Turkish monetary policy inventions

2011 has been the year of the Central Bank of Turkey, as the Bank made its mark on economics literature with its “inventions.”

2011 has been the year of the Central Bank of Turkey, as the Bank made its mark on economics literature with its “inventions.”

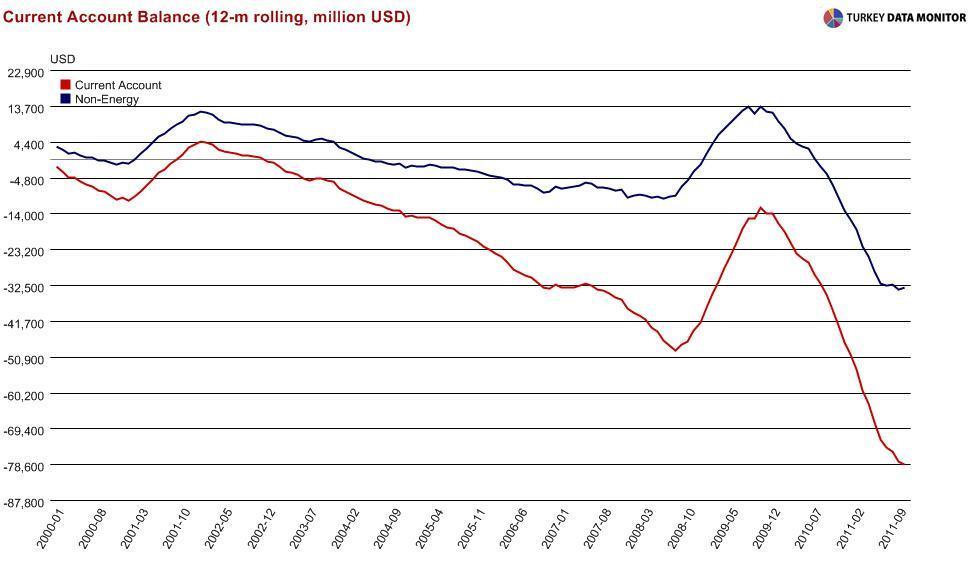

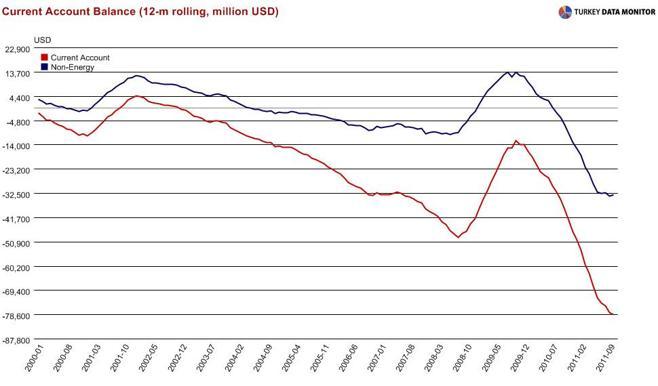

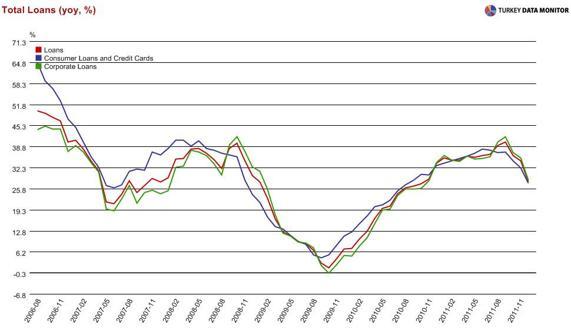

The Bank is definitely not the first central bank to deviate from orthodox monetary policies. That’s a pity. It would have been a consolation prize after last year’s policies managed only a gradual adjustment in the current account deficit and failed to curb credit, at least not until the banking regulator’s own measures came into effect during the summer.

To add insult to injury, we will probably be ending the year with double-digit inflation when the December figures are released tomorrow. But while its heterodox approach may not be novel, the interest rate corridor introduced in October is definitely a “Turkish invention,” in Governor Erdem Başçı’s own words.

And for good reason. The flexibility it provides the Bank in a volatile global environment has come at the expense of enormous uncertainty for markets. Having noticed this, the Bank has tried to increase predictability, first by disclosing regularly the minimum amount at which it would fund banks at the policy rate, and then starting one-month repo auctions to extend funding maturity.

In fact, Başçı added predictability and better communication to flexibility as the Bank’s monetary policy pillars when he introduced the policy framework for 2012 on Tuesday. But cracks in the new pillars were quick to appear. The following day Başçı announced significant policy changes during his presentation to the Istanbul Chamber of Industry. According to the governor, any given day between now and the next monetary policy meeting can be labeled as “normal” or “exceptional”.

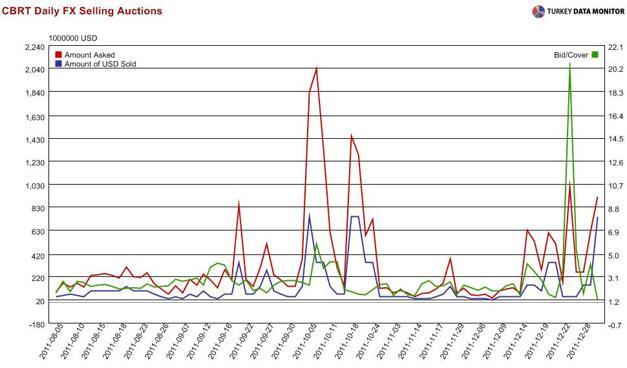

On normal days, the Central Bank will sell only $50 million in daily foreign currency auctions, and keep the effective cost of funding for banks in the 5.75-8 percent range by offering TL 3-7 billion via one-week repo auctions. On exceptional days, it will not fund the markets at the policy rate and will intervene in currency markets if necessary.

By these criteria, the last three business days of the year were all exceptional days, leading me to question whether the exception has become the norm. We also know now that Friday before last, when the bank sold only $50 million, despite announcing an auction for $1.35 billion and receiving bids of $ 1 billion, was a normal day.

That day was actually exceptional for yet another Turkish monetary policy invention, according to economist Mahfi Eğilmez. Inspired by the term “fiscal illusion”, invented by Italian economist Amilcare Puviani, he defines “monetary illusion” as “acting as if having money despite having none.”

But the Bank’s most important invention is “expectations manipulation,” which has replaced traditional expectations management. It works by massaging data and charts, downplaying inflationary risks and modifying previous analyses, all of which I detail at my blog.

Unfortunately, none of these inventions will work. That’s why no one else was rushing to “invent” them, until along came a central bank eager to make its mark on economic theory, even if at the expense of the economy and markets of its homeland.