Given the Turkish Lira’s volatility and the economy’s bad press, there is widespread pessimism among Turkish investors. While we cannot forecast the short-term evolution of the currency or economy, we can make a rational assessment of long-term economic dynamics and highlight the country’s strengths. Interestingly, these long-term dynamics make the case for an economically viable country because the country possesses some concrete tools to fix its problems. While short-term issues and speculative attacks continue, a calm approach and a lot of hard work will be required to tackle the various problems. However, there is hope for our economy in the mid-term.

If we look at the country’s economic history for the last 100 years, the Turkish economic expansion has been quite remarkable given the few natural resources it has. In fact, Turkey is one of the few successor states of the Ottoman Empire without oil reserves. Instead, its economic expansion was primarily driven by the hard work of its people. During the republic’s first two decades, it not only laid the groundwork for its industrialization plans through projects like railways, but it also paid the bulk of the debt inherited from the Ottoman Empire. In order to achieve this, the country tapped into an invaluable resource that was its human capital. Turkey still has a relatively young population that is willing to contribute to the economy. This resource is likely to remain intact for the next two decades and could help fuel growth in the mid-term as well.

While the Turkish economy has economic imbalances, such as a current account deficit and a lack of domestic savings, it still has monetary and fiscal tools that other countries lack. Unlike Greece, which adopted the single currency and handed away its monetary power, Turkey still has its currency and monetary sovereignty. Even though depreciating its currency might not be ideal, the option still exists and might be an effective solution in solving problems like current account deficits.

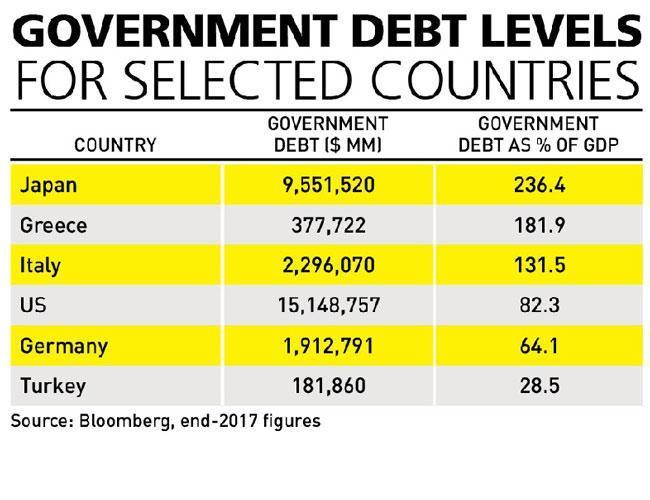

Another important fact is that while the Turkish private sector is highly indebted the same does not hold true for the Turkish public sector. The table above presents the government debt of selected countries and the percentage of the GDP that it corresponds to. As the table shows, Turkey’s government debt only stands at 28.50 percent of the GDP. This means that the Turkish public sector can still borrow money from international markets to fix its economic problems and stimulate its private sector. In terms of government debt, the Turkish situation is much better than that of Greece, Italy, or the U.S., which have debt levels amounting to 181.9 percent, 131.5 percent, and 82.3 percent of their GDPs respectively.

Lastly, one can also mention seasonality as a short-term factor. The summer months of July and August are known for their infamous lack of liquidity. The markets are not as deep as they are during the rest of the year and external shocks cause larger-than-average movements. The return of market participants might help increase depth, which in return has the potential to make the currency more resistant. In sum, there are challenges ahead especially in the short-run, however, Turkey has some solid long-term tools and potential to resolve its problems.