My fourteen-oh-four moment

As loyal readers would know, I have been a

staunch

critic of Turkish monetary policy. But some key events last week have lifted this veil of ignorance and made me reconsider my position.

First of all, thanks to an article in Bloomberg, I noticed that lira volatility had fallen of late. The perennial skeptic in me was quick to question this right away: After all, the ECB’s liquidity injection at the end of last month and, more recently, fresh hopes of a new round of quantitative easing (QE3) in the United States have increased risk-taking.

For example, according to data from fund-tracker EPFR, during the second half of March, there were record outflows from long-term developed country bonds, which are traditional safe havens. The main beneficiaries of this recent risk-on mode have been emerging market equities and bonds. Therefore, volatility could have fallen across the board, but a couple of clicks in the Bloomberg terminal revealed that the lira has been less volatile than peers as well. So the

Central Bank’s monetary policy is working after all!

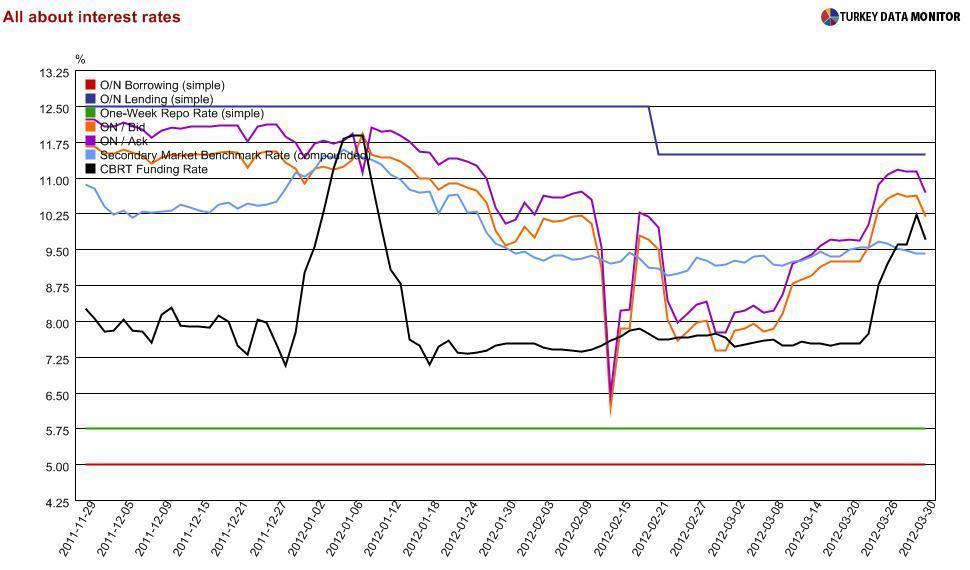

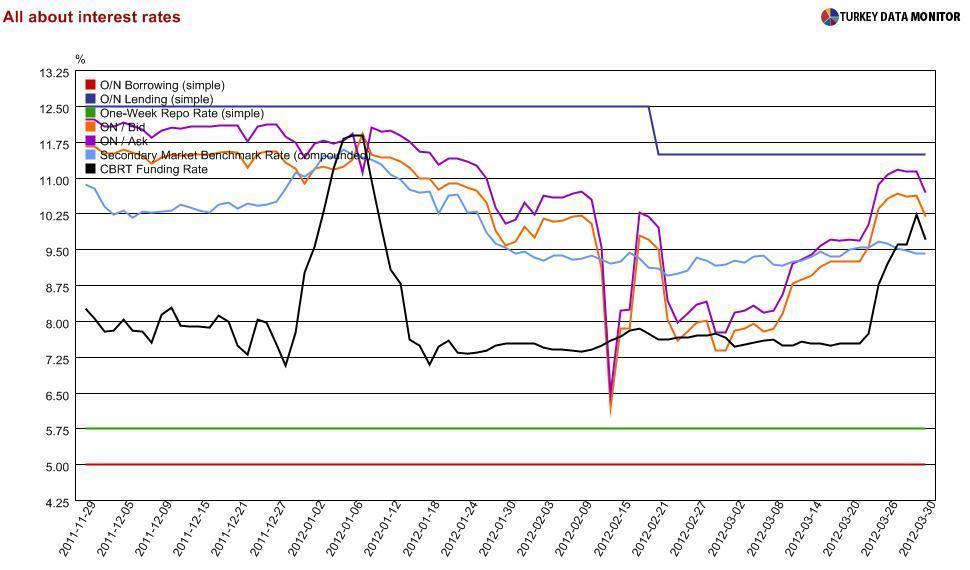

Never mind that volatility has fallen precisely because trading volumes have dropped: No one would like to try to second-guess interest rates when they could wake up and find out that the Central Bank wouldn’t provide any funding at the fixed one-week repo rate, declaring it an “

exceptional

day” in their terminology. This was the case last week, as money market rates and banks’ effective funding costs shot up.

And that could also be why the drop in the lira’s volatility has not been accompanied by appreciation. This is all well when global liquidity is plenty, but there could be a clamoring for this sidelined money in a couple of months if eurozone woes resurface or QE3 is not forthcoming.

In fact, we saw traces of that world when emerging market equity funds posted their first outflows of the year last week. The Central Bank would say they have enough policy flexibility to react to a sudden stop of capital flows right away, and I am sure they are right.

If monetary policy is right on track, the cautionary

Turkey views released last week by credit rating agencies

S&P and

Moody’s as well as

the

piece in the Financial Times on Prime Minister Recep Tayyip Erdoğan’s autocratic policies could be something to do with his visit to Iran. At least, that’s what the pro-government daily Sabah was claiming. I guess it has to be the

Zionist-Illuminati-Opus

Dei alliance in action again.

The Sabah piece was also suggesting that that it was now The Economist’s turn to “attack” the country. Journalists from the weekly were actually in Istanbul last week, meeting with economists, finance professionals and the like. That’s what I call “investigative journalism.”

As I was contemplating all this in the wee hours of Saturday morning, two gin-scented tears trickled down the sides of my nose. But it was all right, everything was all right, the struggle was finished. I had won the victory over myself. I loved the Central Bank.

If you haven’t noticed it already: Happy April Fool’s Day! By the way 1404 is 1984 in the Islamic calendar, as you might have guessed from my homage to the George Orwell novel in the last paragraph.

As loyal readers would know, I have been a staunch

critic of Turkish monetary policy. But some key events last week have lifted this veil of ignorance and made me reconsider my position.

As loyal readers would know, I have been a staunch

critic of Turkish monetary policy. But some key events last week have lifted this veil of ignorance and made me reconsider my position.