Stocks, lira gain ground on interest rate hike

ANKARA

The Turkish lira rallied against other exchange rates as Turkish stocks gained ground on Nov. 19 following an interest rate hike by the country’s Central Bank.

In line with market expectations, the bank raised its one-week repo rate - also known as its policy rate - by 475 basis points to 15 percent.

It also decided to provide all funding through this rate, which it identified as its main policy rate.

The lira rose by around 2.5 percent against the U.S. dollar as soon as the move was announced. The U.S. dollar/Turkish lira exchange rate stabilized below the 7.60 mark, decreasing by more than 1.3 percent from the previous close.

The country’s benchmark stock index surpassed 1,300 points with the backing of strong buying, up 0.9 percent from the previous close and 1,284 points from before the pre-hike level.

The hike met market expectations for an increase that would help support the lira and contain inflation.

“This was absolutely the right and logical decision,” said Timothy Ash, senior EM sovereign strategist at Bluebay Asset Management in London.

“There is even a chance here of foreign portfolio guys putting money back in and a reversal of dollarization,” he added.

The decision was announced in a statement following the bank’s first policy meeting under its new governor, former Finance Minister Naci Ağbal, who was appointed on Nov. 7.

Ağbal’s appointment was followed by the resignation of Finance Minister Berat Albayrak, who was later replaced by Lütfi Elvan, a former deputy prime minister.

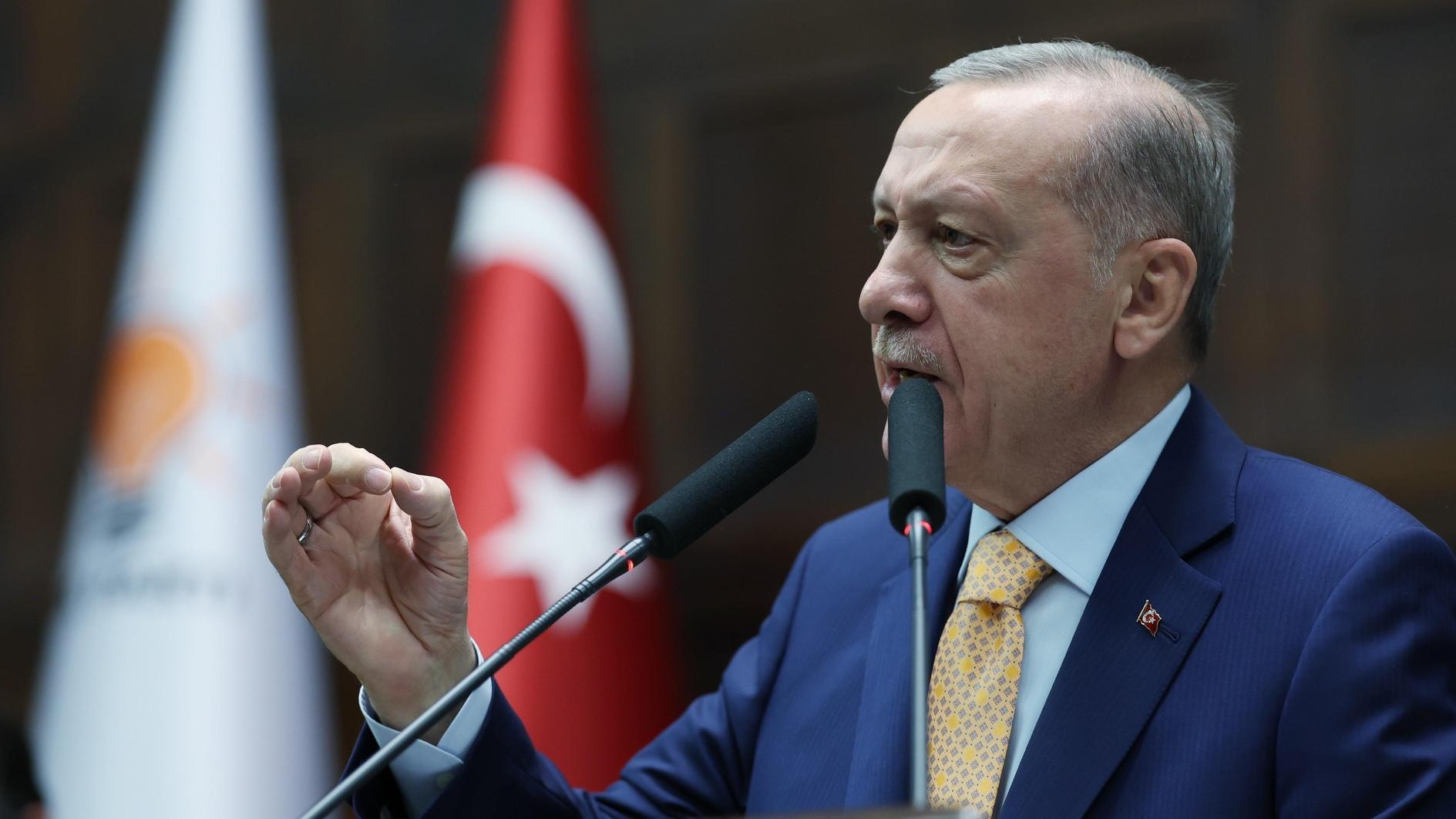

The policy meeting was being closely watched after President Recep Tayyip Erdoğan last week promised reforms and a new era in the management of the economy to attract foreign investments.

“In the periods ahead, all factors affecting inflation will be taken into account, and the tightness of monetary policy will be decisively sustained until a permanent fall in inflation is achieved,” the bank said.

In a statement, the bank identified the “lagged” effects of depreciation in the Turkish lira, as well as increasing international food prices and worsening inflation expectations as factors that have adversely affected the country’s inflation outlook.

“While tracked data for November point to an increase in inflation due to the recent exchange rate volatility, this is assessed to be temporary with the decisive monetary policy stance,” it said.

Underlining that the recovery in economic activity continues, the bank said partial restrictions introduced against the novel coronavirus pandemic amid rising infections heightened uncertainty in the short-term outlook on economic activity, particularly in the services sector.

“Besides, strengthening domestic demand, due to the lagged effects of strong credit impulse during the pandemic, affects the current account balance adversely through the imports channel.”

The bank made it clear that it would employ transparent and strong monetary tightening in order to eliminate risks to the inflation outlook, contain inflation expectations and restore the disinflation process.

“The permanent establishment of a low inflation environment will affect macroeconomic and financial stability positively through the fall in country risk premium, reversal in the dollarization trend, accumulation of foreign exchange reserves and the perpetual decline in financing costs.”

It added that Central Bank funding will be provided through the one-week repo rate, which will be the main policy tool and “the only indicator for the monetary stance.”

Last month, the Central Bank kept its policy rate steady at 10.25 percent. In its eight meetings in 2019, the bank cut the rate by a total of 1,200 basis points, from 24 percent. This year, the bank boosted the number of its MPC meetings to 12. The consumer price inflation stood at 11.89 percent in October.