IMF (and Cosmo) imply Turks could come after El Presidente

The International Monetary Fund (IMF) published its biannual publications,

World Economic Outlook (WEO) and

Global Financial Stability Report (GFSR), during the IMF-World Bank Annual Meetings in Lima this past week. Both reports contain grim warnings for Turkey.

The GFSR notes that while developed countries decreased their leverage after the global crisis, “key emerging market (EM) economies relied on

rapid credit creation to sidestep the worst impacts of the global crisis,” resulting in “sharply higher leverage of the private sector” in many EMs.

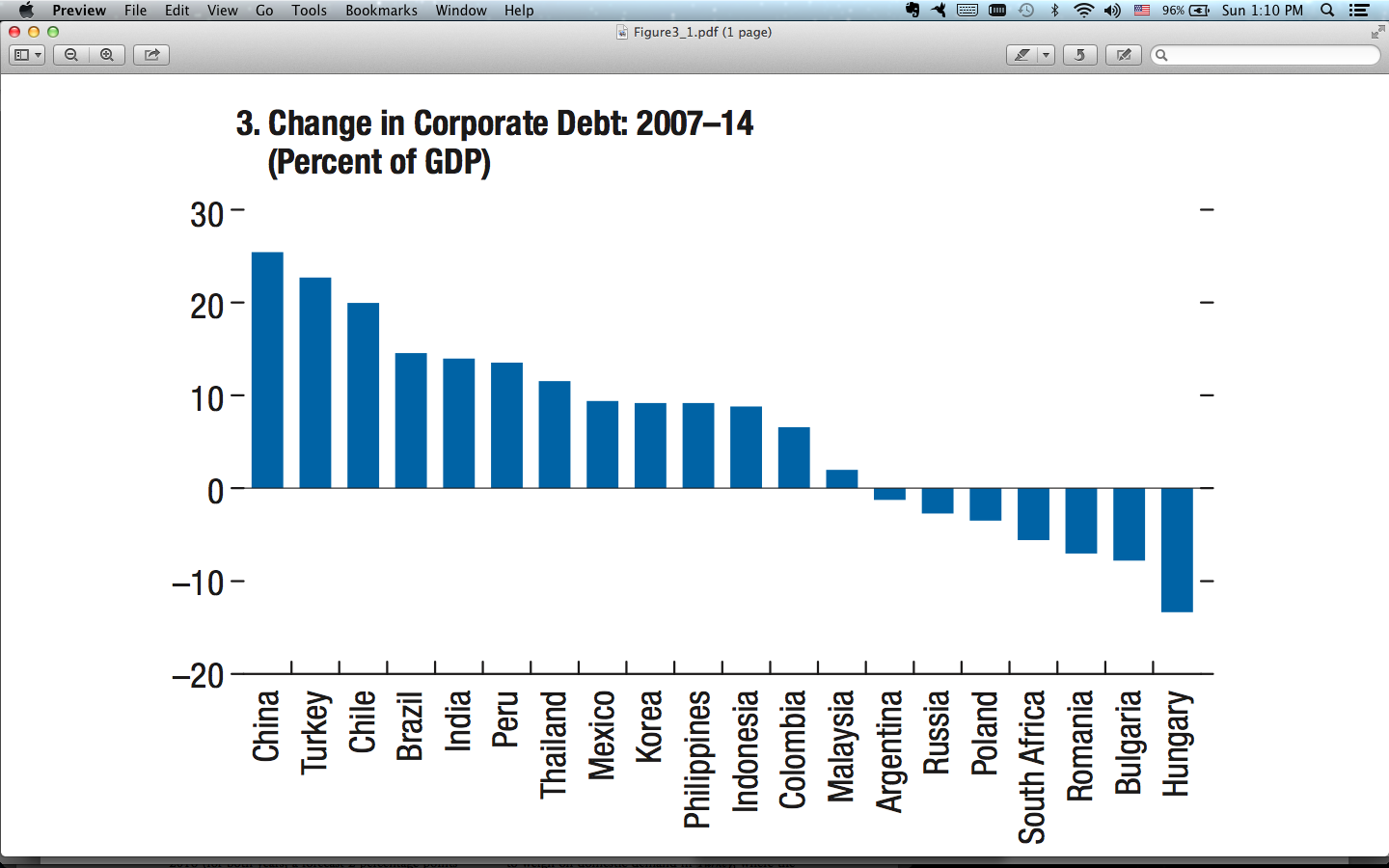

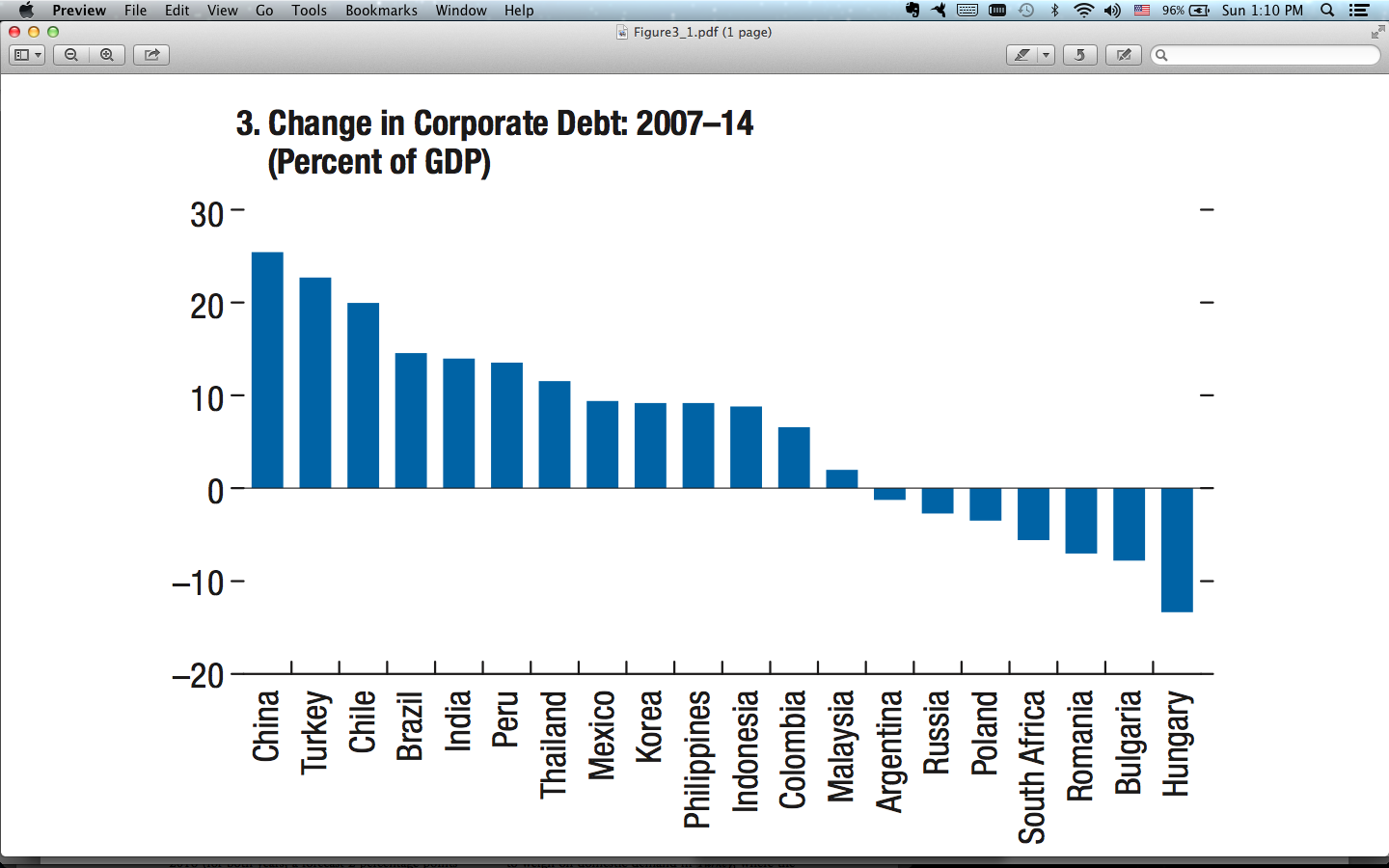

Turkey turns outs to be the country where the

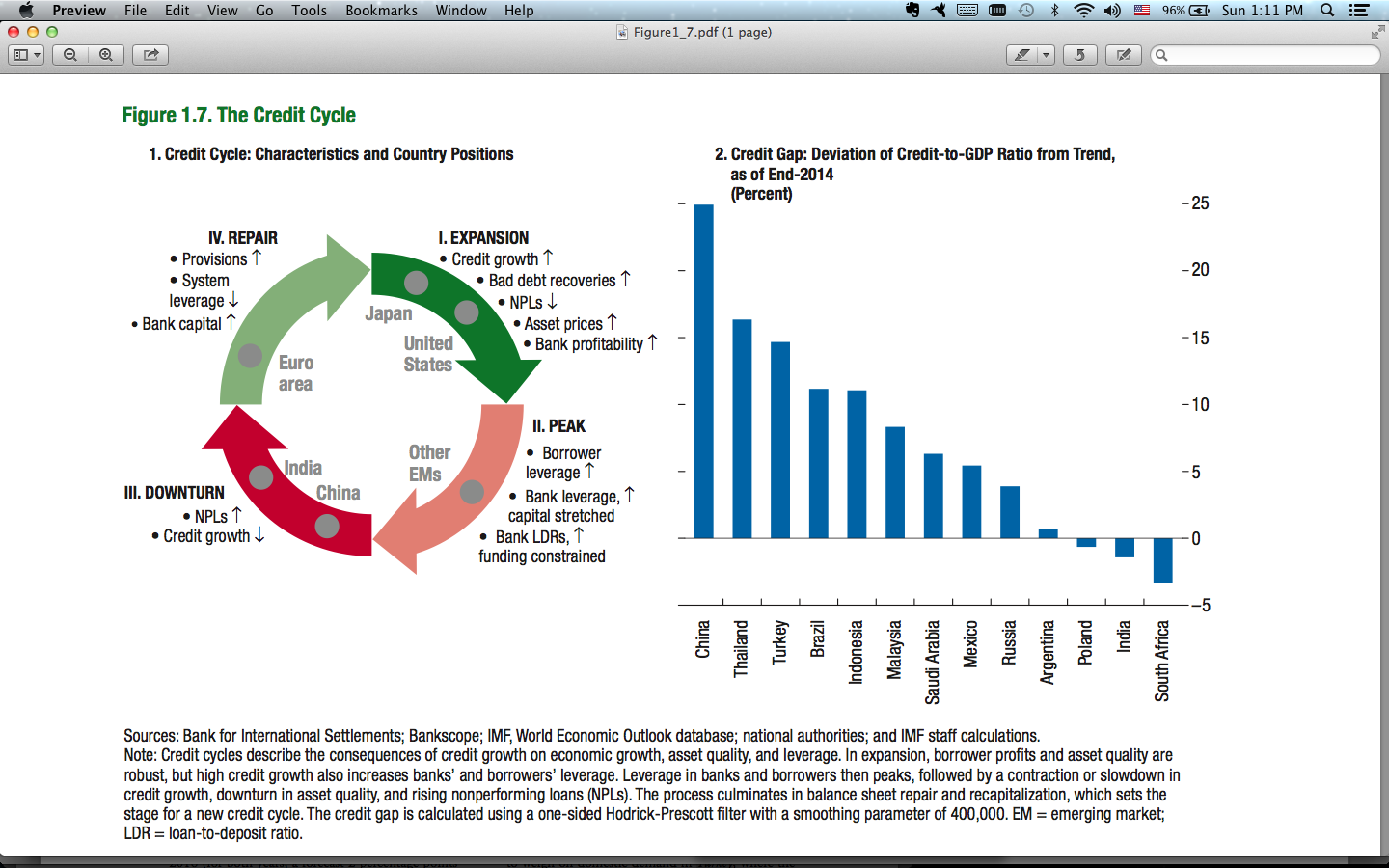

change in corporate debt, as percent of its GDP, from 2007 to 2014 was the largest after China. Similarly, the deviation of credit-to-GDP ratio from its long-run trend, what the IMF calls the “

credit gap,” is the highest after China and Thailand. Therefore, once funding becomes scarce and more expensive as a result of the U.S. Central Bank Federal Reserve’s interest rate normalization, Turkish companies are likely to feel the strain.

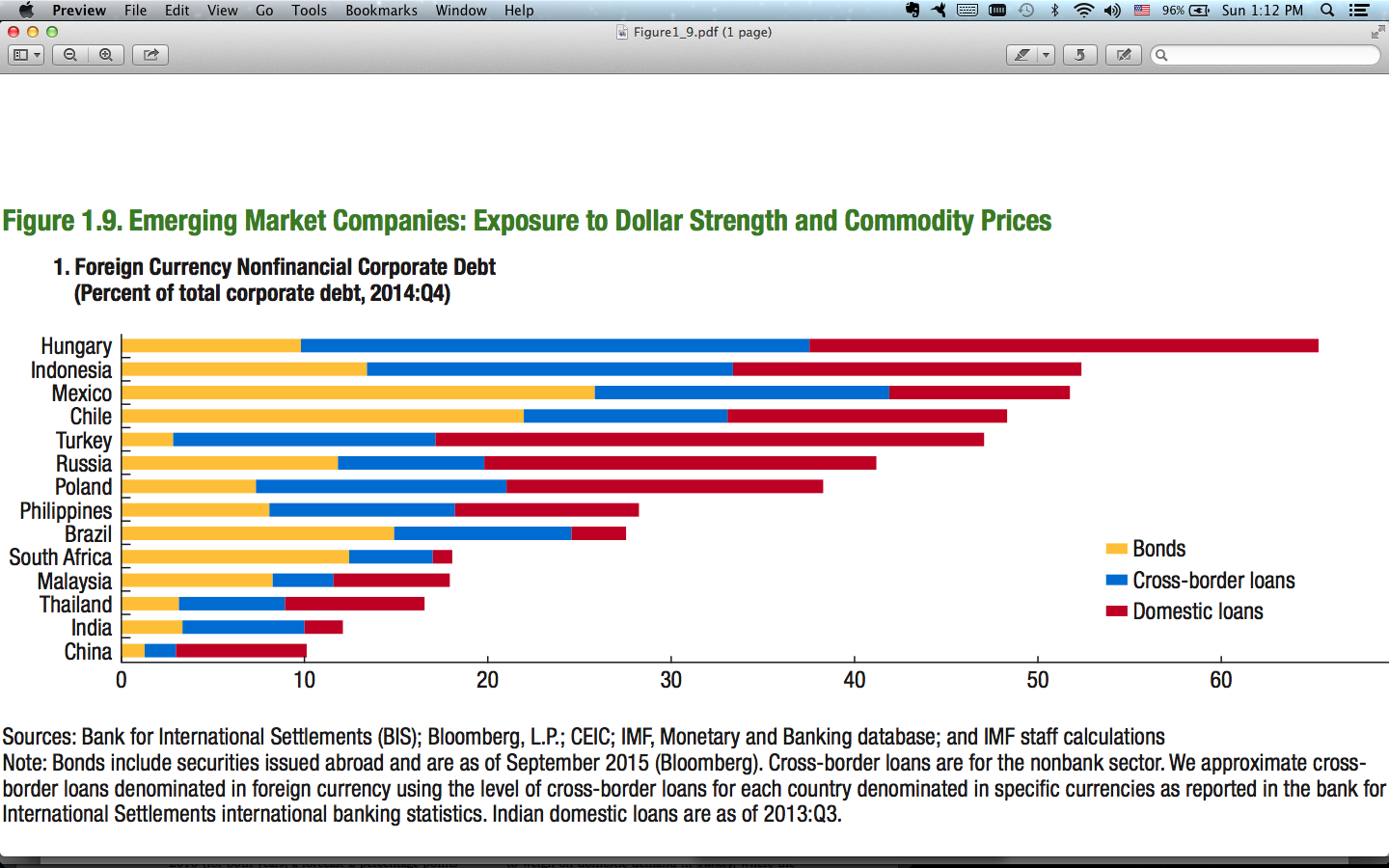

A large chunk of this debt is in dollars, making the country’s non-financial sector vulnerable to the expected greenback strength. According to the IMF’s calculations, Turkey has

one of the highest exposures among EMs to dollar strength and commodity prices, with the bulk of the risk coming from domestic loans.

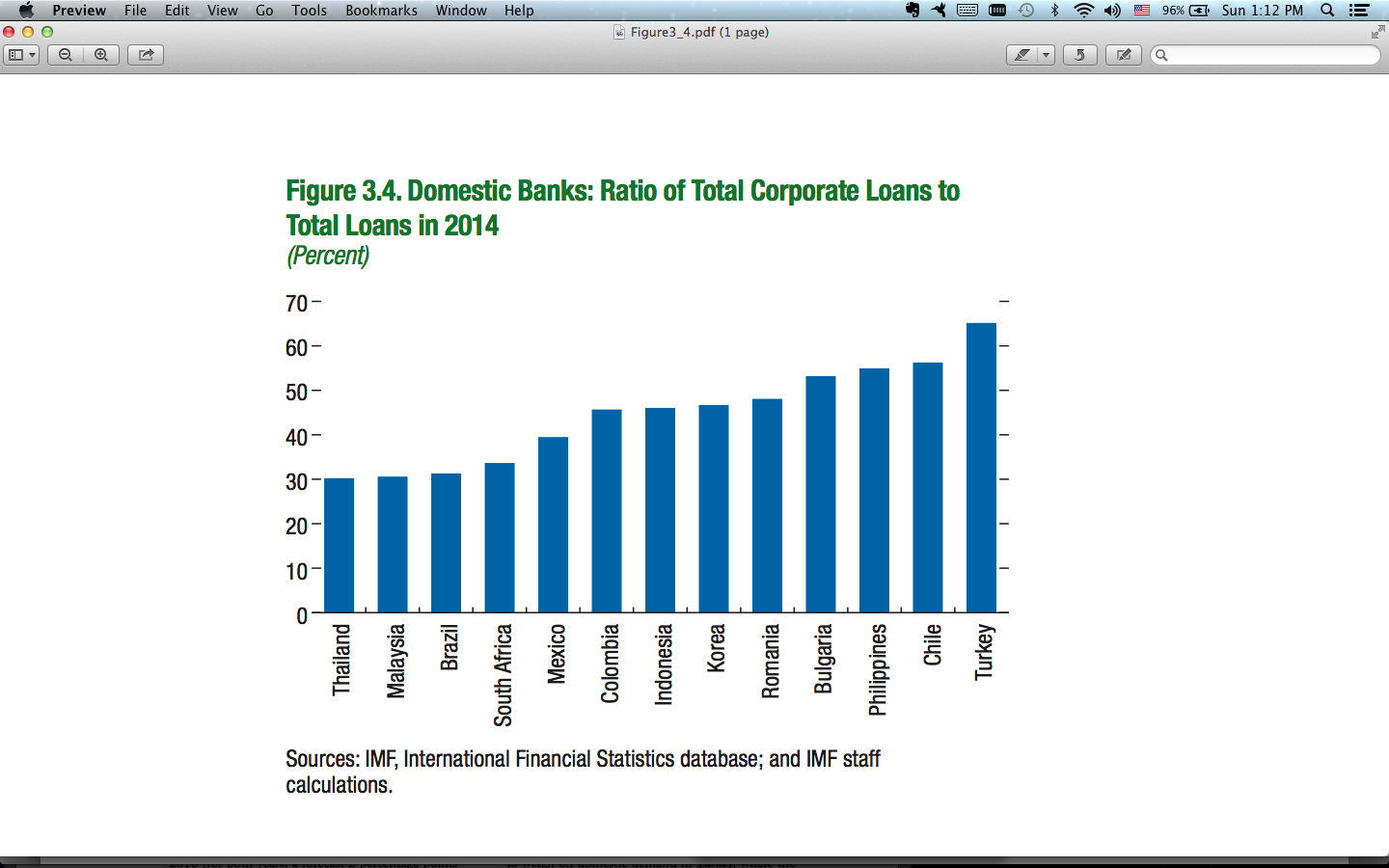

Indeed, Turkish banks had the

highest ratio of corporate loans to total loans in the EM universe in 2014. As American businessman Paul Getty

famously said, “If you owe the bank $100, that’s your problem. If you owe the bank $100 million, that’s the bank’s problem.” In other words, if Turkey’s companies sneeze, its banks will catch colds.

The IMF also

lowered its Turkish growth forecasts from 3.1 to 3 percent for 2015 and from 3.6 percent to 2.9 percent for 2016 in the WEO. The IMF noted that “the impact of still-elevated corporate debt on investment, together with political uncertainty, is expected to weigh on domestic demand in Turkey, where the growth of activity is projected to remain at about 3 percent in 2015-2016.”

The IMF presents the decrease in growth as result of cyclical and, therefore, temporary factors. While those are definitely partly responsible for the dismal performance, structural factors are at play as well. I just cannot imagine how Turkey could grow more than 3-3.5 percent in the absence of the external financing it has come to rely on, at least without changing its growth model by enacting

key structural reforms.

Therefore, while I find the IMF’s WEO growth revisions more disturbing than its warnings in the GFSR, the Turkish economic outlook may be even grimmer. At the end of the day, the economy could withstand some bankruptcies, but not sustained low growth. If nothing else, the country’s demographics means that growth would need to exceed 3.5 percent just

to keep unemployment at bay.

This is really bad news for President Recep Tayyip Erdoğan. After all, as the U.S. comedy show Seinfeld’s unforgettable Cosmo Kramer

once remarked, “When there’s no work and the people get restless, who do you think they come after? El Presidente!”

The International Monetary Fund (IMF) published its biannual publications, World Economic Outlook (WEO) and Global Financial Stability Report (GFSR), during the IMF-World Bank Annual Meetings in Lima this past week. Both reports contain grim warnings for Turkey.

The International Monetary Fund (IMF) published its biannual publications, World Economic Outlook (WEO) and Global Financial Stability Report (GFSR), during the IMF-World Bank Annual Meetings in Lima this past week. Both reports contain grim warnings for Turkey.