Japan’s central bank joins US Fed in its easing policy

TOKYO - The Associated Press

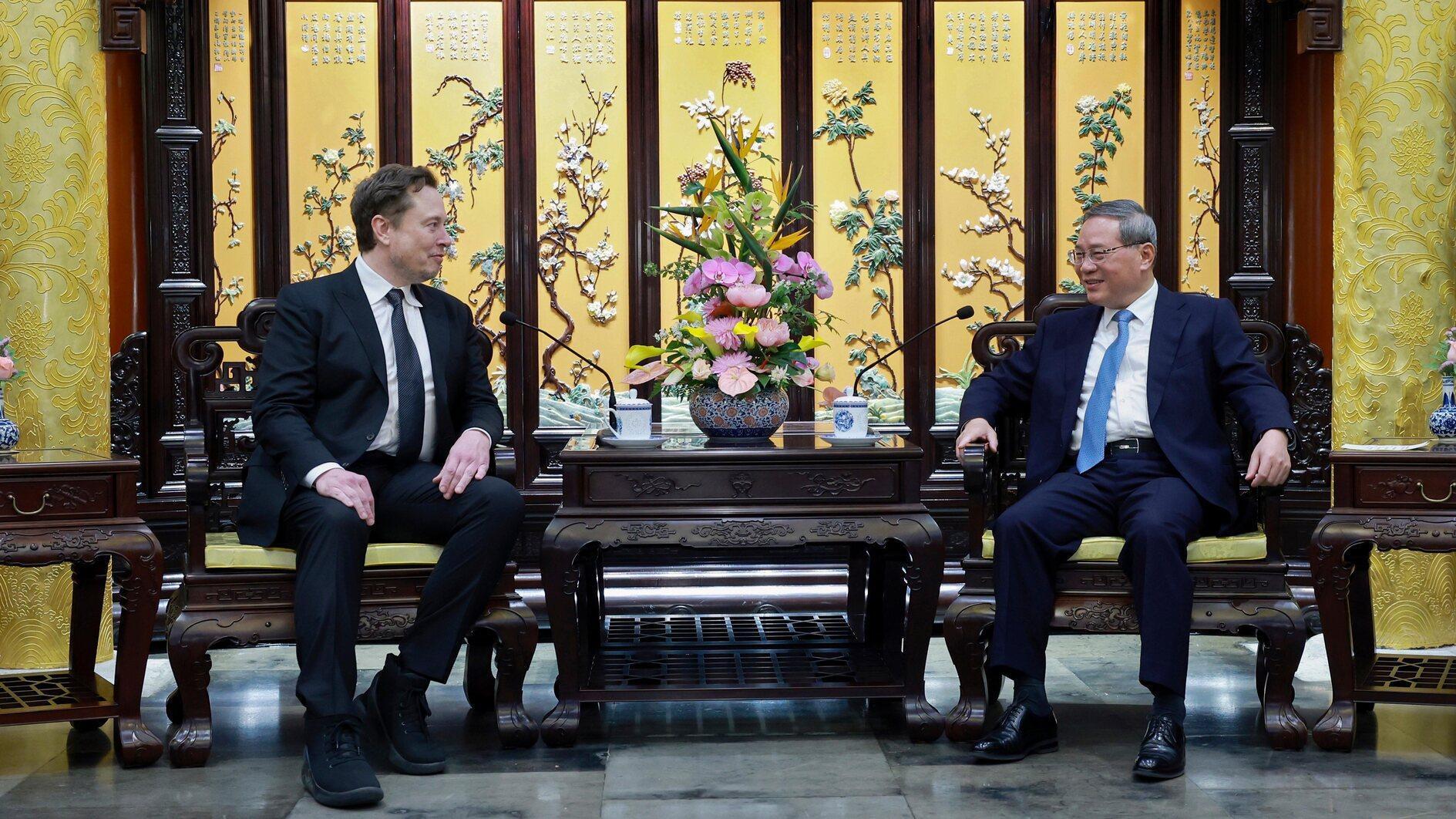

A man sits on a bicycle as a high-speed ship goes by in Tokyo. The Japanese central bank has said it was in ‘pursuit of powerful monetary easing.’ REUTERS photo

Japan’s central bank expanded its monetary easing by 10 trillion yen ($126 billion) yesterday, moving to nurture the country’s feeble economic recovery and cushion its exporters from the yen’s rise.The Bank of Japan wrapped up a two-day policy meeting by increasing its asset-purchasing fund to 55 trillion yen ($695 billion) from 45 trillion yen. That followed the U.S. Federal Reserve’s decision last week to stimulate growth through so-called quantitative easing.

The Turkish Central Bank also eased on Sept. 18 its policy by pushing the upper end of its interest rate corridor to 10 percent from 11.5 percent, in a bid to back economic growth amid negative signals from key sectors.

“There remains a high degree of uncertainty about the global economy,” the Japanese central bank said in a statement. “The pick-up in economic activity has come to a pause,” it said, forecasting that activity will remain flat.

Japanese gov’t bonds

In what it said was the “pursuit of powerful monetary easing,” the bank also eliminated a minimum required interest rate on Japanese government bonds it purchases, a move that will help to stabilize the yen, said Masayuki Kichikawa, an economist at Bank of America-Merrill Lynch.

He characterized the BOJ’s move as a “pleasant surprise” since the central bank had not been expected to ease policy until late October.

Recent weak economic data and strong pressure from politicians anxious to not to see a further deterioration ahead of elections, expected soon, may have played a role.

The U.S. Federal Reserve, similarly alarmed by chronic weakness in the U.S. economy, launched an aggressive new effort Thursday to boost the stock market and make borrowing cheaper for years to come.

The Fed said it would buy mortgage bonds for as long as it deems necessary and keep interest rates at record lows until mid-2015 - six months longer than previously planned.

Japan has been wrestling for years with deflation, or falling prices, which can be a drag on economic growth. The rapid aging of the population has made the effort to break free from the prolonged bout of deflation doubly difficult.

“It shows they are cooperating to end deflation as soon as possible,” Kichikawa said. The move to eliminate the 0.1 percent floor for rates on interest-bearing bonds was likely to have more impact than the 10 trillion yen ($127 billion) increase in asset purchases, he said.

In any case, it was good news for the markets. Japanese shares surged, with the benchmark Nikkei 225 index hitting its highest level in more than four months. The Japanese yen, meanwhile, weakened to 79.17 yen per dollar by mid-afternoon, from 78.66 yen in the morning.

The Japanese yen had continued to strengthen in recent weeks, prompting Finance Minister Jun Azumi to hint last week that intervention was likely.

‘Critical challenge’

“The recent one-sided trend toward the higher yen clearly does not reflect the actual conditions of the Japanese economy,” Azumi said on Sept. 14. “We will not rule out any measures against excessive (currency) movement and will take decisive action whenever needed.”

The world’s third-largest economy faces a “critical challenge” in overcoming deflation and returning to sustainable growth, the central bank said.

The strong yen, which erodes overseas earnings while making Japanese exports more expensive in global markets, has pummeled Japanese manufacturers already suffering from weak global and domestic demand.

Industrial production fell 1.2 percent in July from June compared with forecasts for a 4.5 percent increase.

The outlook for coming months is even gloomier. Manufacturers foresee output barely inching up 0.1 percent in August and sliding 3.3 percent in September.