Turkish Lira, Russian Rouble bonds to join Barclays Global Index

LONDON-Reuters

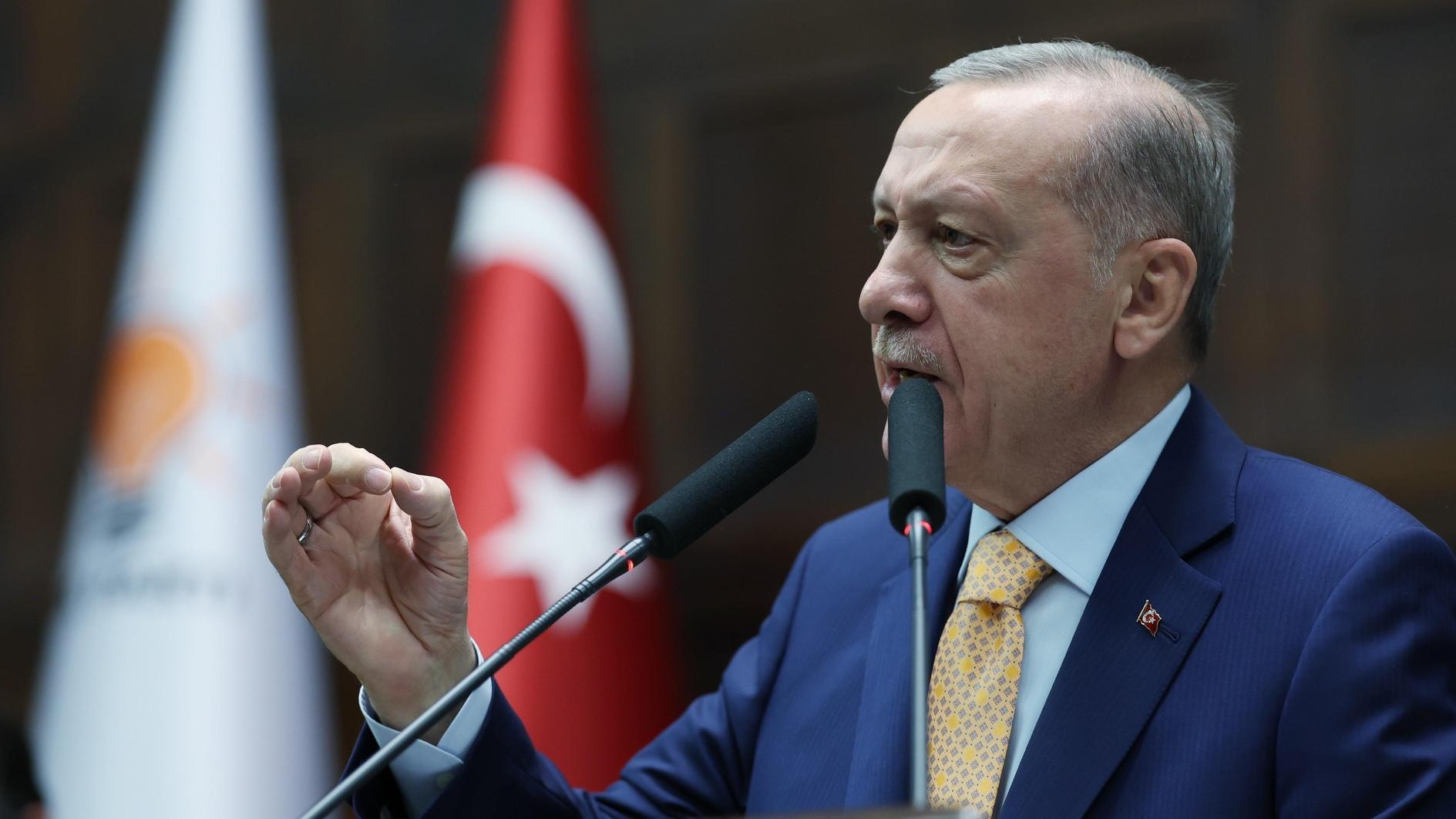

REUTERS Photo

Barclays said government bonds in lira and rouble would enter the Barclays Global Aggregate Index from March 31 2014, joining the 22 currencies already included.Turkish and Russian local currency bonds may receive billions of dollars in capital inflows after their inclusion into a flagship global index, a vote of confidence for markets that are just recovering from a bruising summer selloff.

Being part of a widely-used index tends to bring in cash because investment funds tracking the index will have to make room in their portfolios for the bond or stock in question.

Although the index share -- 0.14 for Turkey and 0.17 for Russia -- is small, it will give investors extra access to two important emerging markets and their high yielding bonds. The two countries’ foreign currency debt is already included.

“The weights are optically modest, but the amount tracking the index is sizeable. We estimate potential tracking flows of $2.5-3.0 billion to Russia and $2.0-2.2 billion to Turkey,” Barclays told clients late on Tuesday.

Barclays does not disclose how much investor cash is benchmarked against its indices but it said: “There should be a positive sentiment effect from index inclusion for both local markets, as the inclusion is not a mechanical process but relies also on the input of investors.”

To qualify for inclusion in the Global Aggregate Index a credit must have an investment-grade rating and a freely traded, convertible currency. There must also be a liquid forward market that allows investors to hedge their currency exposure.

Russian hard currency bonds have been in the Barclays index since 2008, while Turkish dollar and euro-denominated government bonds joined in June 2013 following the sovereign’s promotion to investment grade.

Vote of confidence

Investors did not expect any immediate reaction, with flows from tracking funds seen materializing only after March 31.

“It’s clearly a very big index and it’s very important. (But) Turkey and Russia are going to be very very small in the index,” said Angus Halkett, a portfolio manager at Stone Harbor Investments.

UBS strategist Manik Narain said both markets had taken in huge inflows earlier this year, with Russian OFZ debt especially benefiting from liberalization of the rouble bond market.

Since February, foreign investors buying OFZ bonds have been able to process them through international clearing houses Euroclear and Clearstream, enjoying easier and quicker access to the market.

“I think most of the investors who wanted exposure to these bonds will have already gotten in after Euroclearability in Russia was announced last year and Turkey’s upgrade to investment grade,” Narain said.

Russia is likely to benefit more from the move, he said noting that foreign holdings of Turkish and Russian debt are currently around $57 billion and $26 billion respectively.

The other important effect is psychological.

The lira and rouble were among those bruised by the selloff that hit emerging markets from May-August, with the former plunging to record lows against the dollar.

But Barclays said the decision to include these currencies into the index had been endorsed by investors.

“This is further evidence of the increasing trend of emerging markets issuance becoming eligible for the mainstream benchmark fixed income indices,” it said.

Emerging currencies already represented in the index are Mexican peso, Polish zloty, South African rand, Malaysian ringitt, Thai baht, Singapore dollar, Israeli shekel, Czech crown, Hong Kong dollar and Chilean peso.

Inclusion of lira and rouble bonds will bring the emerging markets component of the index to 5.6 percent, Barclays said, contrasting this a 0.38 percent share in 1999.