IMF says euro banking union needed urgently

WASHINGTON - Agence France-Presse

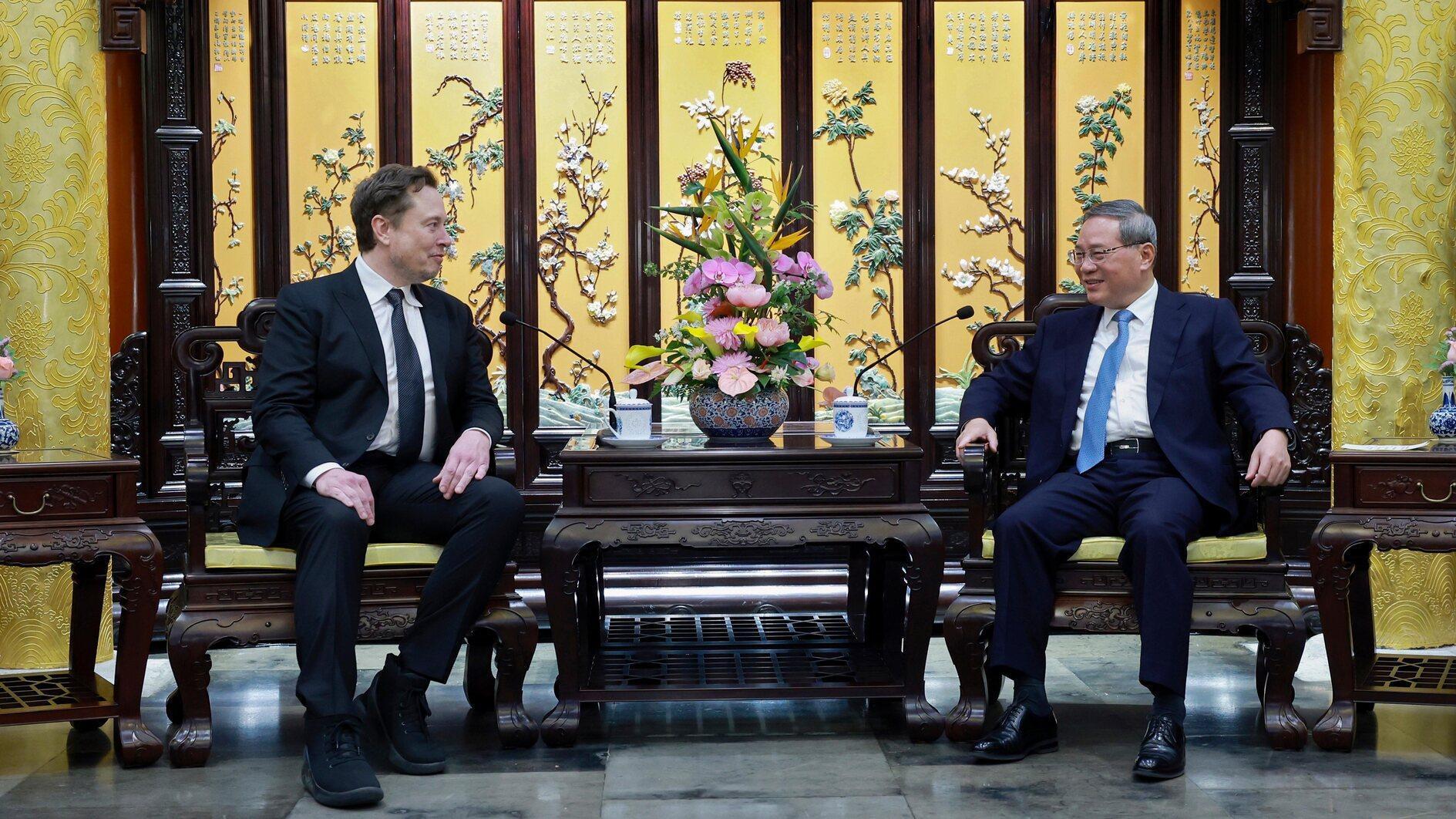

The IMF headquarters in Washington DC is seen in this photo. The IMF says that the eurozone needs a banking union and the ECB needs demand-generating policies. AFP photo

The International Monetary Fund (IMF) on June 21 said the euro area needs to move now to establish full banking union and that the European Central Bank should move on more demand-generating stimulus policies. Underscoring that the eurozone crisis is in a “critical stage”, the IMF stepped up pressure on Europe’s leaders to take real action on the banking sector and economic growth in their coming summit.The Fund said in its annual review of the euro area economy that boosting demand cannot wait for structural reforms across the eurozone.

And it insisted, echoing the international pressure that was clear in the G20 summit in Mexico on Monday and Tuesday, that the region needed to establish a unified system for bank monitoring, resolution and deposit insurance.

“The euro area crisis has reached a critical stage,” the IMF said.

“Despite extraordinary policy actions, bank and sovereign markets in many parts of the euro area remain under acute stress, raising questions about the viability of the monetary union itself.” With Europe’s leaders scheduled to meet in a summit next week to decide their next moves to try and halt a crisis that has steadily worsened against all other efforts, the IMF argued that strong action was urgently needed.

“The immediate priority is concrete action toward a banking union for the euro area,” it said.

While a harmonized resolution process for failed banks, already in the offing, is good, the IMF said, it is not enough.

“A deposit guarantee scheme needs to be established at the regional level to help break the links between domestic banks and their sovereigns, and support depositor confidence.” The IMF urged that individual eurozone countries take needed reforms, especially to regulated labor markets, to help revive growth.

But it said that ECB stimulus action is still needed in the short term to get economies out of recession.

“Because structural reforms will take time to generate growth, aggregate demand support is needed in the short run.” “With inflationary pressures expected to weaken substantially, the ECB has room, albeit limited, to ease policy rates and signal a commitment to a more accommodative stance for a prolonged period.” The global crisis banker suggested that on top of the ECB’s regular monetary support, it could resume bond-buying efforts and introduce quantitative easing.