I expect you to die, Mr. Bond

That’s what the villain Auric Goldfinger tells 007 when the latter asks, “

Do you expect me to talk?” in the Bond movie Goldfinger. This is exactly how I feel about Turkish bonds.

My timing would seem awry to traders. After all, there was

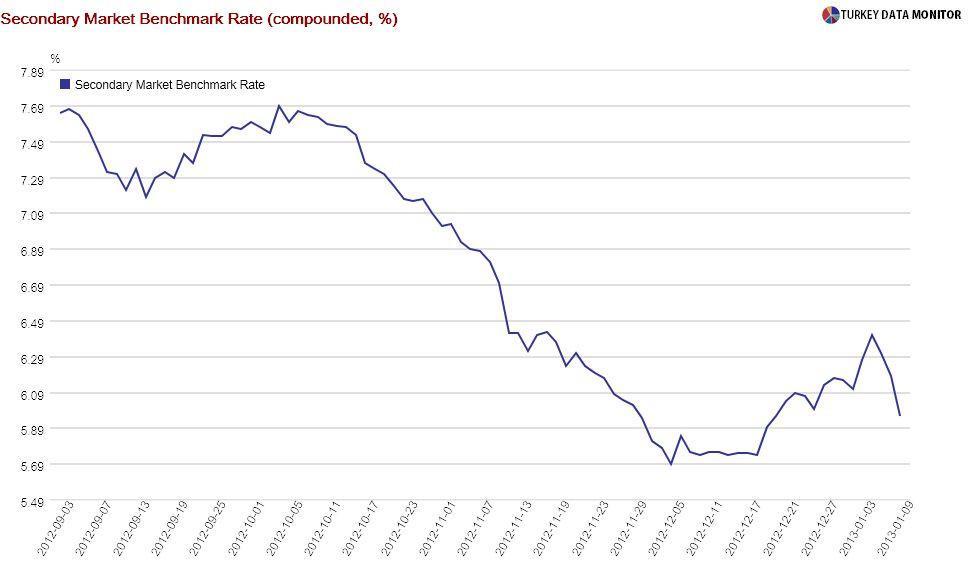

record demand for the four Treasury auctions in the first two days of week, which was followed by a strong rally Jan. 9. The new benchmark two-year bond, which was introduced Jan. 8, ended the day below 6 percent.

All in all, bond yields fell around 0.5 percentage points this week alone and are not too far away from the all-time lows attained in early December. But this rally was the result of a combination of local and global factors that may not be as supportive in the future.

Starting with the local, while acknowledging the robust demand, Ekspres Invest economist Özlem Derici notes that there was a supply effect as well: The Treasury decided to sell less than the expected amount, probably because of money coming in from the recent

Halkbank public offering and

electricity distribution privatizations.

But the Treasury is facing heavy redemptions in February and March. And so without extra cash flows, it may stick to

its borrowing schedule of 13 billion and 10 billion Turkish Liras in these two months. This strong supply could cause upward pressures on bond rates.

Monetary policy and inflation have been supportive of yields as well. Expectations of a policy rate cut fueled the early-December rally, and

inflation ended the year at 6.2 percent, more than a full percentage point lower than what the Central Bank was expecting as late as the end of October.

Thanks to the recent

tobacco tax hikes, inflation is likely to rise to 7 percent this month and then stay there for the next couple of months. Since inflation expectations are mainly backward-looking in Turkey, they are likely to edge up as well, which could weaken the lira and prevent further downward moves in yields.

As for the monetary policy, the real exchange rate is

within the Central Bank’s comfort zone, and leading indicators are showing a pick-up in economic activity, and so the scope for further policy rate cuts is rather limited.

But I would argue that global factors are much more important in determining the fate of Turkish bonds. As bond-investor Pimco’s chief executive, Mohamed El-Erian,

wrote in the Financial Times, the Federal Reserve (Fed) and other developed country’s central banks’ “experimental activities” have investors searching for yields.

He warns about betting against this “central bank put,” but risk appetite was back with a vengeance on Jan. 9 and 10, partially driven by hopes of

easing from the Bank of Japan. El-Erian’s warnings are for the longer-term. Despite some recent signs to the contrary, the Fed is unlikely to unwind its balance sheet soon.

Until that day comes, it will be

real money flows into emerging markets, which amounted to a whopping $1.8 billion in the last four days, that will decide whether Mr. Bond dies soon or

another day.

That’s what the villain Auric Goldfinger tells 007 when the latter asks, “Do you expect me to talk?” in the Bond movie Goldfinger. This is exactly how I feel about Turkish bonds.

That’s what the villain Auric Goldfinger tells 007 when the latter asks, “Do you expect me to talk?” in the Bond movie Goldfinger. This is exactly how I feel about Turkish bonds.