Believe in me and win

During his

interview with state-run Anadolu Agency on August 27, Central Bank of Turkey Governor Erdem Başçı stated that the dollar-lira exchange rate would be 1.92 or lower at the end of the year, adding that those who believed in him would win.

Regardless of the perils of committing to a specific level of the currency or the ethics of giving investment advice, you could indeed make a lot of money if you take Başçı at his word and he turns out to be right: The end-year dollar-lira forward rate is 2.12. But before you put all your life savings into a “Başçı bet,” I should tell you that how the Central Bank will appreciate the lira

is a mystery.

Many were expecting the Governor to adopt a hawkish stance to talk markets down, perhaps by underlining that the Bank would raise interest rates if necessary to stabilize the currency. Instead, the Governor

gave up on this important weapon by stating that the average funding rate would hover between 6.75 and 7.75 percent, not higher, until inflation hit the Bank’s end-year forecast of 6.2 percent.

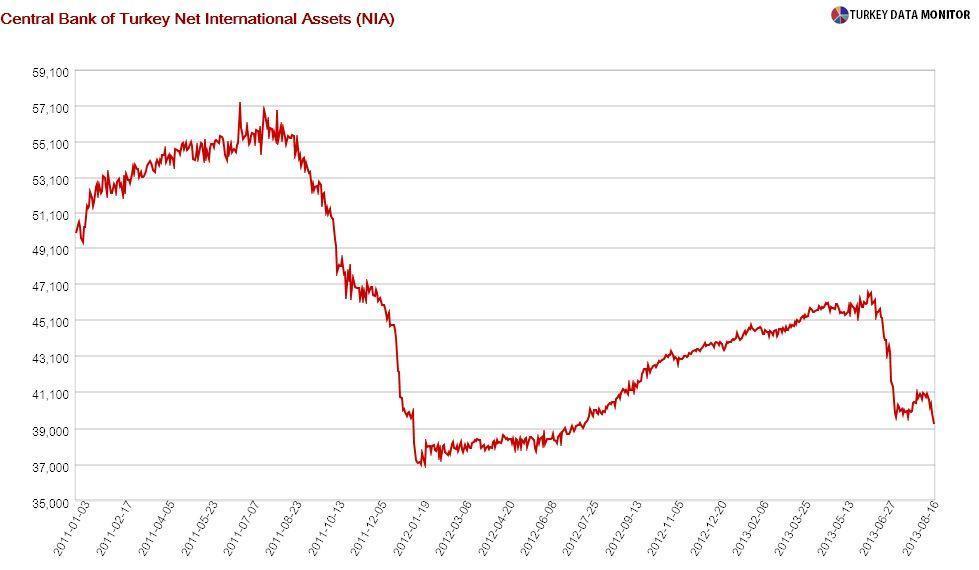

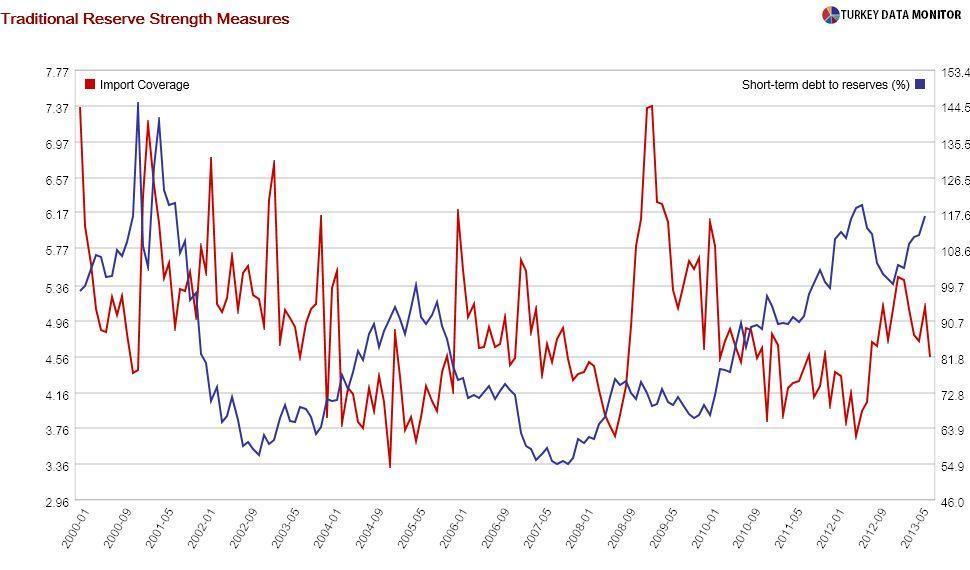

That leaves reserves. Currently at $40 billion, net international reserves are very low compared to peers, and traditional reserve strength measures such as import coverage and short-term debt to reserves are ringing alarm bells. Interestingly enough, while he stated they would “defend the lira like lions,” Başçı also emphasized that they would not use a lot of reserves in the process.

The Governor said they would introduce new measures to prop up the currency soon but declined to explain what these were, noting that the element of surprise would render them more effective. Rumors that the Bank would arrange a currency swap with the Federal Reserve were denied by Bank officials.

Capital Economics, a macroeconomic research company,

believes the Bank could restrict commercial banks’ use of the

Reserve Option Mechanism or place a cap on liquidity provision via the overnight lending facility. The former would not make a big difference, and the latter would cause the average funding rate to rise above 7.75 percent.

Işık Ökte, strategist at Halk Invest, argues that the Central Bank could put its money where its mouth is by offering end-year forwards at 1.92. I also think the Bank will resort to derivatives, which could backfire if markets are not convinced. Özlem Derici of Ekspres Invest, on the other hand, thinks that the “novelty” is preannounced additional tightening that will be independent of the exchange rate.

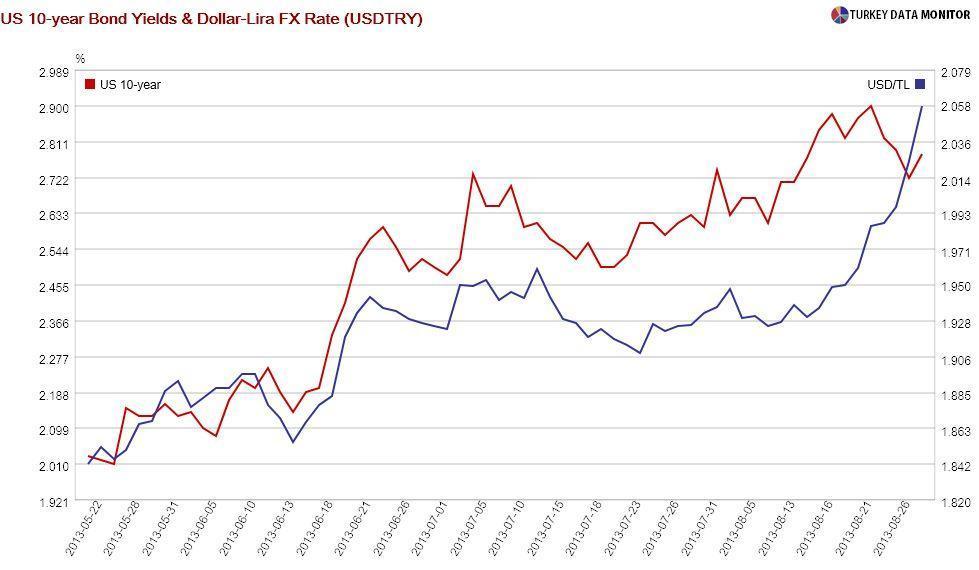

In any case, the Central Bank’s credibility is getting pummeled. The lira plummeted as Başçı was speaking, a clear indicator that markets did not buy his remarks. More importantly, it has not only decoupled from peers, but from U.S. 10-year government bond yields as well. While the latter fell, probably due to Syria worries and better than expected U.S. data, the lira continued to depreciate.

You would really need to be a

borderline genius, as a hands-down genius market economist recently labeled Başçı, to manage that.

During his interview with state-run Anadolu Agency on August 27, Central Bank of Turkey Governor Erdem Başçı stated that the dollar-lira exchange rate would be 1.92 or lower at the end of the year, adding that those who believed in him would win.

During his interview with state-run Anadolu Agency on August 27, Central Bank of Turkey Governor Erdem Başçı stated that the dollar-lira exchange rate would be 1.92 or lower at the end of the year, adding that those who believed in him would win.