There’s no spoon (or new monetary policy tool)

“We were terrified!” That’s how the hedge fund manager I met with Wednesday evening summarized his impressions of the

Turkish Central Bank’s meeting with economists that morning.

The Central Bank made a U-turn on some key statements made by Governor Erdem Başçı during

a TV interview on Aug. 26. For one thing, they gave up on the dollar-lira exchange rate target that Başçı had announced. Deputy Governor Turalay Kenç clarified that “the exchange rate could be above or below 1.92 at the end of the year.”

Başçı had also emphasized that the Bank would introduce new and very effective measures to prop up the currency soon. Unless the Central Bank is trying to hide its arsenal for now, Kenç hinted that

there is no tool other than foreign currency (FX) reserves.

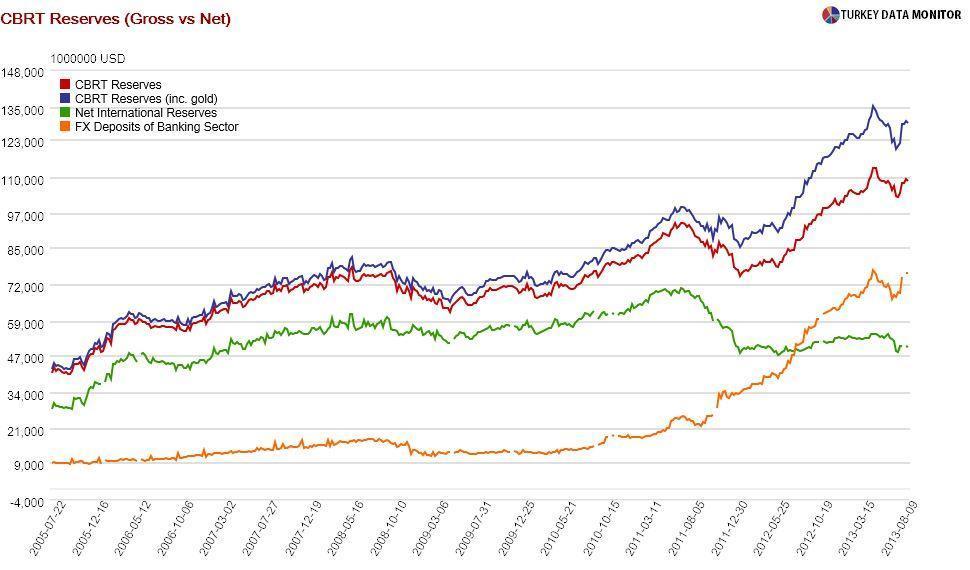

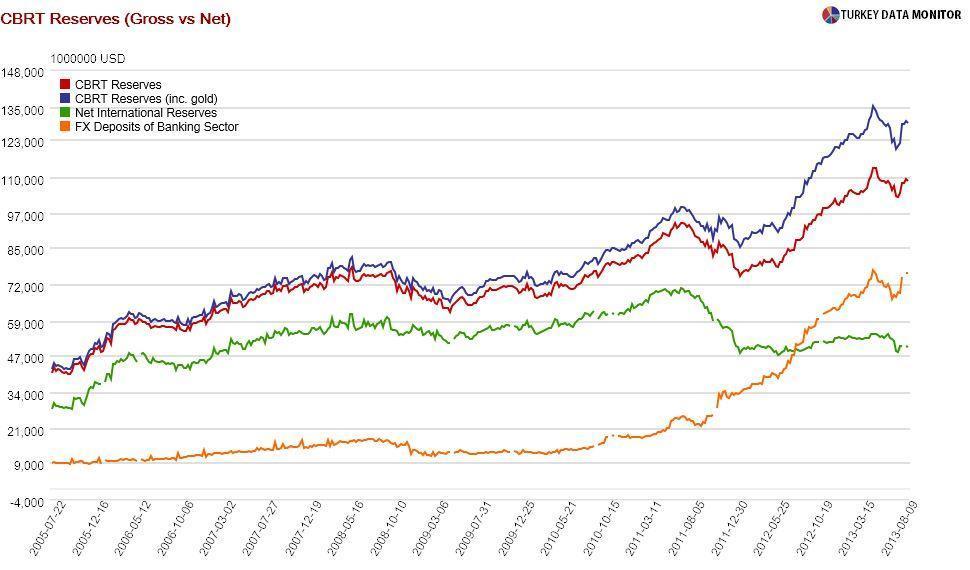

He noted that the Bank had at its disposal the FX held under the

Reserve Option Mechanism ($32.1 billion) and as required reserves ($28.1 billion). Never mind that this money is owned by commercial banks. In response to a question on how these reserves would be utilized, Kenç said “this was the surprise part.” The Bank will probably resort to cuts in

reserve requirement ratios and/or reserve option coefficients.

The other monetary policy “novelty” is preannounced additional tightening independent of the exchange rate, also revealed by Başçı on Aug. 26. In fact, after announcing additional monetary tightening on Sept. 9, the Bank increased the minimum FX auction amount, first to $120 and then to $140 million. I am sure this will make a huge difference -

not! This rhetoric is harming the Central Bank’s credibility, but what really terrified many was Kenç’s claim that the Central Bank had reserves to cover more than the annual current account deficit if need be. I am shocked that anyone who is familiar with Nobel laureate Paul Krugman’s

currency crisis model, or knows about how George Soros

broke the Bank of England by shorting the pound, can make such a statement.

Başçı and Kenç are no idiots, but since

The Master does not

allow them to hike rates, they have to come up with “novel” tools and act as if they believe the international turbulence is temporary. But the fund manager I spoke to is skeptical that Turkey will attract as much money as before, even if the global environment improves. He claims that markets have become very skeptical of Turkish economic policymaking.

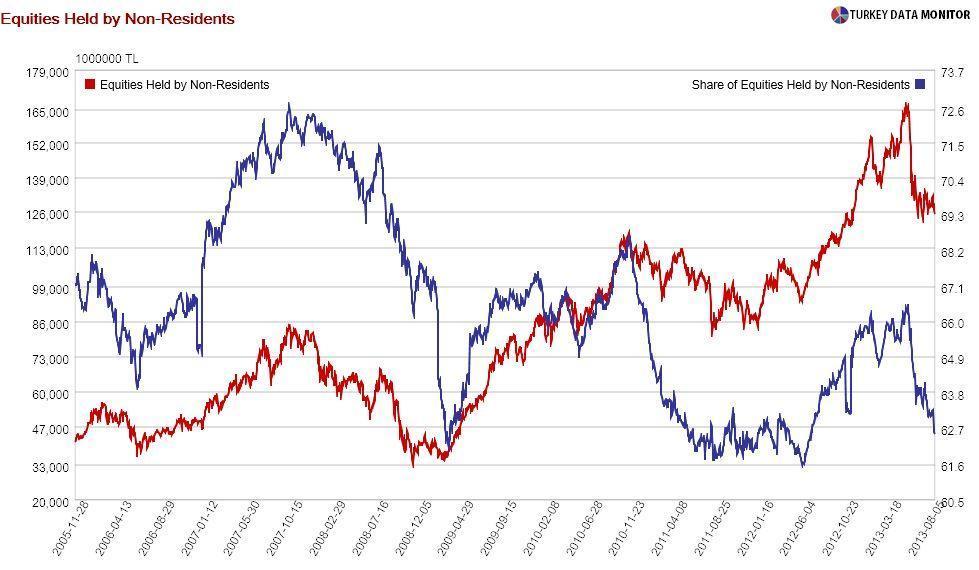

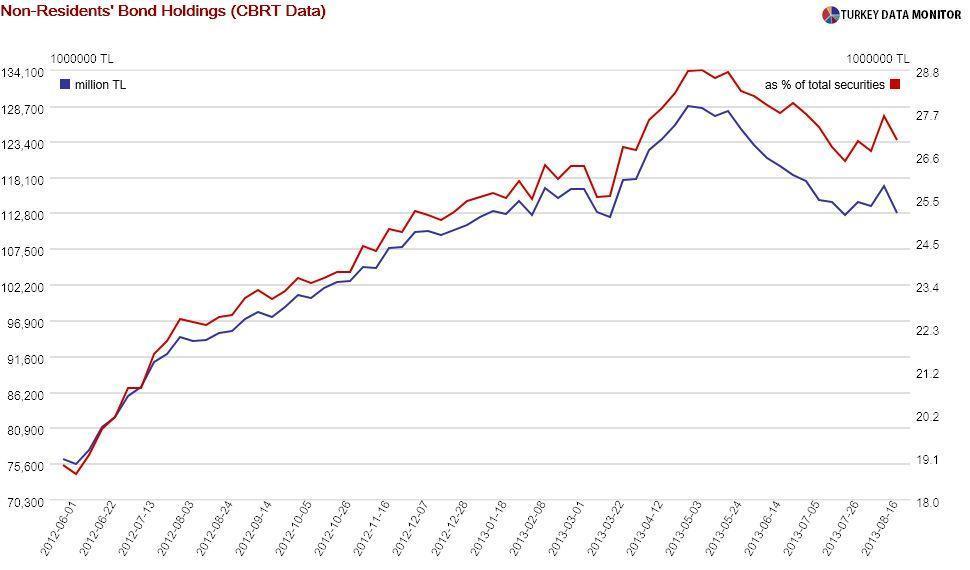

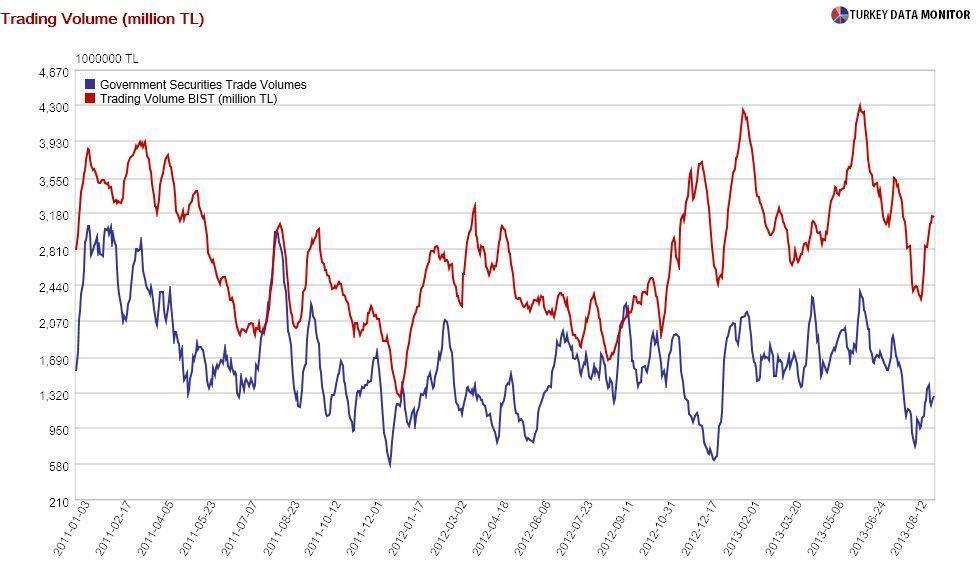

Moreover, he believes Turkey may be at a stage where the eventual rate hike may make things worse in the short run by scaring foreign investors away. This is actually what happened in India, which has, like Turkey, a large foreign investor base. Since equities and bonds are not very liquid, such an exodus attempt could lead to a mass panic.

So what is the solution? He feels a comprehensive structural reform agenda may restore confidence. But would a government that

hasn’t implemented much reform for the past decade suddenly embark on such a potentially politically costly journey before triple elections?

“We were terrified!” That’s how the hedge fund manager I met with Wednesday evening summarized his impressions of the Turkish Central Bank’s meeting with economists that morning.

“We were terrified!” That’s how the hedge fund manager I met with Wednesday evening summarized his impressions of the Turkish Central Bank’s meeting with economists that morning.