Fed links rates to US joblessness

WASHINGTON - Agence France-Presse

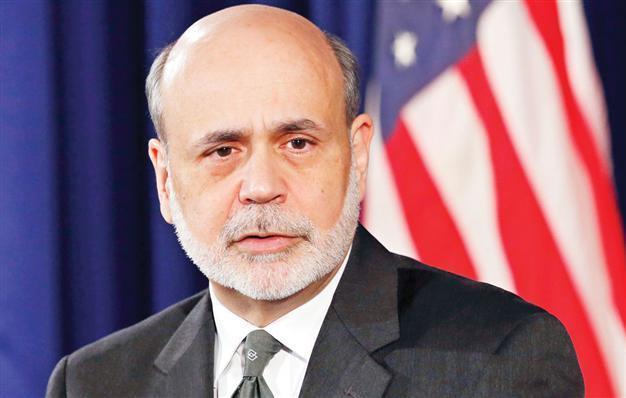

Chairman of the FED, Bernanke, says the US economy is still hindered by high unemployment. REUTERS photo

The U.S. Federal Reserve laid out target levels on unemployment and inflation for raising interest rates for the first time Dec. 12, surprising analysts who expected such a move would wait until next year.

In an effort to better signal its policy path, after its benchmark rate has been locked at 0-0.25 percent for four years, the Fed said it would not lift rates as long as the inflation outlook was below 2.5 percent and the jobless rate, now at 7.7 percent, stays above 6.5 percent.

Saying the economy continues to grow only at a “moderate” rate, the Federal Open Market Committee (FOMC) also launched a new, open-ended $45 billion a month bond-buying program to replace the bond-swap Operation Twist program that expires at year-end.

That will take its total “quantitative easing” asset purchases, of both Treasury bonds and mortgage-backed securities, aimed at pushing down long-term rates to encourage investment, to $85 billion a month.

Warning on fiscal cliff

After a two-day policy meeting, Fed Chairman Ben Bernanke stressed that the economy, while growing at a moderate pace, was still hindered by high unemployment, which he called “an enormous waste of human and economic potential.” He also warned that Congress and the White House needed to urgently find a solution to the fiscal cliff crisis, which could send the economy back into recession next year.

“Even though we have not even reached the point of the fiscal cliff potentially kicking in, it’s already affecting business investment and hiring decisions by creating uncertainty or creating pessimism,” Bernanke said at a post-meeting news conference.