The duke of moral hazard, encore

Prime Minister Recep Tayyip Erdoğan never ceases to amaze me. Just as I was thinking he had set a new standard in damaging the economy by attacking the Central Bank, he raised the bar by announcing a vast debt amnesty.

Prime Minister Recep Tayyip Erdoğan never ceases to amaze me. Just as I was thinking he had set a new standard in damaging the economy by attacking the Central Bank, he raised the bar by announcing a vast debt amnesty.The new draft law, which was sent to Parliament on June 2, is restructuring a number of debts, from traffic tickets to social security insurance premiums and taxes. Cash taken from businesses by their owners is also included. Erdoğan cronies who were scrambling to come up with millions to buy a newspaper on the PM’s orders will now be able to formalize all the missing cash from their companies. The bribes registered in Reza Zarrab’s excel sheet will be legalized as well.

A government official told Reuters the law “had been prepared by ruling party lawmakers at Erdoğan’s bidding” without consultation with the Ministry of Finance. Along with his row with the Central Bank, this move shows Erdoğan is increasingly leaving Deputy Prime Minister Ali Babacan and Finance Minister Mehmet Şimşek out of the economic decision-making process and relying more and more on his own judgment – and that of his chief economic adviser, Brave Cloud.

A second government official summarized the gist of the new law by noting it was “fulfilling the requirements of the current political environment, not necessarily those of the economy.” As I argued in Monday’s, June 2, column Erdoğan needs growth to make sure he gets elected President in August. That’s why he has been pressuring the Central Bank to cut rates.

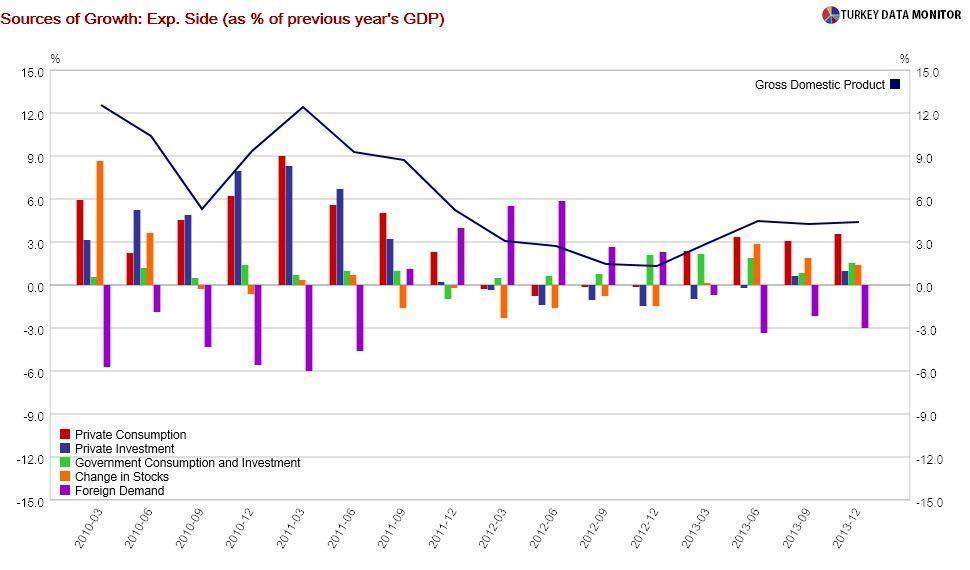

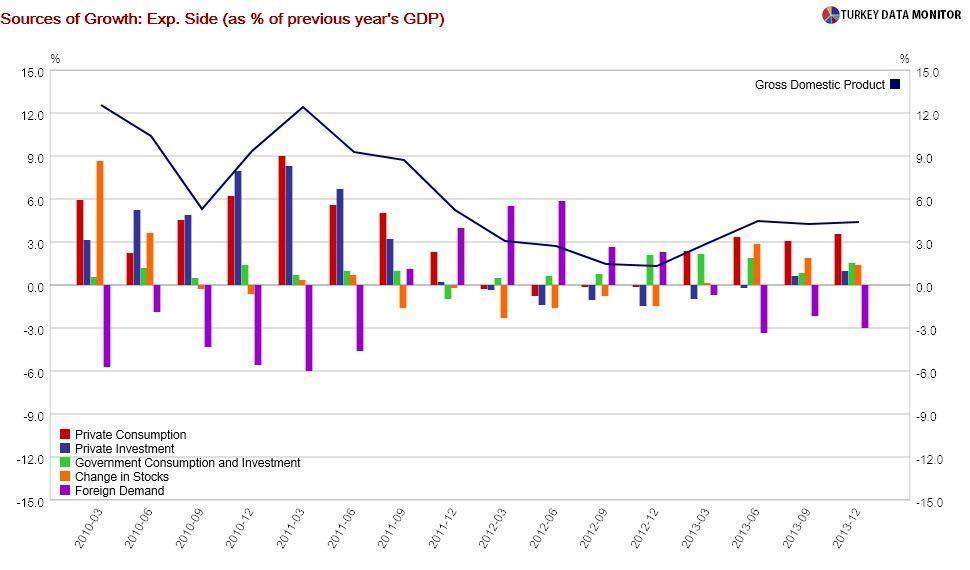

He also needs money to boost growth. Public consumption and investment have in fact been contributing significantly to growth since the last quarter of 2012. Özlem Derici, chief economist of DenizInvest, forecasts the Turkish economy will grow just short of 5 percent annually when first quarter national income accounts are released on June 10. She expects public consumption and investment to contribute 1 percentage point each to first quarter growth.

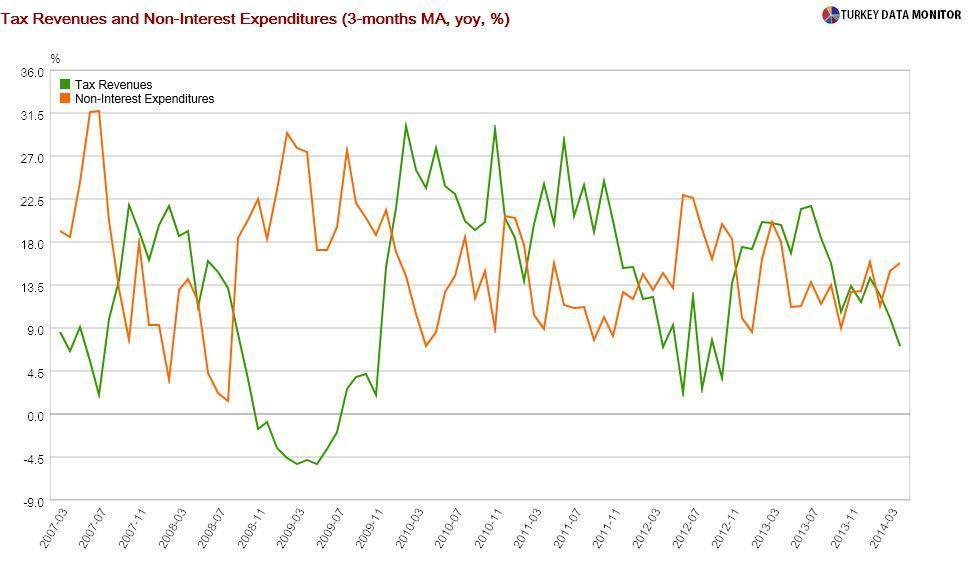

However, the budget is deteriorating, as evidenced by the growing wedge between tax revenues and non-interest expenditures. Erdoğan needs money urgently to make sure the public-led growth continues without worsening the budget too much and undermining investor confidence. Besides, he wants to undertake pork-barrel spending and keep voters happy before the elections.

Erdoğan has a tendency to introduce debt amnesties before elections. He had also introduced one in November 2010, a few months before the general elections. Interestingly enough, the government started working on the new amnesty only a couple months after the last installment for payments for the previous one in March. The timing is meaningful (“manidar” in Turkish), to say the very least.

The message to consumers and businessmen is clear: You should not pay your debt to the government, as you are sure to get an amnesty in a couple of years. Businesses that do are left at a disadvantage against competitors. This is a textbook example of the concept of moral hazard. Thanks to our Duke of Moral Hazard Erdoğan, the Turkish government is encouraging its citizens not to comply with the law.

This column is dedicated to my friend Esther, whose tragic fate I wrote about in my April 11 column. She was a big fan of the Dukes of Hazzard when she was a kid – and was very happy to see my reference to it in my 2010 column.