Turkish lenders still under pressure despite slight recovery

ISTANBUL

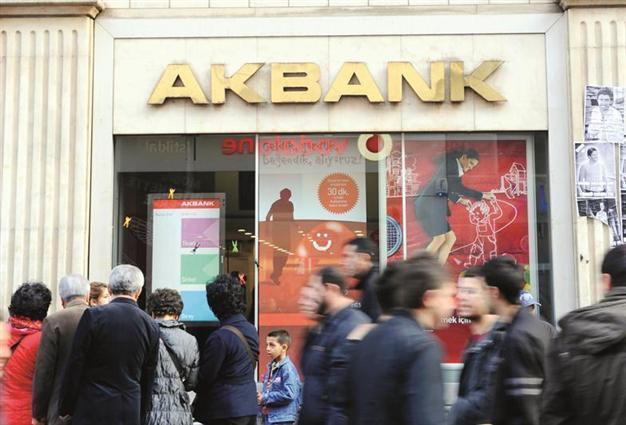

Akbank is one of the lenders that logged declining profits in the second quarter of 2014.

Despite a slight recovery in the second quarter, Turkish lenders have recorded falling profits for the first half of the year due to an increase in interest rates, as well as limitations on credit card and loan spending.Three of Turkey’s largest banks have announced their balance sheets for the second quarter over the past week, revealing that Turkish lenders are still feeling the pressure from the tough conditions in the sector, in spite of eye-catching progress from the ailing first quarter.

While the Central Bank’s massive hike greatly reduced the high demand for loans, the banking watchdog’s regulations curbed the demand for credit card usage and borrowing loans by restricting installment payments on several goods and lifting loan amounts with the aim of reducing domestic spending that led to a rise in imports.

The results announced by the state-owned Halkbank, as well as Garanti and Akbank, show they have been affected by the higher interest rates, which were hiked by the Bank in January to defend the Turkish Lira from a month-long freefall and macro-prudential measures introduced by the country’s banking watchdog.

State-owned lender Halkbank, which suffered a huge loss in reputation amid claims of mediating Turkey’s gold-for-gas trade with Iran, particularly because of graft accusations against its former CEO Süleyman Aslan, announced on July 25 its net profit dropped by 12 percent on annual basis and became 632.2 million liras in the second quarter.

Garanti also announced financial figures on the same day and recorded an 810.4 million-lira profit, marking an 8.6-percent decline from the same period of last year.

Another private lender Akbank, meanwhile, has posted a 2.3 percent lower profit compared to last year at 893 million liras.

However, all three lenders managed to raise their profits compared to the first quarter, earning stronger than expected first half profits.

While Halkbank’s profits soared by 19.3 percent between the end of the first and second quarters, Garanti bank announced a 6.6-percent jump on quarterly basis.

Akbank logged an even more remarkable increase of 37 percent, by raising its profit in the second quarter.

The perk up in the sector mainly stemmed from the Central Bank’s gradual interest rate reduction, which contributed to margins with the positive effect of decline in deposit costs.

The Bank shaved its benchmark interest rates from 8.25 percent to 10 percent in its past three meetings and is continuing to give signals of more “measured and gradual cuts.”

The escalating hope to see more interest rate reductions is boosting the sector’s morale as well.

Stressing the bank foresees the Bank to continue rate reductions, Halkbank CEO Ali Fuat Taşkesenlioğlu said, “We believe we will see a recovery in profit margins because of this.”