Kuwait to sell bourse with HSBC

KUWAIT CITY - Agence France-Presse

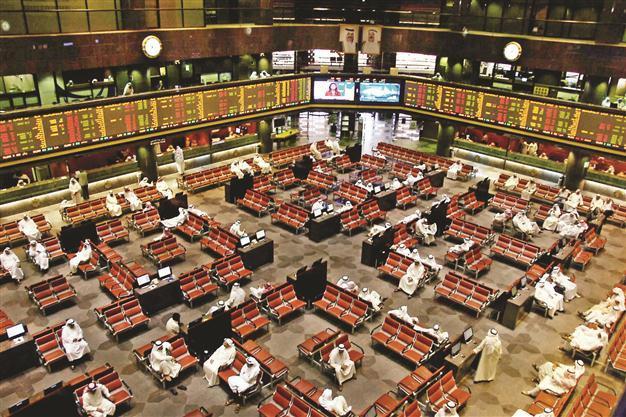

Kuwait’s Capital Markets Authority prepares to privatize the bourse. AFP photo

Kuwait’s Capital Markets Authority signed an agreement with HSBC bank yesterday for the privatization of the Kuwait Stock Exchange and setting up a new company to run the bourse.Under a law passed two years ago, 50 percent of the Kuwait Stock Exchange Company would be put up in an initial public offering while the rest would be sold to companies listed on the bourse.

‘Investors will benefit’

The agreement was for a period of six months under which HSBC bank would begin the privatization process, KSE Company’s Abdullah al-Gabandi told a news conference.

“We are confident that the privatization of the stock exchange will be of a great benefit to Kuwait’s economy, investors and the listed companies,” he said.

Parliament in 2010 passed legislation to set up the CMA as an independent regulator for Kuwait’s stock market with an aim to boost transparency in the Arab world’s third largest bourse in terms of capitalization.

The market has a capitalization of around $100 billion and lists 215 local and foreign companies.