Spain and Italy under market storm ahead of Greek elections

MADRID

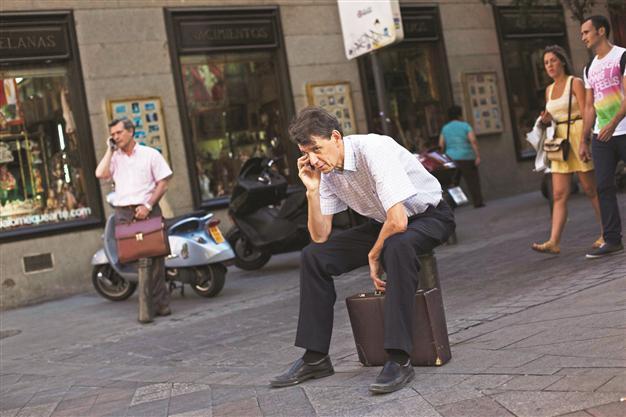

Spanish businessmen talk on their cell phones as they hold on to their briefcases on the street in Madrid. Market euphoria over a bailout for Spanish banks faded quickly. REUTERS photo

Spain and Italy’s borrowing costs shot to danger levels yesterday as investors worried about a vast banking rescue for Spain and feared a stormy Greek exit from the eurozone.

Four days after Spain’s eurozone partners agreed on a banking sector rescue loan of up 100 billion euros ($125 billion), markets reacted negatively on concern that the deal will push Spanish sovereign debt even higher.

Two major concerns are stalking the markets: an array of doubts over the bank rescue deal, and this weekend’s Greek elections, which in a worst-case scenario could send Athens back to the drachma. Some media reported that technical preparations were under way in case Greece had to leave the single currency, including consideration of possibly imposing capital controls.

Italy concerns

It is impossible to say how things may turn out, said Edward Hugh, independent economist based in Barcelona. “This thing is like an express train accelerating towards the buffers in the station,” he said. “You have got this cocktail now with the Greek elections coming this weekend and talk of capital controls over Greece, you have got Italy coming back into the line of fire and then you have got this uncertainty about Spain.”

Austria’s Finance Minister Maria Fekter also said Italy, the eurozone’s third economy, may need a financial rescue because of its high borrowing costs. Fekter’s comments in a television interview amplified investors’ fears that Europe’s leaders are far from ending two and a half years of turmoil.

Spain’s benchmark 10-year government bond yields leapt to 6.6540 by mid-morning from 6.51 percent the day before, flirting with last month’s six-month highs and at a level regarded as impossible to sustain over the longer term. The nation’s risk premium -- - the extra rate investors demand to hold its 10-year bonds over their safer German counterparts -- soared to 5.34 percentage points, not far from the euro-era record of 5.48 percent struck shortly before the banking rescue.

Markets also punished Italy, at risk of being the next domino to fall in the eurozone crisis as it struggles to boost growth and confronts a public debt mountain of 1.9 trillion euros. Italy’s 10-year government bond yield leapt to 6.197 percent from the previous day’s closing level of 6.03 percent.

The rescue for Spain exposed a string of new doubts over its impact on the debt; how it will be implemented; and whether it will be just the first rescue for a nation struggling to cut deficits in a period of recession and sky-high unemployment. Spain is expected formally to seek the loan at a eurozone finance ministers meeting June 21, and a final figure would come after a review by the European Union, European Central Bank and IMF, officials say.

A report by Barclays Capital analysts said that a loan of 70-80 billion euros would push up Spain’s public debt by 7-7.5 percentage points from the end-2011 level of 68.5 percent of economic output. Under this scenario, Spanish public debt would likely peak at 95 percent of economic output by 2015, they predicted.

Compiled from AFP and Reuters reports by the Daily News staff in Istanbul.