China’s giant state-run companies want more expansion, investment

BEIJING - Reuters

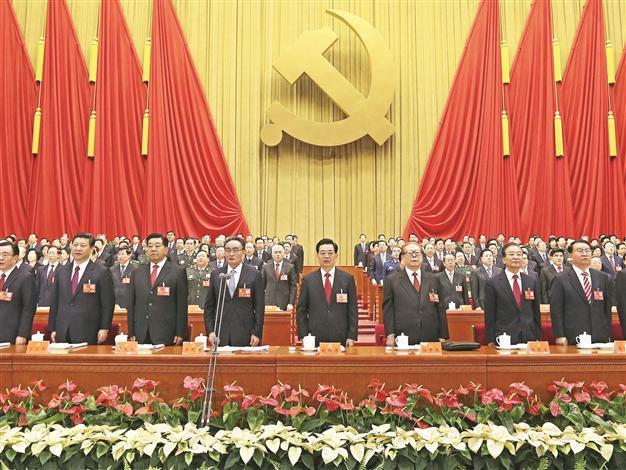

This handout photo provided by Xinhua News Agency on Nov 8 shows Chinese President Hu Jintao (C), former president Jiang Zemin (front 5th R) and other Chinese leaders on the stage at the opening of the 18th Communist Party Congress. AFP photo

As Chinese party delegates spent day two of the 18th Communist Party Congress on Nov. 9, a once-in-a-decade event, the big state-owned enterprises in the world’s second largest economy argued for continued expansion, echoing outgoing President Hu Jintao’s comments, which urged more investment in major government firms.

At the opening of the congress on Nov. 8, Hu stressed the importance of continued one-party rule and how it was threatened by corruption, a reference to the downfall of one-time high-flying politician Bo Xilai.

He also suggested a further strengthening of the state in strategic sectors, with the possibility of more market-oriented competition in other sectors.

“The direction of the SOE (state-owned enterprise) reform should be: SOEs must be more market-oriented and they must keep strengthening their vitality and influence,” Wang Yong, the head of a commission on supervising and administering state-owned assets, told reporters.

“Scholars may have different views, but that’s the development need of the enterprises and the state.” Hu had said that Beijing must “unwaveringly consolidate and develop the public sector of the economy.”

“(We should) invest more state capital in major industries in key fields that comprise the lifeline of the economy and are vital to national security.”

But outgoing Premier Wen Jiabao vowed in a speech earlier this year that Beijing would push ahead with monopoly-busting. “We must move ahead with reform of the railway, power and other industries, complete and implement policies and measures aimed at promoting the development of the non-state economy, break monopolies and lower industry thresholds for new entrants,” he had said.

65 firms in Forbes listState-owned enterprises and affiliated businesses account for more than half of output and employment in China, the world’s second-biggest economy. They include power grid-operator State Grid, the world’s seventh-biggest company. Oil giants Sinopec Group and China National Petroleum Corp, parent of PetroChina, rank fifth and sixth, respectively. Of the 70 mainland companies on the 2012 Fortune Global 500 list, 65 are state-owned.

Chinese reformers and Western governments say their sheer size and market dominance creates a drag on the economy through vast opportunity for corruption and waste, leading to higher costs for consumers.

Calls for reform built up as factions maneuvered ahead of the leadership transition at the congress. When Xi Jinping, Hu’s anointed successor, is in place he will be under immediate pressure to break the grip of inefficient SOEs and reinvigorate China’s three-decade-long economic miracle.

But he will have to deal with the divisions within the party on policy. On Nov. 9, data for October showed the economy was pulling away from its slowest growth in three years. Analysts said that thanks to a raft of pro-growth policies rolled out by the government in recent months.

Wang, the state assets commission chief, admitted that the enterprises were saddled by a bloated workforce, a legacy of the planned economy.

But he and other state-firm bosses emphasized their importance to what they called “national economic security” in their gathering, laying out plans for further investment and overseas expansion.

The large state role prompted a U.S. congressional advisory panel to complain this week that Chinese investment in the United States had created a “potential Trojan horse.”