Obama warns of debt, Fitch may cut ratings

WASHINGTON - Agence France-Presse

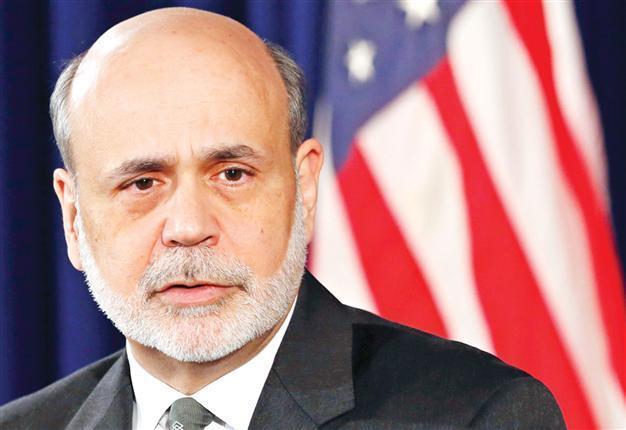

US Chairman of the Federal Reserve Ben Bernanke urges lawmakers to lift the country’s borrowing limit to avoid a potentially disastrous debt default, warning that the economy was still at risk from political gridlock over the deficit. REUTERS photo

U.S. President Barack Obama has warned Republicans against using the debt ceiling as a “bargaining chip,” saying a failure to raise it would sow financial chaos and send markets into a tailspin. A sharp warning on the issue followed Obama’s speech.

“To even entertain the idea of this happening, of the United States of America not paying its bills - it is irresponsible, it is absurd,” Obama said, repeating his demand for a rise in the nation’s borrowing limit.

“We are not a deadbeat nation,” the president said in the final press conference of his first White House term.

“While I’m willing to compromise and find common ground over how to reduce our deficits, America cannot afford another debate with this Congress about whether or not they should pay the bills they’ve already racked up.” Congressional refusal to raise the debt limit beyond its current level of $16.4 trillion could delay key government payments, including Social Security checks and veterans benefits, paychecks to troops, air traffic controllers and the honoring of contracts with small businesses. It could also result in another downgrade of the U.S. credit rating, with potentially severe consequences for the global economy. “Investors around the world will ask if the United States of America is in fact a safe bet,” Obama said.

“Markets could go haywire, interest rates would spike for anybody who borrows money... It would be a self-inflicted wound on the economy.” The United States ran up against its current debt limit at the end of 2012, but the government is using “extraordinary measures” to extend the limit until late February. U.S. Federal Reserve Chairman Ben Bernanke also waded into the debate, telling a university forum it was “very, very important that Congress take the necessary action to raise the debt ceiling.” Obama said any potential solution lies with the Republican House leadership, some of whose members have demanded that any rise in the debt ceiling be matched dollar for dollar with deep spending cuts.

Lawmakers can “act responsibly, and pay America’s bills, or they can act irresponsibly and put America through another economic crisis,” Obama said.

Fitch’s warningMeanwhile, Fitch ratings agency issued a strong warning to the United States yesterday to deal with its recurrent debt-ceiling dramas in a way which strengthens the economy in the long term, saying that its top “AAA” credit rating was at stake. Fitch said it might revise downward its notation for the United States from the “AAA” level if Congress did not reach agreement on raising the ceiling for the national debt. Fitch said that failure to raise the limit in time would lead to a formal revision by Fitch of its ratings of U.S. debt instruments, but the agency also said the risk of a U.S. default was extremely low. However, Fitch also warned that fundamental strengths in the U.S. economy were being undermined by the weight of debt and associated strains.

Chinese fund to cut holding US government bonds

SHANGAI – Agence France – Presse

China’s sovereign wealth fund, which has more than $480 billion in assets, could cut holdings of US Treasury Bonds as they are becoming a less attractive investment, state media said yesterday. The Shanghai Securities News quoted Lou Jiwei, chairman of sovereign wealth fund manager China Investment Corp (CIC), as telling a conference in Hong Kong on Jan. 14 that the U.S. economic recovery had made other investments appealing.

China has the world’s largest foreign exchange reserves and according to U.S. government figures is the largest foreign holder of U.S. Treasuries with $1.16 trillion at the end of October last year, the latest available statistic. In line with the future U.S. economic recovery, the appeal of U.S. debt is weakening, Lou said, adding that it was not a good investment target, from a long-term perspective. However, he stated that completely stopping buying of U.S. Treasuries could hurt the fund’s ability to manage risk. For this reason, CIC’s method is to buy relatively less U.S. debt with hopes of allocating more to stocks and other assets, Lou told, without specifying whether he was specifically referring to U.S.-dollar assets.