Ar’Che’typical approach to capital flows

In one of the hit songs of the musical Evita, Che sings that “when the money keeps flowing, you don’t ask how.” But that’s exactly what I am planning to do.

In one of the hit songs of the musical Evita, Che sings that “when the money keeps flowing, you don’t ask how.” But that’s exactly what I am planning to do.Money is definitely flowing to Turkey. According to the latest data from the Turkish Central Bank, the bond holdings of non-residents, adjusted for exchange rate and price effects, increased by $346 million the week before last. In fact, both equities and bonds have received strong inflows since June.

Turkey is not the sole magnet for hot money. All emerging markets are benefiting from the risk-on sentiment and expectations of quantitative easing by the major central banks. Recent events have boosted those expectations. For example, many interpreted Fed Chairman Ben Bernanke’s speech at the Jackson Hole meeting of central bankers on Friday as a harbinger of QE3. European Central Bank President Mario Draghi skipped the gathering, supposedly because he is currently busy working on his own version.

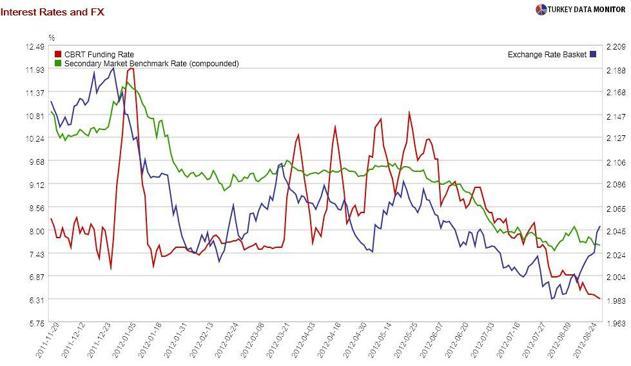

But Turkey is getting more flows than most of its peers for a number of reasons. Despite recent indicators of a slowdown and the Turkish Central Bank’s sharp lowering of interest rates in the last couple of months, the country still offers one of the highest growth rates and yields in the emerging world. It also provides a safe haven near the troubled eurozone, as the Wall Street Journal argued in a recent article.

But whatever the reason, as long as the money keeps flowing, the Central Bank will narrow the interest rate corridor it put in place last October to defend the lira when it was faced with a sudden stop (of capital flows). Critics like Murat Üçer of Turkey Data Monitor contend that this won’t be so simple. He argues that such flows, by their nature, are fickle. The corridor may therefore end up being the Central Bank’s Hotel California- you can check out, but you can never leave.

One part of this equation that many observers are overlooking is the Japanese retail investors, epitomized by Mrs. Watanabe, the Japanese housewife. According to data from Bloomberg, the lira was the most popular currency in non-yen denominated Uridashi bonds, with a net issuance of $2 billion during the first half of this year.

Most of this increase came at the expense of Brazil, as growth worries, lower interest rates and a weak currency caused the real to fall out of favor. The Brazilian Central Bank cut the benchmark rate by 50 basis points on Wednesday, but it also signaled that easing was over, while at the same time hinting that it would defend the real. Therefore, Deutsche Bank analysts note that “the Mrs. Watanebe effect” may tame.

However, Mrs. Watanabe is not like a trader; she changes positions gradually. And one thing working in the lira’s favor is its still-low share (1.2 percent) in Japan’s total emerging markets portfolio investment. In their note dedicated to Japanese portfolio flows to Turkey, Barclays analysts calculate that Turkey could attract $5-6 billion a year from Japan. That’s one third of the current yearly portfolio flows.

This picture has led me to be positive for lira assets and the Turkish economy. Given my forecasting track record, this means that the country is probably headed for a crash landing.