Kill (conspiracy theories and corruption) Bill

According to the ruling Justice and Development Party (AKP), the graft investigations are part of an international plot to prevent Turkey from becoming a regional power by

thwarting Erdoğan’s mega projects like the third bridge and the new airport. If that is indeed the case, we should be grateful to the conspirators. The winning consortium paid way too much for the airport auction,

hinting of rent-seeking in the future. In any case, you can have a look at my column on

corruption at Fatih Municipality to decide for yourself if there is truth to the allegations.

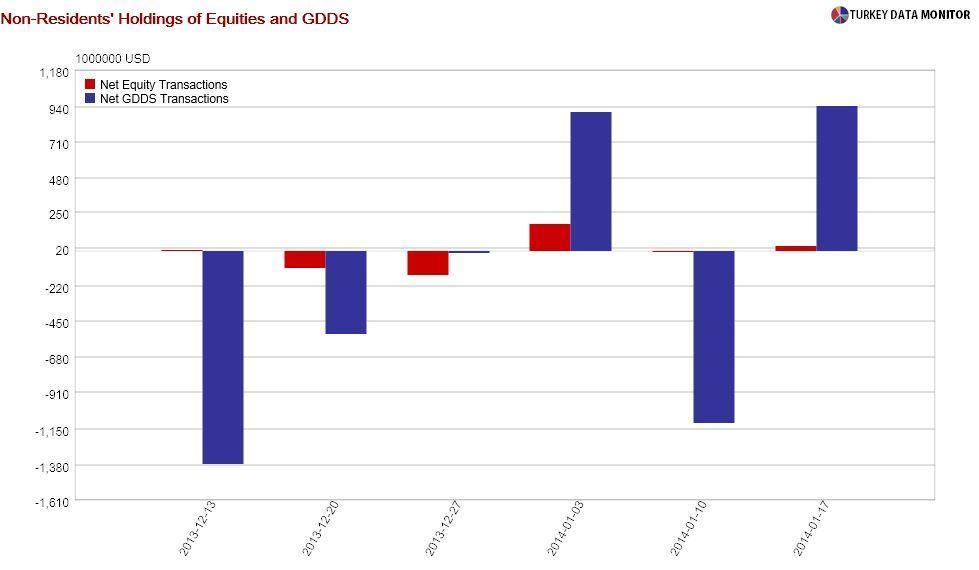

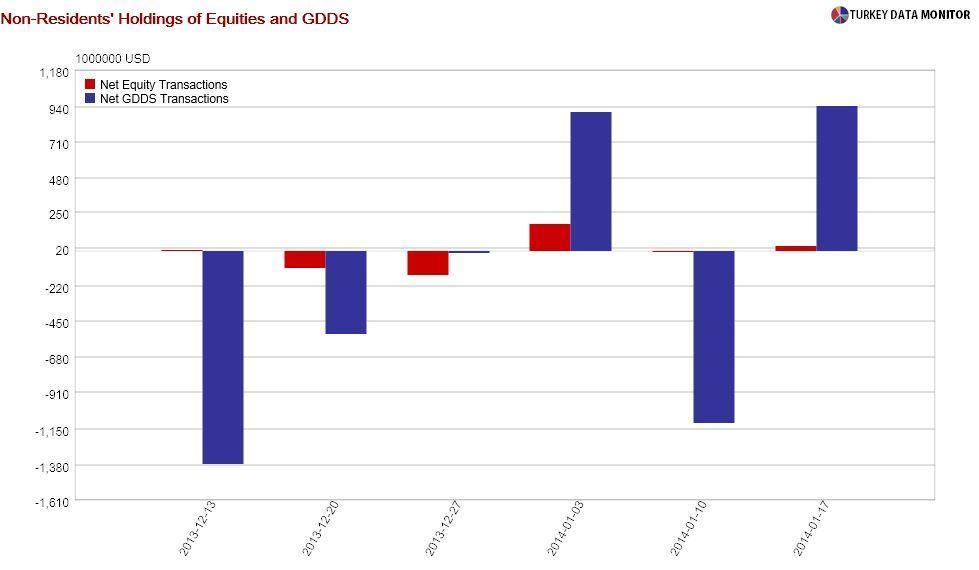

Besides, there has not been a mass exodus from Turkish assets that would support the AKP’s conspiracy theories. Outflows in the last two weeks of December were followed by strong inflows, as some investors saw a buying opportunity. Net flows to Turkish equities and bonds since Dec. 20 are $-55 and 192 million.

There has also been a lot of discussion on the economic

costs of the investigations. Economy tsar Ali Babacan and Prime Minister

Recep Tayyip Erdoğan have emphasized losses from plunging stock prices,

rising interest rates and depreciating currency. They estimate costs

incurred during the first 2-3 weeks of the graft scandal to be anywhere

from $50 to 120 billion.

I have several problems with this logic. First and foremost, even if there is an

international conspiracy to disrupt Turkish markets,

it was imprudent economic policymaking that made Turkey so vulnerable.

For example, even though it was well-known that flows to emerging

markets would decrease once the Fed started tapering its bond purchases,

no precautions were taken.

Similarly, wasn’t it the Central Bank

that implicitly encouraged firms to borrow in foreign currency by

keeping the exchange rate virtually constant throughout 2012? How about

all those companies who had believed in Governor Erdem Başçı’s end-year

dollar-lira exchange rate forecast of 1.92 ?

“Believe in me and win,” the Governor had said at the end of August.

I

am also surprised by the AKP’s obsession with asset prices. Stocks go

up and down. Besides, only about a few million Turks are invested in the

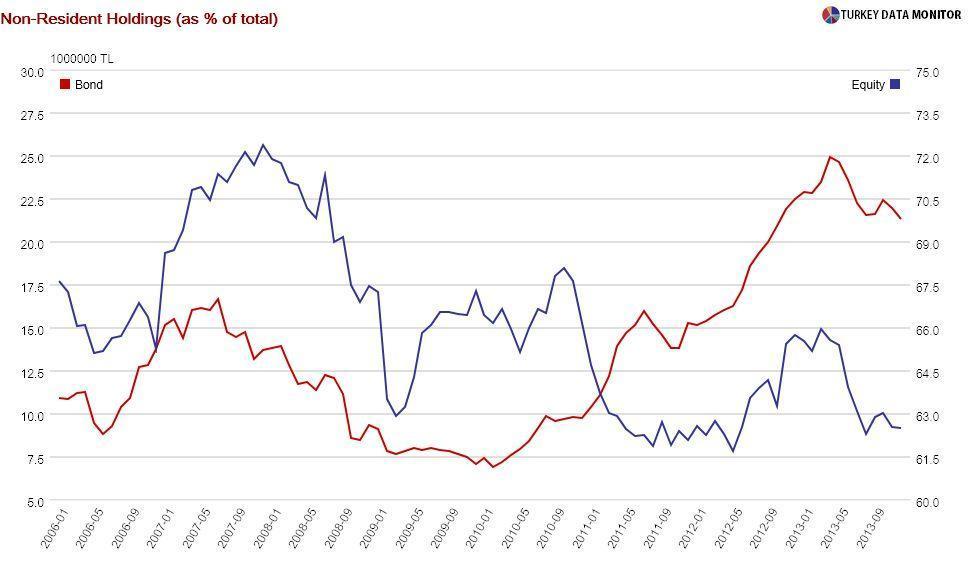

stock market, directly or indirectly through funds. Nearly two thirds

of the market is owned by foreigners; the same financiers the AKP has

been accusing of plotting against them. A few thousand rich domestic

residents own most of the rest, and so we cannot speak of a wealth

effect.

Even when it comes to interest rates, officials continue to emphasize the government’s borrowing costs (bond yields) over the loan rates businesses and consumers have to pay. At around 20 percent, foreigners’ share in Turkish government bonds is smaller, but it is the domestic banks, not residents, who own the rest.

In sum, independent of whether there is a conspiracy against the AKP or not, the economic costs put forward by the AKP do not make sense. I have not seen many, not only government officials but economists as well, mention the real costs, which I will discuss on Monday.

According to the ruling Justice and Development Party (AKP), the graft investigations are part of an international plot to prevent Turkey from becoming a regional power by thwarting Erdoğan’s mega projects like the third bridge and the new airport.

According to the ruling Justice and Development Party (AKP), the graft investigations are part of an international plot to prevent Turkey from becoming a regional power by thwarting Erdoğan’s mega projects like the third bridge and the new airport.