member eurozone, provided it contains the debt crisis.

While the eurozone gained some breathing space at the beginning of the year due to the European Central Bank’s pumping over a trillion euros into banks, tensions have soared in recent weeks after inconclusive elections raised the spectre of a Greek exit from the euro. There is no guarantee Greeks will elect parties in new elections next month that are committed to pursuing the austerity policies required by the country’s massive international bailout and that will be key to keeping the country in the eurozone.

“Elections in a number of euro-area countries have signaled that reform fatigue is increasing and tolerance for fiscal adjustment may be reaching a limit,” Agence France-Presse quoted Padoan as saying. Recession, “rising unemployment and social pain may spark political contagion and adverse market reaction,” with countries outside the eurozone also at risk of being hit, he added. The OECD forecast that eurozone unemployment would rise to 10.8 percent this year.

“The risk is increasing of a vicious circle, involving high and rising sovereign indebtedness, weak banking systems, excessive fiscal consolidation and lower growth,” Padoan warned.

With EU leaders meeting in Brussels Wednesday to contemplate measures to boost growth, the OECD said “credibility and confidence would be enhanced by euro-area and EU-wide measures”. While credible medium-term plans to reduce deficits were essential, the OECD said “the speed of consolidation should depend on country-specific circumstances”.

New French President Francois Hollande has called for a growth pact to complement the EU fiscal pact, pitting him against German Chancellor Angela Merkel. The OECD said growth in Germany was not enough to carry along the rest of the eurozone, and said higher wages in the country could boost domestic demand and contribute to a less painful readjustment for others.

Turkish growth

The OECD projected that Turkey’s economy would grow 3.3 percent in 2012 and 4.6 percent in 2013.

The Turkish government’s growth forecast for this year is more than 4 percent, and the 2013 forecast in the government’s medium-term program stands at 5 percent. According to OECD’s, the ratio of Turkey’s current account deficit to its gross domestic product would be 8.9 percent in 2012 and 8.4 percent in 2013.

The report projects Turkey’s unemployment rate at 9.5 percent in 2012 and 9.1 percent in 2013. The report also said that the acceleration of structural reforms in production and business markets would help reduce and re-balance the pressure of inflation.