Irrational exuberance a la Turca

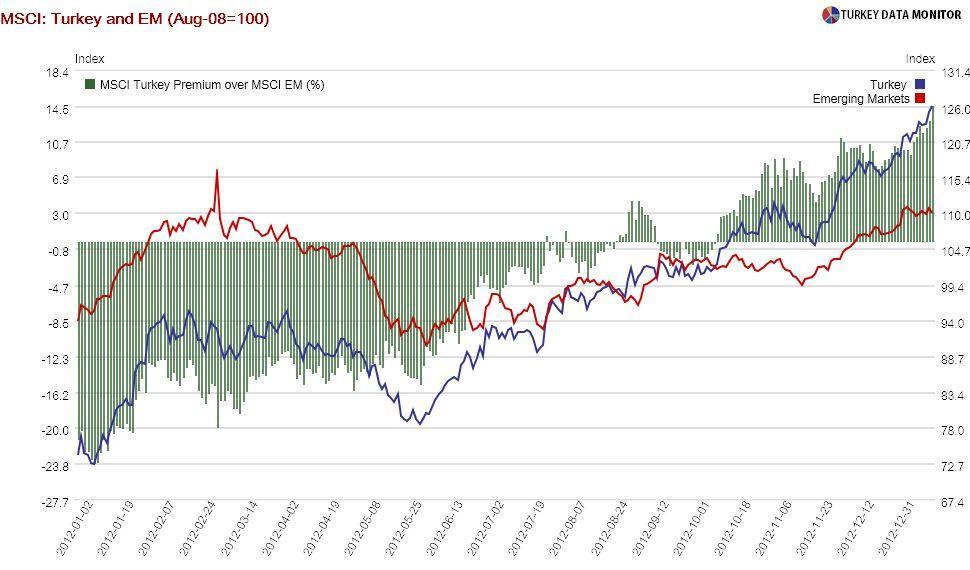

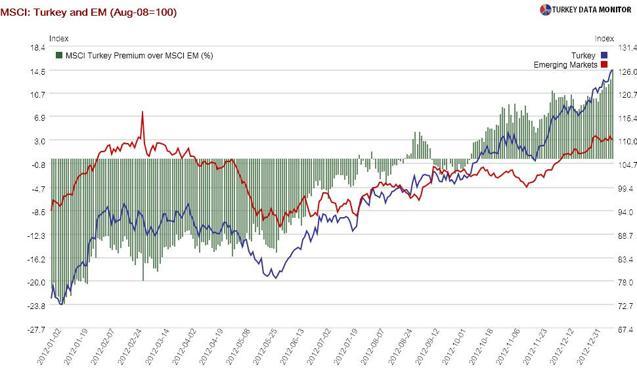

As I argued in my Jan. 11 column and later at my blog, last week’s rally in Turkish assets was caused by money flowing into emerging markets.

As I argued in my Jan. 11 column and later at my blog, last week’s rally in Turkish assets was caused by money flowing into emerging markets.Negative economic news, such as lower growth forecasts from the World Bank and Germany, tampered with capital inflows this week. As a result, while emerging markets’ stocks fell to a one-week low and their currencies weakened on Jan. 16, Turkish equities reached new highs. What’s going on?

Before proceeding further, it is important to note that bonds did not join this week’s rally, although there was strong foreigner interest in ten-year government bonds on Jan. 17. This may be because of simple arithmetic: As one trader noted, interest rates can fall only so much, while the sky is the limit for equities.

She also underlined that the Central Bank would probably not allow further credit growth. As liquidity is tightened, banks are likely to have less room for bonds. After all, despite robust foreigner appetite, banks still hold more than half of Turkish bonds.

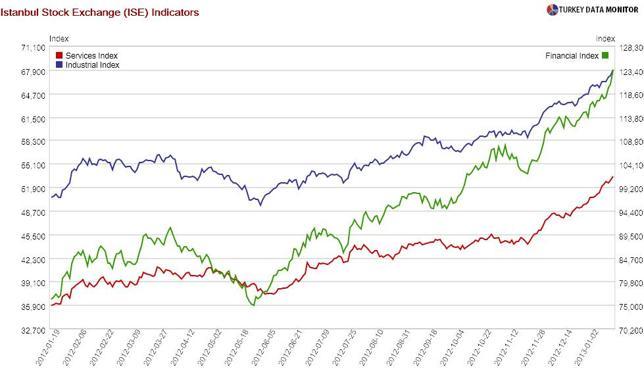

But then I would have expected more interest in non-financials than banks. On the contrary, bank stocks rose much more than industrials on Jan 16. As Deutshce Bank argues in a recent note, there are other good reasons, such as the low interest-rate environment and economic recovery, for non-bank stocks to perform well.

I have been offered an answer: Several market professionals have told me that rumors of an upgrade to investment grade by a second ratings agency were behind this week’s rally. As Atilla Yeşilada of GlobalSource Partners noted, there was other good news too, such as Finance Minister Mehmet Şimşek’s remarks that there may be record-level privatizations in 2013.

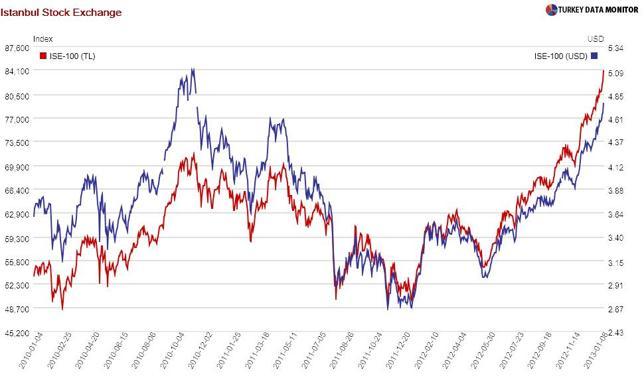

But the euphoria does not seem to be dying down soon. One of the research reports I read the morning of Jan. 17 was titled “Is the target 90,000 or 98,000?” - referring to the Istanbul Stock Exchange’s National-100 index, which is currently just above 84,000.

The 98K figure is from the same Deutsche report I mentioned above, and while it is based on sound economic analysis, the number is a ceiling for the whole year, not a level the bank believes will reached in a month. Most of the other guesstimates are derived from technical analysis, which your friendly neighborhood economist dismisses as “voodoo-nomics”.

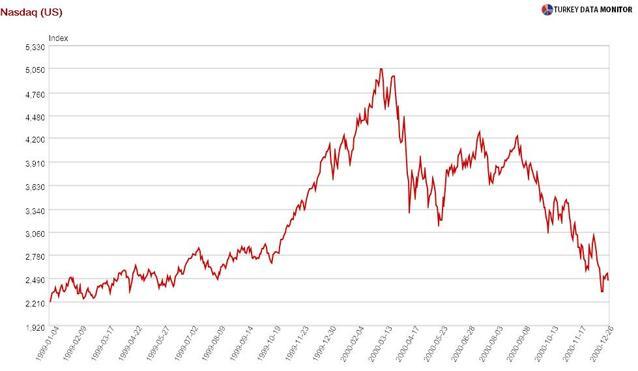

The ISE may go into six-digit territory, but even with a second investment grade and all the extra fund flows associated with it, it won’t be because of fundamentals. Işık Ökte, head of research at Halk Invest, labels the current environment as one of momentum trade- “short-term trading strategies based on price movements, not fundamentals”. He gives the U.S. Nasdaq stock index in 1999, at the height of the dotcom boom, as the classical example.

I prefer “irrational exuberance,” which was coined by former Fed chairman Alan Greenspan. Yale economist Robert Shiller foresaw the collapse of the tech stock bubble in his 2000 book with this title. The time is ripe for a similar book on Turkey.