Turkey's central bank keeps rates on hold

ISTANBUL - Reuters

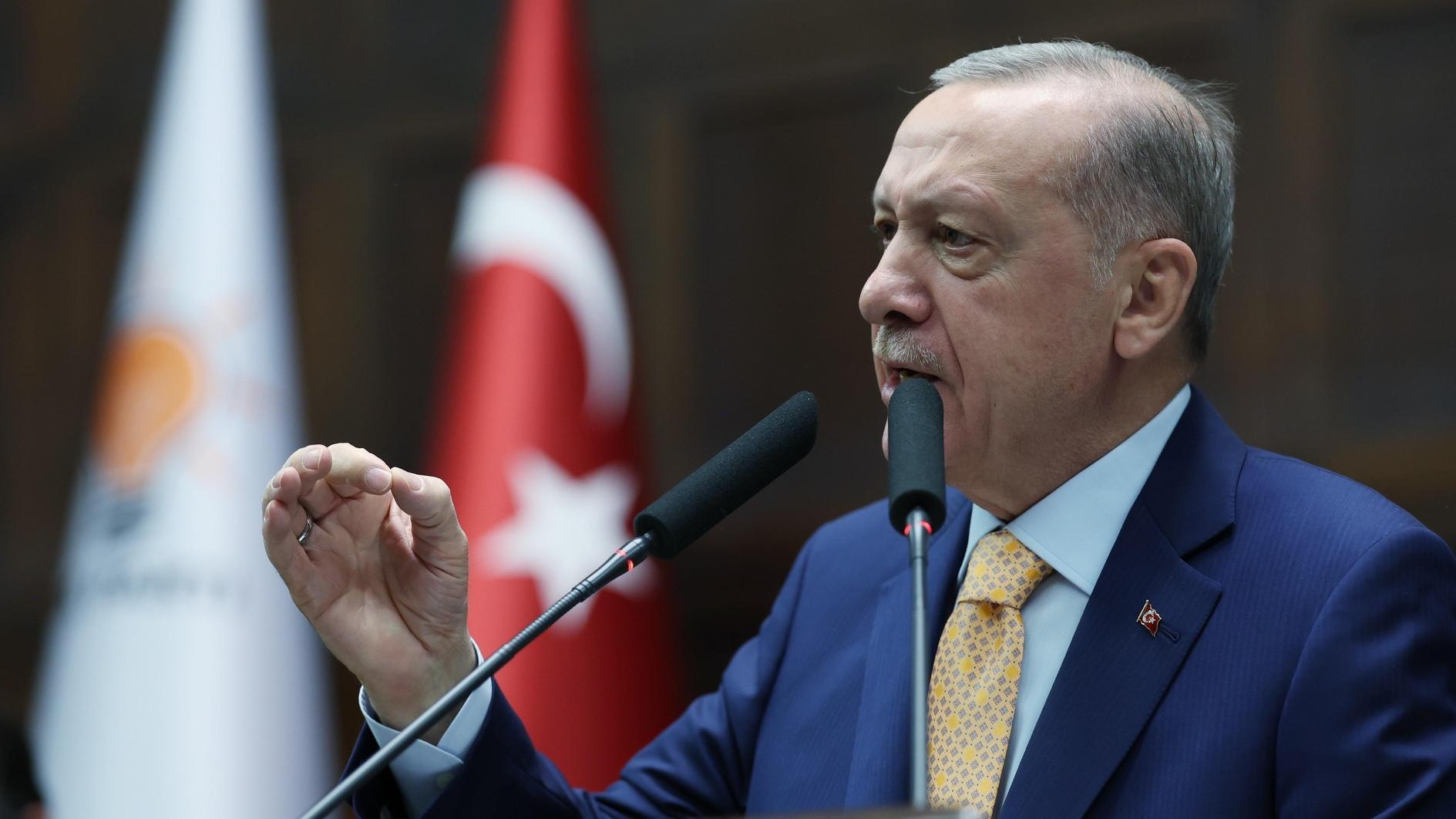

Turkish Central Bank Gov Erdem Başçı speaks during a meeting. DAILY NEWS photo, Selahattin SÖNMEZ

Turkey’s central bank stuck to its pledge not to defend the lira with rises in interest rates yesterday, betting on continued support for the currency from a delay in any trimming of U.S. monetary stimulus.Emerging market currencies, including the lira, have rallied since the U.S. Federal Reserve opted last month not to trim its bond purchases. Growing expectations that it is unlikely to do so before March have lent more support in October.

That has given the Turkish bank more room to keep rates low as it seeks to support shaky economic growth. At the meeting it kept its main policy rate, the one-week repo rate, at 4.50 percent, its borrowing rate at 3.50 percent and its overnight lending rate at 7.75 percent.

The bank said inflation was expected to continue to fall, although it expected core indicators to remain above target for some time because of recent exchange rate volatility. “The committee will maintain the cautious monetary policy stance and continue implementing additional monetary tightening at the appropriate frequency until the ... inflation outlook is in line with medium-term targets,” it said.

Turkish markets were largely unmoved by the decision, which was in line with expectations after Governor Erdem Başçı signaled several times that the bank was not planning to change interest rates any time soon.

All 15 economists in a Reuters poll had expected key rates would be left unchanged. None forecast a change in the reserve requirements the bank uses to manage liquidity conditions.

Başçı said last month financial markets had already priced in the bulk of the impact of a reduction of U.S. monetary stimulus and that the lira, which fell as much as 15 percent from February to September, should soon recover.

Turkey had been among the most high-profile victims of the shift in global capital prompted by signals the Fed would rein in its ultra-easy monetary policy.

The lira has recovered more than 5 percent since hitting a record low against the dollar of 2.0840 on September 5.

Başçı has said repeatedly that he would not need to raise interest rates in the short term to defend the currency, having spent a quarter of the bank’s reserves to prop it up since May. In one of the world’s most complex policy mixes, the central bank has been battling to support the lira with forex auctions, liquidity adjustments and verbal intervention without resorting to rate hikes that might cool growth.