The slight fall in inflation not enough to lower interest rates

The Central Bank is not expected to change the interest rates in today’s last annual Monetary Policy Committee (PPK) meeting. Despite the expectation of a fall in inflation rates, markets are not predicting that the Central Bank will lower interest rates soon.

The Central Bank, it its recent statements, was emphasizing that it would continue its tight monetary policies until the target inflation rate is neared. Thus, market actors, to a great extent, express their expectation that since the target has not been neared, no changes will be made in interest rates.

In short, if the Central Bank decides to lower interest rates in today’s meeting, this will be a big surprise to the markets. There could be those who think the benchmark interest rate will not be changed, but the top limit of the interest rate corridor might be lowered. However, when we take into consideration that the Central Bank has shrunk the liquidity of the Turkish Lira recently to curb the foreign exchange rates; for this reason, the market interest rates have already pressed the top limit, then we can see that this probability is a very weak one.

As of the end of November, the annual inflation rate is 9.2 percent and this rate is expected to slightly fall in December. In the Central Bank’s expectation survey, since June this year, inflation expectations for the first time fell. Inflation expectations for the end of 2014 fell from 9.22 percent to 9.02 percent. Medium-term inflation expectations, which are for the coming 12 months, fell from 7.50 percent of last month to 7.21 percent. The expectation for the coming 24 months fell from last month’s 6.87 percent to 6.72 percent.

The most important factor in the fall of inflation expectations is the low course of world oil prices. Despite some movement in the last days, it is widely expected that oil prices in 2015 will be around $70. For this reason, it is expected that one of the most serious problems of Turkey’s economy, the inflation rate, is expected to decline and the current account deficit to shrink.

Exchange rate prevents

Despite the low course of oil prices, the increase in the dollar exchange rate looks as if it will disrupt this improvement. While it is observed that the crisis in the Russian economy negatively affects developing countries like Turkey, news on the Fed’s interest rate increase causes mobility in the exchange rates.

One of the most important factors preventing the Central Bank from lowering interest rates is this high course and uncertainty in dollar exchange rates. While the Central Bank is increasing the amount of foreign currency it releases to the markets to curb the rates, on the other hand, it was forced to restrict the lira. Therefore, interest rates in the market leaned against the top limit of the interest rate corridor.

The possibility of the Central Bank to lower interest rates to prevent extreme climbs in exchange rates and to prevent the lira’s sharp decline has become rare.

In other words, the Central Bank cannot lower interest rates because of technical reasons.

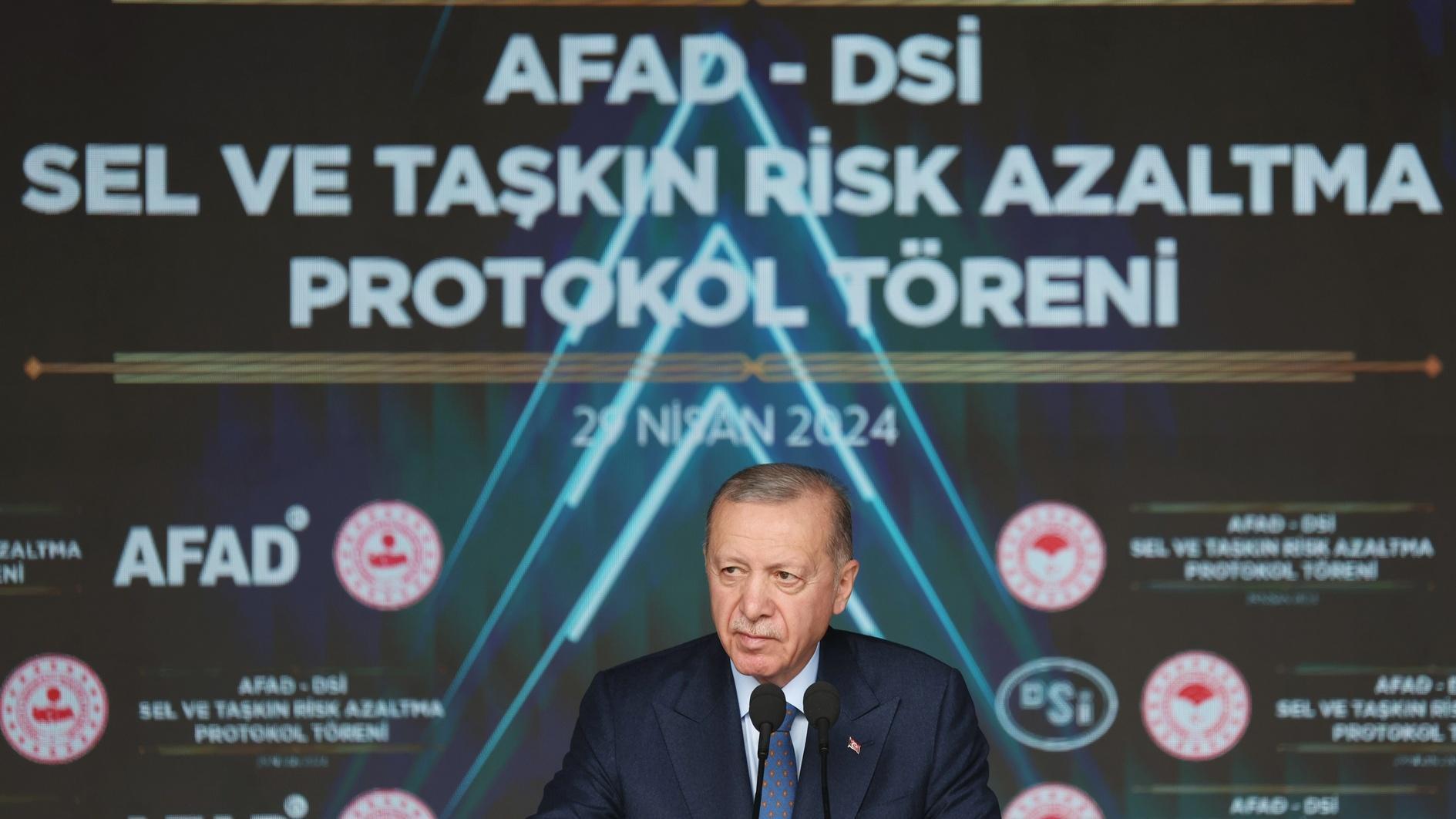

Despite technical reasons, nevertheless, it is observed that President Recep Tayyip Erdoğan’s presure for lowering the interest rates is growing. We do hope the Central Bank does not succumb to the pressure and risks economic instability.