How I learned to stop worrying and love the deficit

In my

December 6 column, I noted, after going through different measures to reduce Turkey’s current account deficit, and therefore dependence on external financing, that most policies would need several years to be effective. In the meantime, we have to find ways to live with the deficit.

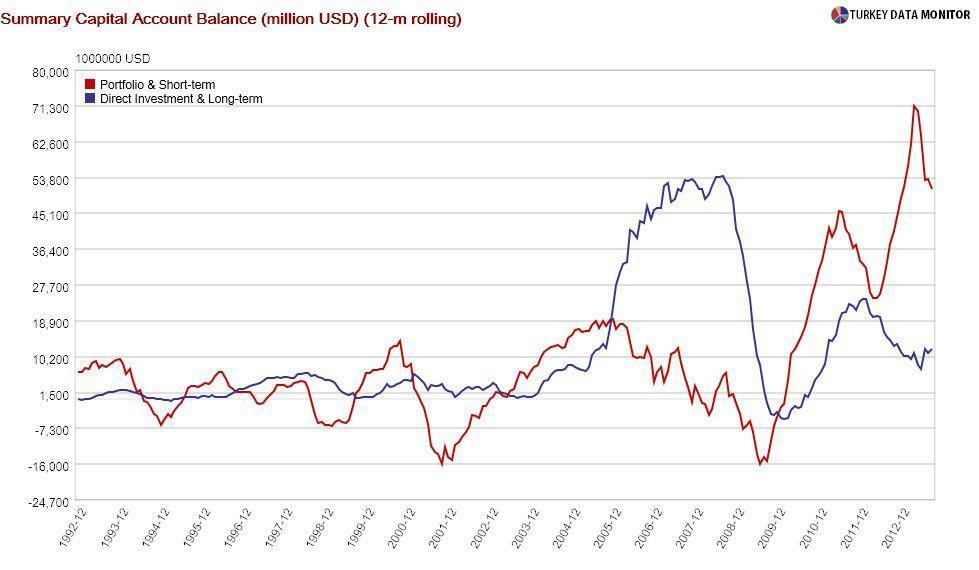

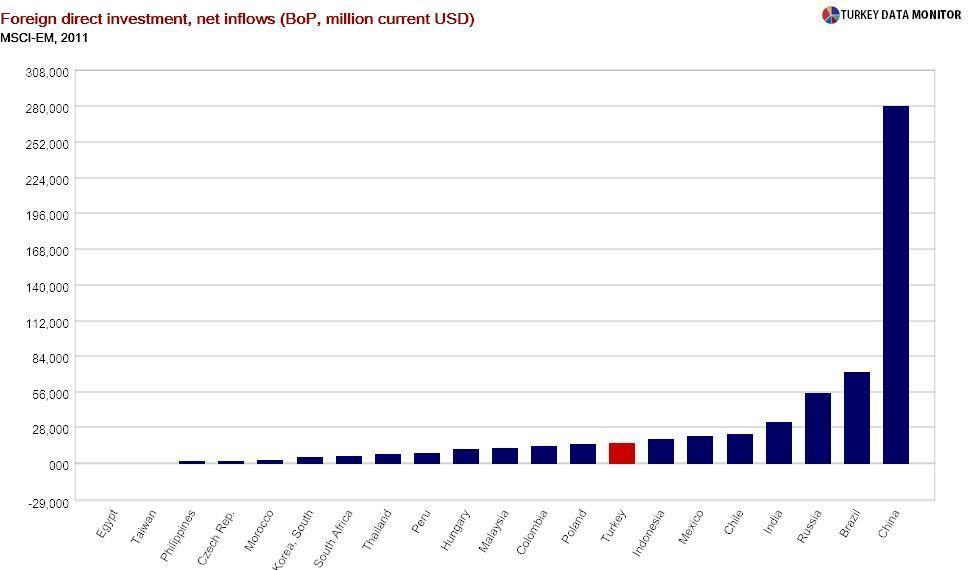

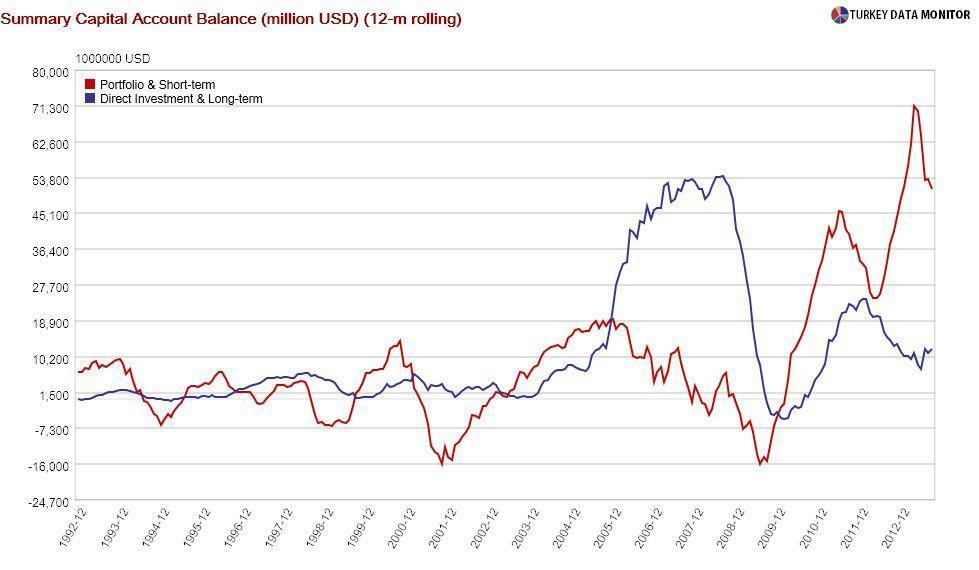

The easiest solution would be to change the composition of external financing from short to long-term. Foreign direct investment (FDI) is particularly desirable. After all, a foreign company that has physical assets in the country cannot just pack up and leave, while funds can virtually exit overnight if they are worried they will be losing money on their investments.

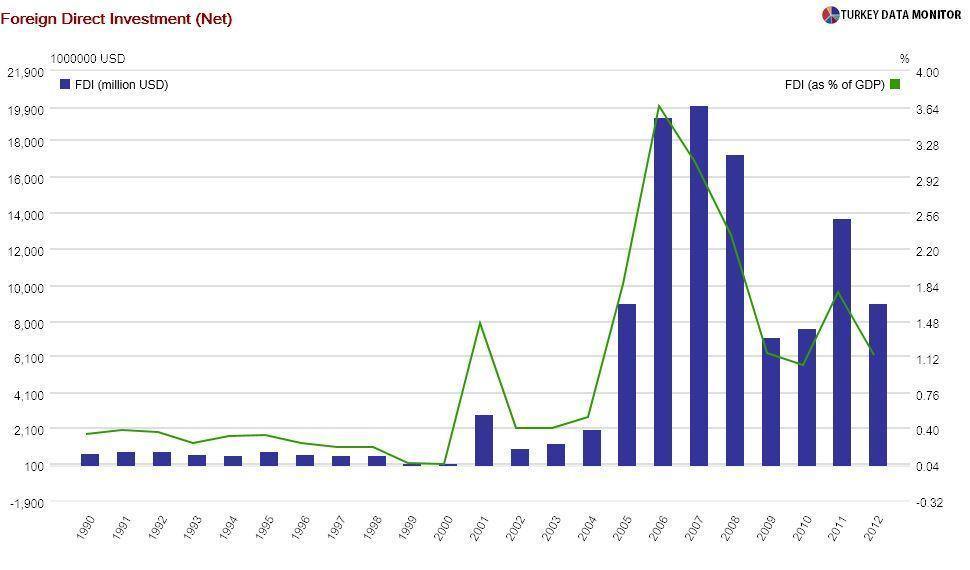

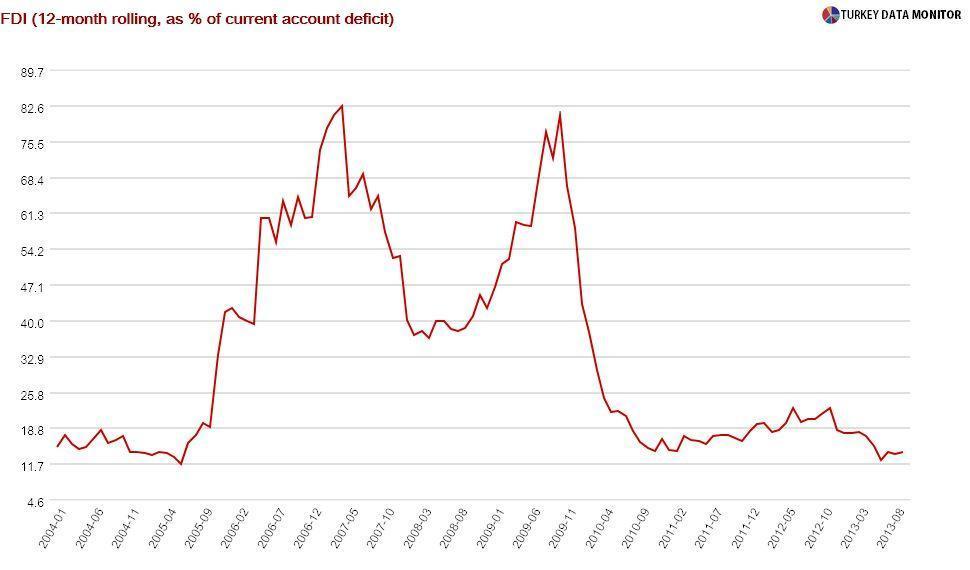

Turkey finally started to get the interest of foreign companies in the last decade after attracting only a few hundred million dollars annually in the 1990s. The country’s net FDI in the three years from 2006 to 2008 was nearly $60 billion. But cumulative net FDI was only $37 billion in the following four years, one third of which came in 2011. Combine this with the surge in the current account deficit, and while more than 80 percent of the deficit was being financed by FDI in early 2007, that ratio is now down to 14 percent.

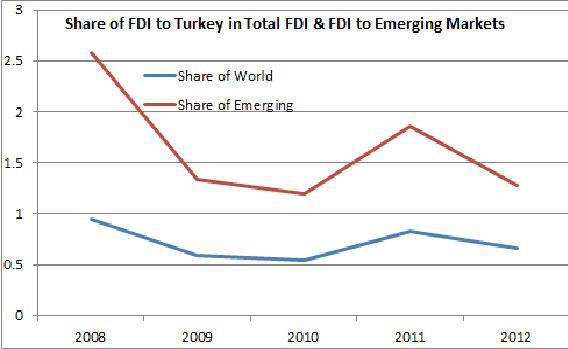

We should be careful in reading too much into the FDI figures. For one thing, sale of key one-off state assets fueled the rise in FDI from 2006 to 2008. Besides, the fall and subsequent rebound in FDI is in line with global trends. However, FDI to Turkey fell more than the worldwide decrease, and it hasn’t recovered as much.

You could argue that the business environment, which is

not conducive to FDI, is to blame, but the same investment climate was in place from 2006 to 2008. In any case, we should not hope for significantly more FDI in the near-term. However, it is also possible to create buffers against reversals or slowdowns in short-term capital flows, as the IMF’s latest

World Economic Outlook explains.

The Fund’s economists noticed that volatile capital inflows are balanced by offsetting outflows of domestic residents (and vice versa) in some countries. Digging into the data, they found that such countries share some common characteristics: For one thing, they have strong institutions, such as independent, inflation-targeting central banks as well as fiscal rules. As a result, they have lower inflation and countercyclical fiscal policy.

Moreover, these countries have stronger financial supervision and regulation. They also have more flexible exchange rate regimes and limited restrictions on capital flows. Last but definitely not the least, they have large domestic financial systems, with Chile being the prime example. Incidentally, this South American country attracts more FDI than Turkey despite its smaller size.

Now, I have yet another reason to lament that the Central Bank of Turkey is

de facto not independent anymore. Or that the

fiscal rule was ditched in 2010 despite economy tsar Ali Babacan’s enthusiasm. Or that the exchange rate is

not as flexible as it used to be.

In my December 6 column, I noted, after going through different measures to reduce Turkey’s current account deficit, and therefore dependence on external financing, that most policies would need several years to be effective. In the meantime, we have to find ways to live with the deficit.

In my December 6 column, I noted, after going through different measures to reduce Turkey’s current account deficit, and therefore dependence on external financing, that most policies would need several years to be effective. In the meantime, we have to find ways to live with the deficit.