Summer(s) of discontent

Now is the Summer(s) of our discontent, made inglorious winter by this sun of Chicago.

If I am ever to write a fictionalized account of the woes of emerging markets (EMs) and particularly Turkey this summer, I will probably start it with this sentence. I would not only be

paying homage to the Bard, but also summarizing a vital part of the current market turmoil.

You probably already know that markets are jittery because of worries that the Federal Reserve (Fed), the Central Bank of the United States, will

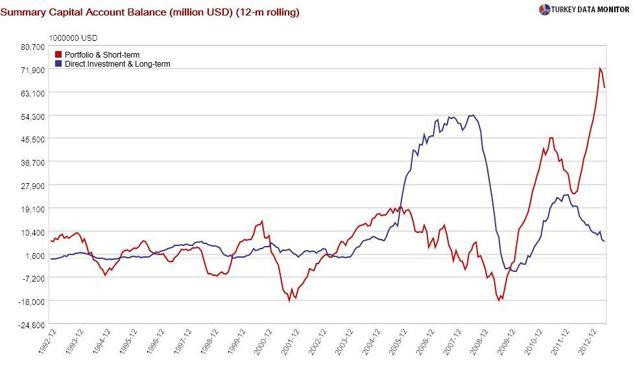

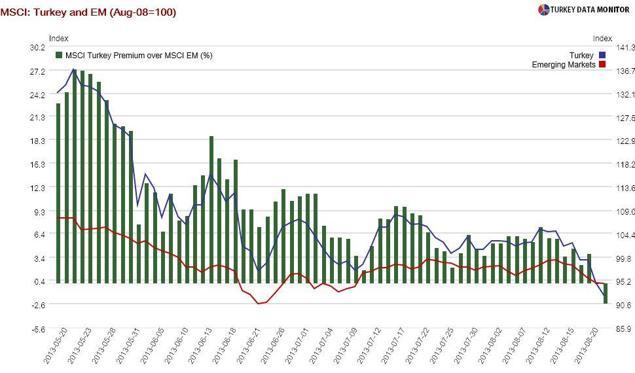

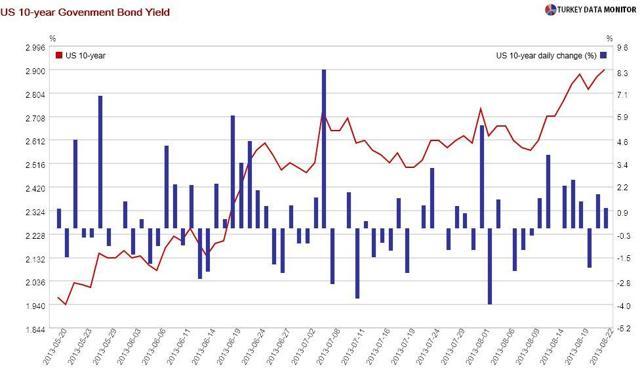

start tapering its $85 billion a month of bond purchases soon. As a result, U.S. government bond yields have been on an upward trend since May 22, when Fed Chairman Ben Bernanke first made the tapering suggestion. EMs have been hit the worst, with many, like Turkey, seeing net outflows from bonds and equities since the end of May.

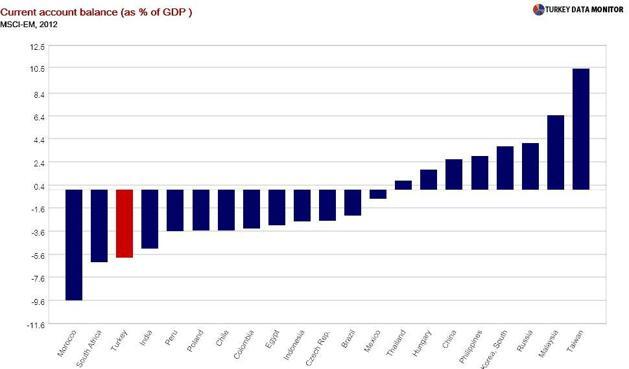

Countries with

large current account deficits and financing needs have been affected the most. External vulnerability is the common trait of the “fragile five,” a term recently coined by the head of EM sales of a major investment bank for Brazil, India, Indonesia, South Africa and Turkey.

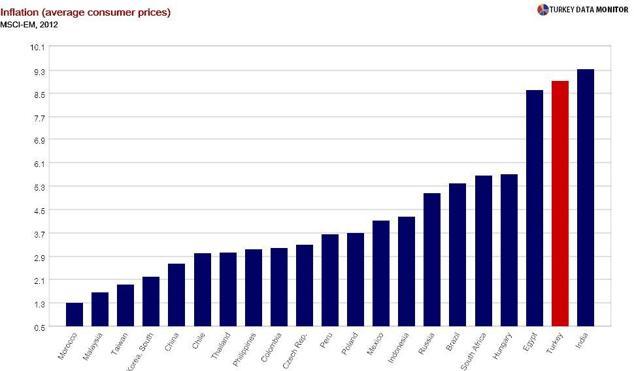

With more than 90 percent of capital inflows short-term, Turkey is more dependent on hot money than the other four. Moreover,

unlike almost all peers, Turkey has high inflation.

Capital Economics, a macroeconomic research company,

recently noted they don’t expect currency weakness to cause EM inflation to rise. Turkey could be an exception. No wonder its not only Turkish stocks that have been underperforming their peers, the Turkish Lira has also been the worst performer of the fragile five of late.

Although the Fed is likely to start implementing it in September, the pace of tapering is uncertain and will depend a lot on the next Fed chairman. Larry Summers, one of the two leading candidates,

voiced doubts on the effectiveness of quantitative easing (QE) back in April. He is likely to exit QE and

cause interest rates to rise faster than Janet Yellen, the other primary contender, who is considered to be a monetary policy dove.

Economist Justin Wolfers recently argued

in his Bloomberg column, after comparing Summers and Yellen odds from

Irish betting site Paddy Power with yields on U.S. inflation-indexed bonds, that markets don’t have a preference between the two. My graduate school classmate is usually right, but U.S. government bonds tell a different story.

10-year yields have been consistently rising, along with Paddy Power Summers odds, since Aug. 7, when he became

a clear favorite. Another indicator is the explicit mention, in the past couple of weeks, of Summers worries in the

dozens of analyst reports I skim every day. Despite

his close ties to Wall Street, it seems markets are actually jittery over

concerns that President Barrack Obama will pick him.

Obama, a son of Chicago, is expected announce his choice in the fall. If that turns out to be Summers, the summer of discontent could lead to a fall in Turkish assets that could last well into Turkey day.

Now is the Summer(s) of our discontent, made inglorious winter by this sun of Chicago.

Now is the Summer(s) of our discontent, made inglorious winter by this sun of Chicago.