How hot money might temporarily park in emerging markets

Mustafa Sönmez - mustafasnmz@hotmail.com

AFP photo

Last year was regarded as a new milestone after the 2008-2009 crisis. The expansionary monetary policy adopted to overcome the crisis was to end with the U.S. Central Bank, the Fed, hiking rates, supposedly ushering in a new era.

When it was almost certain that a rate hike was to happen in 2015, short-term capital movements – so-called “hot money” – turned their faces to the United States from emerging countries like Turkey where they had parked for a long time. This situation decreased the appetite toward many countries including Turkey, and capital withdrawals occurred, meaning all local currencies lost value against the dollar.

Losses of 2015

The rate of loss could further increase depending on the economic fragilities of each country as well as their political and geopolitical risks. For instance, the average value of the Russian ruble was 38.5 percent against the dollar in 2014; in 2015, the average exceeded 61 percent.

Following the ruble is the Brazilian real. The currency lost 42 percent of its value against the dollar in 2015 compared to its value in 2014. Colombia also experienced a 37.5 percent devaluation.

Northern Europe’s rich Norway devalued its krone according to the changing climate at a rate of 28 percent.

And in Turkey, the 2014 average of the dollar was 2.19 Turkish Liras, but the average in 2015 was 2.72 liras. The loss has exceeded 24 percent.

The local currencies of two other emerging countries of Europe, Hungary and Poland, lost 20 percent, while the Czech currency lost around 18 percent.

In other regions, there were losses against the dollar. In Asia, the Malaysian, Indonesian and South Korean currencies lost between 8 and 19 percent. In Japan, the yen was devalued by nearly 15 percent in 2015.

India, which is in a special situation with a remarkable growth that has distinguished it from others to a certain degree, the loss of the rupee remained at 5 percent.

Different climate in 2016

When 2015 ended and 2016 began, the month of January was full of signs that the 2015 climate was continuing, but after February, the climate changed.

Since the first day of 2016, conditions originating from China have impacted all markets; they then began recovering after Jan. 21. Toward the end of February, the sun came up and in March, the financial weather turned sunny. There was more than one factor playing a role in this climate change.

The Fed, in the face of the events in global markets and the expectations of a slowdown in the world economy, gave signals that it would further slow the rate hikes…

Despite the recent strong employment figures, there was no interest rate hike in the March meeting. The abundance of money waiting to be withdrawn with the rate hike and the dollar liquidity that are remaining in the markets support the global risk appetite. The short-term capital movements have started turning their faces again to “emerging markets” that they had been distanced from.

Europe, Japan

Even though it is not known how long it will last, one other wind that strengthened the new climate is from Europe. Europe has not been especially successful, particularly due to the effect of the drop in oil prices, in creating inflation. Once more, a time frame has started in which negative interest rates have become deeper and the purchase of bonds has increased. When a statement was released at the ECB meeting at the end of January, investors started taking their positions and looking for new destinations to park their money.

Similarly, the Japanese Central Bank took a step toward monetary expansion. At the end of January, Japan changed its benchmark interest rate to negative. This has been another factor supporting the global risk appetite and steering investors toward emerging markets.

Emerging country currencies

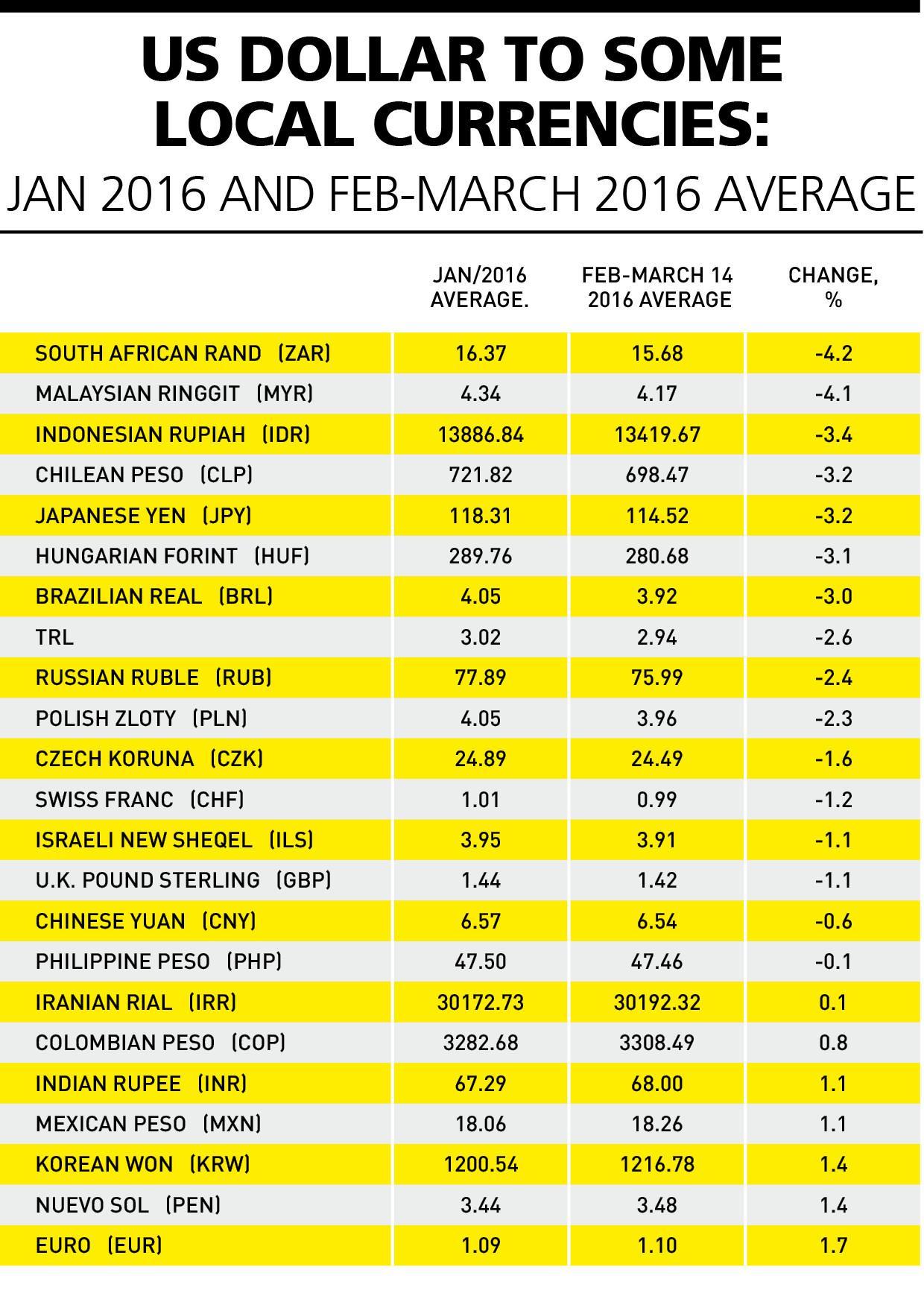

The new climate, which started at the beginning of February although it remains unclear how long it will last, began as an investment inflow to emerging countries, allowing local currencies to gain value against the dollar. When January and February averages, plus the first half of March, are compared, one of the emerging currencies, the South African rand, gained value of around 4 percent against the dollar. Among other currencies that gained value slightly are Malaysia, Indonesia and Chile. Also the yen gained value against the dollar at more than 3 percent.

Among the emerging currencies, the Brazilian real and the Turkish Lira stood out with value gains of around 3 percent. The January average of the lira was 3.02; it went down to 2.94 after February.

Competition for attracting investments

The return of the interest of global funds to emerging countries and the increase in their risk appetites also make the competition to attract capital fiercer. By offering high yields to global funds, there are attempts to draw more capital.

It was for the benefit of developing country bonds that investors turned to higher interest rates because of the current negative interest rates in Europe and Japan.

Turkey, for the first time since April 2015, will issue dollar bonds. The Undersecretariat of the Treasury has authorized Bank of Amerika Merrill Lynch, Citigroup and Deutsche Bank to issue bonds in dollars due 2026.

Russia is also expected to return to the Eurobond market. For the first time since 2013, Russia contacted 25 foreign banks for Eurobonds with the hope of returning to the international loan market.

Poland, among the emerging countries of Europe, was the first developing country that was able to return to international markets by selling 1 billion euro bonds.

Bulgaria also joined the countries wanting to take advantage of low interest rates as it issued two-year Eurobonds.

On the other hand, Brasilia has issued 10-year bonds with 6.125 percent interest rates for $1.5 billion dollars. Argentina is another country planning to return to the markets. Experts state that if Argentina realizes its plans of borrowing $15 billion, then it will break the record for developing countries in 2016. Chile, on the other hand, sold 1.2 billion 10-year dollar bonds after eight months.

Iraq is also reported to be preparing to sell domestic bonds to finance its budget deficit. This sale is the first since 2003.

In a nutshell, until a new rate hike decision by the Fed changes the climate, in the relaxed monetary climate, there is now an opportunity for emerging countries like Turkey to draw global funds – even if for just a short time.

In the event that there are no extraordinary political or geopolitical risk increases in Turkey, then this climate is likely to foster capital inflows and thus strengthen the lira.

However, it is not known how long this will last or what the final figures will be.